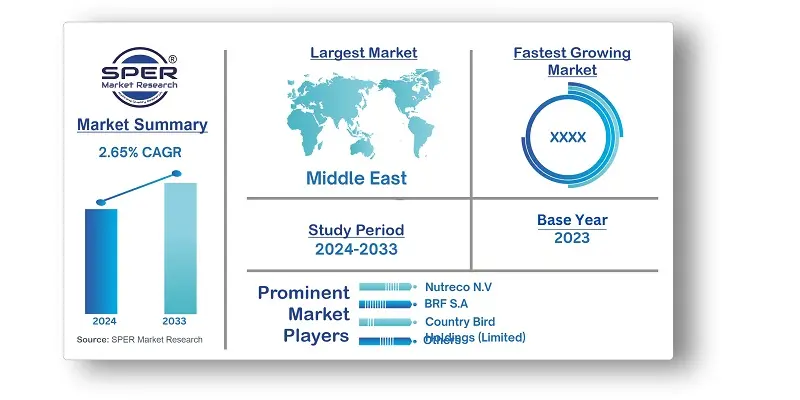

South Africa Animal Feed Market Trends, Share, Size, Demand, Revenue and Future Outlook

South Africa Animal Feed Market Growth, Size, Trends Analysis- By Type, By Livestock, By Raw Material- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Nov-2024 | Report ID: FOOD24124 | Pages: 1 - 107 | Formats*: |

| Category : Food & Beverages | |||

- Evonik declared in May 2023 that it would launch an improved Biolys. It would be a reliable source of lysine for animal feed. The essential amino acid L-lysine would be easier for customers to provide for their animals' needs.

- Wilbur-Ellis Nutrition and Bond Pet Foods established a partnership in April 2024 to create specialized ingredients for pet food applications. Wilbur-Ellis Nutrition and Bond have formed their second strategic cooperation with a major leader in the global pet food business.

- Technological Progress in Feed Production: Pelletizing and extrusion are two technological innovations that have changed feed production and increased animal feed efficiency. Pelletizing compresses feed materials into dense pellets, which improves digestibility and nutrient absorption. Similarly, extrusion cooks feed materials at high temperatures and pressures, increasing nutritional bioavailability. These approaches ensure that feeds have consistent quality and nutritional value, which benefits both animal health and production efficiency. For example, pelleted feeds for poultry have been found to improve feed conversion rates and growth performance.

- High demand for animal-derived products: Changing cuisines, rising incomes, and expanding populations have all contributed to an increase in demand for animal products. Animal-based proteins, such as milk, eggs, and meat, are increasingly in demand around the world.

- Strict regulations: Animal feed is subject to a number of stringent regulatory demands to safeguard animal safety, and animal feed manufacturers face a difficult burden in complying with these rules. These regulations have resulted in longer time-to-market and slower commercialization, which has affected animal feed sales.

- Prices of raw materials fluctuate: Prices for raw materials used to create animal feed fluctuate due to a variety of circumstances such as trade limitations, changes in economic conditions, and so on. These changes can reduce profit margins for businesses and inhibit market expansion.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Type, By Livestock, By Raw Material |

| Regions covered | Cape, Eastern Cape, Free State, Gauteng, KwaZulu-Natal, Limpopo, Mpumalanga, North West South Africa, Northern South Africa, Western South Africa |

| Companies Covered | Alltech, Inc, Nutreco N.V, New Hope Liuhe Co., Ltd, Cargill, Incorporated, De Heus Voeders BV, BRF S.A, Country Bird Holdings (Limited), AFGRI Operations (Pty) Limited, RCL FOODS Ltd, Nova Feeds. |

- Livestock Farmers (cattle, poultry, sheep, and pig farmers)

- Dairy Farmers

- Aquaculture Producers

- Feed Manufacturers and Processors

- Agricultural Cooperatives

- Veterinarians and Animal Nutritionists

- Distributors and Wholesalers

- Retailers and Farm Supply Stores

- Government and Regulatory Bodies

- Research Institutions and Academics in Animal Science

- Exporters and Importers of Animal Feed Products

| By Type: | |

| By Livestock: | |

| By Raw Material: | |

| By Region: |

- South Africa Animal Feed Market Size (FY’2024-FY’2033)

- Overview of South Africa Animal Feed Market

- Segmentation of South Africa Animal Feed Market By Type (Fodder and Forage, Compound Feed)

- Segmentation of South Africa Animal Feed Market By Livestock (Pork, Aquatic Animal, Cattle, Poultry, Others)

- Segmentation of South Africa Animal Feed Market By Raw Material (Soy, Corn, Others)

- Statistical Snap of South Africa Animal Feed Market

- Expansion Analysis of South Africa Animal Feed Market

- Problems and Obstacles in South Africa Animal Feed Market

- Competitive Landscape in the South Africa Animal Feed Market

- Impact of COVID-19 and Demonetization on South Africa Animal Feed Market

- Details on Current Investment in South Africa Animal Feed Market

- Competitive Analysis of South Africa Animal Feed Market

- Prominent Players in the South Africa Animal Feed Market

- SWOT Analysis of South Africa Animal Feed Market

- South Africa Animal Feed Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the South Africa Animal Feed Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. South Africa Animal Feed Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in South Africa Animal Feed Market

7.1. South Africa Animal Feed Market Size, Share and Forecast, By Type, 2020-20267.2. South Africa Animal Feed Market Size, Share and Forecast, By Type, 2027-20337.3. Fodder and Forage7.4. Compound Feed

8.1. South Africa Animal Feed Market Size, Share and Forecast, By Livestock, 2020-20268.2. South Africa Animal Feed Market Size, Share and Forecast, By Livestock, 2027-20338.3. Pork8.4. Aquatic Animal8.5. Cattle8.6. Poultry8.7. Others

9.1. South Africa Animal Feed Market Size, Share and Forecast, By Raw Material, 2020-20269.2. South Africa Animal Feed Market Size, Share and Forecast, By Raw Material, 2027-20339.3. Soy9.4. Corn9.5. Others

10.1. South Africa Animal Feed Market Size and Market Share

11.1. South Africa Animal Feed Market Size and Market Share By Region (2020-2026)11.2. South Africa Animal Feed Market Size and Market Share By Region (2027-2033)11.3. Cape11.4. Eastern Cape11.5. Free State11.6. Gauteng11.7. KwaZulu-Natal11.8. Limpopo11.9. Mpumalanga11.10. North West South Africa,11.11. Northern South Africa11.12. Western South Africa

12.1. Alltech, Inc

12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments

12.2. Nutreco N.V

12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments

12.3. New Hope Liuhe Co., Ltd

12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments

12.4. Cargill, Incorporated

12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments

12.5. De Heus Voeders BV

12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments

12.6. BRF S.A

12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments

12.7. Country Bird Holdings (Limited)

12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments

12.8. AFGRI Operations (Pty) Limited

12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments

12.9. RCL FOODS Ltd

12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments

12.10. Nova Feeds

12.10.1. Company details12.10.2. Financial outlook12.10.3. Product summary12.10.4. Recent developments

12.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.