UK Poultry Meat Market Trends, Size, Growth, Revenue, Demand and Future Opportunities

United Kingdom Poultry Meat Market Growth, Size Trends Analysis- By Form, By Distribution Channel - Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Nov-2024 | Report ID: FOOD24125 | Pages: 1 - 107 | Formats*: |

| Category : Food & Beverages | |||

- May 2023: Convenience Foods at Cranswick Milton Keynes is collaborating with Graphic Packaging, a provider of fiber-based packaging, to transfer a variety of cooked meats from plastic to trays made of PaperLiteTM, a thermoformable packaging material made up of 90% plant-based fiber.

- In June 2023, Gressingham Group purchased Hemswell Coldstore, a cold storage facility located in Lincolnshire. They can hold five thousand pallets of frozen meat.

- E-commerce and direct-to-consumer sales: The growth of e-commerce platforms and direct-to-consumer sales channels allows market players to reach a larger consumer base and strengthen brand connections.

- Product innovation and diversification: Creating new chicken meat products, such as ready-to-cook meals, value-added processed goods, and premium or specialty cuts, can satisfy changing consumer tastes and propel market expansion.

- Responsible and sustainable practices: Companies can improve their reputation and draw in eco-aware customers by implementing sustainable manufacturing methods, minimizing their negative effects on the environment, and guaranteeing the welfare of their animals.

- Disease outbreaks and worries about food safety: The poultry sector is at serious danger from disease outbreaks like avian influenza, which can cause supply interruptions and raise consumer concerns about the safety of products.

- Competition from alternative protein sources: As customers seek more sustainable and ethical options, the growing popularity of alternative protein sources such as plant-based meat replacements and cultured meat presents a possible challenge to the poultry meat business.

- Regulatory constraints: Stringent rules governing food safety, animal welfare, and environmental protection can increase compliance requirements and operational costs for market participants.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Form, By Distribution Channel |

| Regions covered | London, East Anglia, Southwest, Southeast, Scotland, East Midlands, Yorkshire, Humberside |

| Companies Covered | Avara Foods Ltd, Blackwells Farm, Copas Traditional Turkeys, Cranswick plc, Danish Crown AmbA, Donald Russell Ltd, Gressingham Foods, JBS SA, Lambert Dodard Chancereul (LDC) Group, Salisbury Poultry (Midlands) Ltd, Wild Meat Company. |

- Poultry Farmers and Producers

- Food and Beverage Manufacturers

- Retailers and Supermarkets

- Butchers and Meat Shops

- Restaurants, Hotels, and Catering Services

- Wholesalers and Distributors

- Frozen and Processed Food Companies

- Health-Conscious Consumers

- Animal Welfare and Sustainability Advocates

- Government and Regulatory Bodies

| By Form: | |

| By Distribution Channel: | |

| By Region: |

- United Kingdom Poultry Meat Market Size (FY’2024-FY’2033)

- Overview of United Kingdom Poultry Meat Market

- Segmentation of United Kingdom Poultry Meat Market by Form (Canned, Fresh / Chilled, Frozen, Processed)

- Segmentation of United Kingdom Poultry Meat Market by Distribution Channel (Off-Trade, On-Trade)

- Statistical Snap of United Kingdom Poultry Meat Market

- Expansion Analysis of United Kingdom Poultry Meat Market

- Problems and Obstacles in United Kingdom Poultry Meat Market

- Competitive Landscape in the United Kingdom Poultry Meat Market

- Impact of COVID-19 and Demonetization on United Kingdom Poultry Meat Market

- Details on Current Investment in United Kingdom Poultry Meat Market

- Competitive Analysis of United Kingdom Poultry Meat Market

- Prominent Players in the United Kingdom Poultry Meat Market

- SWOT Analysis of United Kingdom Poultry Meat Market

- United Kingdom Poultry Meat Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

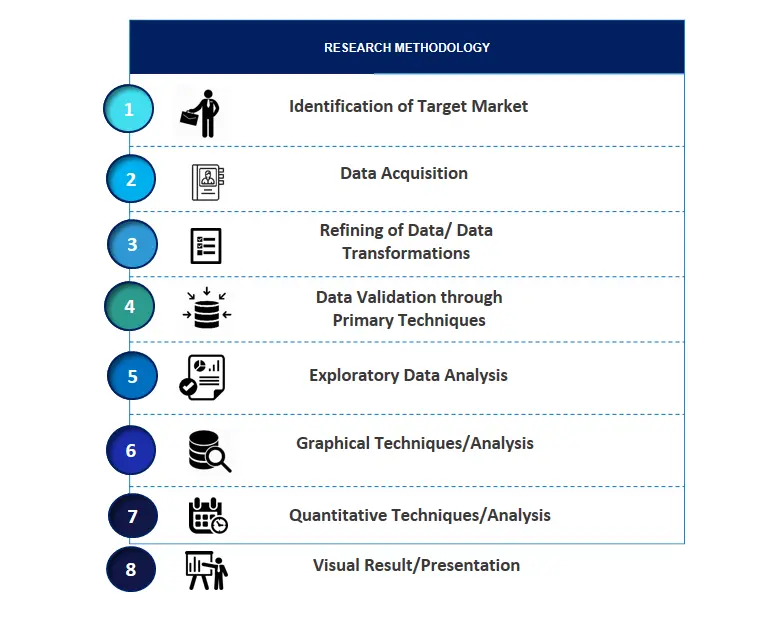

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the United Kingdom Poultry Meat Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. United Kingdom Poultry Meat Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in United Kingdom Poultry Meat Market

7.1. United Kingdom Poultry Meat Market Size, Share and Forecast, By Form, 2020-20267.2. United Kingdom Poultry Meat Market Size, Share and Forecast, By Form, 2027-20337.3. Canned7.4. Fresh / Chilled7.5. Frozen7.6. Processed

8.1. United Kingdom Poultry Meat Market Size, Share and Forecast, By Distribution Channel, 2020-20268.2. United Kingdom Poultry Meat Market Size, Share and Forecast, By Distribution Channel, 2027-20338.3. Off-Trade8.3.1. Convenience Stores8.3.2. Online Channel8.3.3. Supermarkets and Hypermarkets8.3.4. Others8.4. On-Trade

9.1. United Kingdom Poultry Meat Market Size and Market Share

10.1. United Kingdom Poultry Meat Market Size and Market Share By Region (2020-2026)10.2. United Kingdom Poultry Meat Market Size and Market Share By Region (2027-2033)10.3. London10.4. East Anglia10.5. Southwest10.6. Southeast10.7. Scotland10.8. East Midlands10.9. Yorkshire10.10. Humberside

11.1. 1 Sisters Food Group

11.1.1. Company details11.1.2. Financial outlook11.1.3. Product summary11.1.4. Recent developments

11.2. Avara Foods Ltd

11.2.1. Company details11.2.2. Financial outlook11.2.3. Product summary11.2.4. Recent developments

11.3. Blackwells Farm

11.3.1. Company details11.3.2. Financial outlook11.3.3. Product summary11.3.4. Recent developments

11.4. Copas Traditional Turkeys

11.4.1. Company details11.4.2. Financial outlook11.4.3. Product summary11.4.4. Recent developments

11.5. Cranswick plc

11.5.1. Company details11.5.2. Financial outlook11.5.3. Product summary

11.5.4. Recent developments

11.6. Danish Crown AmbA

11.6.1. Company details11.6.2. Financial outlook11.6.3. Product summary11.6.4. Recent developments

11.7. Donald Russell Ltd

11.7.1. Company details11.7.2. Financial outlook11.7.3. Product summary11.7.4. Recent developments

11.8. Gressingham Foods

11.8.1. Company details11.8.2. Financial outlook11.8.3. Product summary11.8.4. Recent developments

11.9. JBS SA

11.9.1. Company details11.9.2. Financial outlook11.9.3. Product summary11.9.4. Recent developments

11.10. Lambert Dodard Chancereul (LDC) Group

11.10.1. Company details11.10.2. Financial outlook11.10.3. Product summary11.10.4. Recent developments

11.11. Salisbury Poultry (Midlands) Ltd

11.11.1. Company details11.11.2. Financial outlook11.11.3. Product summary11.11.4. Recent developments

11.12. Wild Meat Company

11.12.1. Company details11.12.2. Financial outlook11.12.3. Product summary11.12.4. Recent developments

11.13. Others

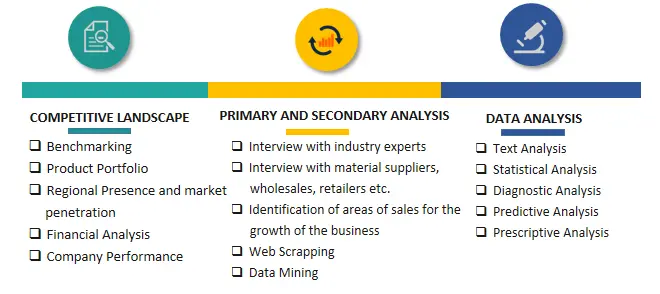

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.