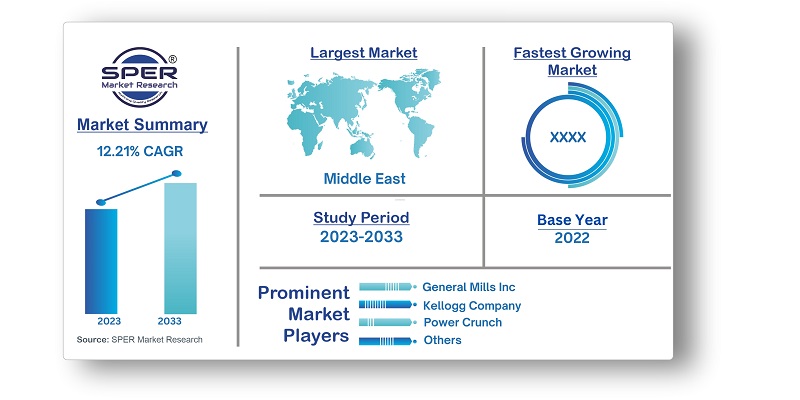

Saudi Arabia Snack Bar Market Growth, Size, Trends, Revenue, Share, Challenges and Future Scope

Saudi Arabia Snack Bar Market Size- By Type, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Sep-2023 | Report ID: FOOD2383 | Pages: 1 - 105 | Formats*: |

| Category : Food & Beverages | |||

- Opportunities: The main factors creating the opportunities in the industry include a growth in the consumption of sweet baked goods, a sizable young population, and shifting lifestyles that require health and wellness products. Thanks to the expanding health and wellness sector, where people desire quick, wholesome snacks, snack bars are expanding phenomenally. Numerous causes, including a mesmerising symphony of novel and imaginative flavours and ingredients, harmonious partnerships with fitness and health clubs, and the noble pursuit of sustainable and eco-friendly packaging, contributed to this astonishing rise. Consumers are interested in unique, uncommon products as they learn more about the cuisine.

- Challenges: The industry for snack bars has identified a number of obstacles that prevent further growth. Although snack bars are becoming more and more popular among consumers looking for convenient and healthy on-the-go food options, they still face a number of significant challenges, including intense competition among established players and new entrants, limited shelf life and raw materials storage, fluctuating snack bar prices, and strict regulations and labelling requirements in some regions.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Type, By Distribution Channel |

| Regions covered | Central Saudi Arabia, Eastern Saudi Arabia, Southern Saudi Arabia, Western Saudi Arabia |

| Companies Covered | Clif Bar & Company, General Mills Inc., GoMacro LLC, Kellogg Company, NuGo Nutrition Inc., Power Crunch, Premier Nutrition Corporation, Simply Good Foods Co., Others |

- Athletes and Fitness Enthusiasts

- Consumers

- Foodservice and Hospitality Industry

- Office Workers

- Parents

- Students

- Travelers

- Vegans and Vegetarians

- Retailers

- Others

| By Type: |

|

| By Distribution Channel: |

|

- Saudi Arabia Snack Bar Market Size (FY’2023-FY’2033)

- Overview of Saudi Arabia Snack Bar Market

- Segmentation of Saudi Arabia Snack Bar Market By Type (Cereal Bars, Energy Bars, Other Snack Bars)

- Segmentation of Saudi Arabia Snack Bar Market By Distribution Channel (Convenience Stores, Hypermarket/Supermarkets, Online Channels, Speciality Stores, Other Distribution Channels)

- Statistical Snap of Saudi Arabia Snack Bar Market

- Expansion Analysis of Saudi Arabia Snack Bar Market

- Problems and Obstacles in Saudi Arabia Snack Bar Market

- Competitive Landscape in the Saudi Arabia Snack Bar Market

- Impact of COVID-19 and Demonetization on Saudi Arabia Snack Bar Market

- Details on Current Investment in Saudi Arabia Snack Bar Market

- Competitive Analysis of Saudi Arabia Snack Bar Market

- Prominent Players in the Saudi Arabia Snack Bar Market

- SWOT Analysis of Saudi Arabia Snack Bar Market

- Saudi Arabia Snack Bar Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analys

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Saudi Arabia Snack Bar Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Saudi Arabia Snack Bar Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Saudi Arabia Snack Bar Market

7.1. Saudi Arabia Snack Bar Market Value Share and Forecast, By Type, 2023-20337.2. Cereal Bars7.2.1. Granola Bars7.2.2. Others7.3. Energy Bars7.4. Other Snack Bars

8.1. Saudi Arabia Snack Bar Market Value Share and Forecast, By Distribution Channel, 2023-20338.2. Convenience Stores8.3. Hypermarket/Supermarkets8.4. Online Channels8.5. Speciality Stores8.6. Other Distribution Channels

9.1. Saudi Arabia Snack Bar Market Size and Market Share

10.1. Saudi Arabia Snack Bar Market Size and Market Share By Type (2019-2026)10.2. Saudi Arabia Snack Bar Market Size and Market Share By Type (2027-2033)

11.1. Saudi Arabia Snack Bar Market Size and Market Share By Distribution Channel (2019-2026)11.2. Saudi Arabia Snack Bar Market Size and Market Share By Distribution Channel (2027-2033)

12.1. Saudi Arabia Snack Bar Market Size and Market Share By Region (2019-2026)12.2. Saudi Arabia Snack Bar Market Size and Market Share By Region (2027-2033)12.3. Central Saudi Arabia12.4. Eastern Saudi Arabia12.5. Southern Saudi Arabia12.6. Western Saudi Arabia

13.1. Clif Bar & Company13.1.1. Company details13.1.2. Financial outlook13.1.3. Product summary13.1.4. Recent developments13.2. General Mills Inc.13.2.1. Company details13.2.2. Financial outlook13.2.3. Product summary13.2.4. Recent developments13.3. GoMacro LLC13.3.1. Company details13.3.2. Financial outlook13.3.3. Product summary13.3.4. Recent developments13.4. Kellogg Company13.4.1. Company details13.4.2. Financial outlook13.4.3. Product summary13.4.4. Recent developments13.5. NuGo Nutrition Inc.13.5.1. Company details13.5.2. Financial outlook13.5.3. Product summary13.5.4. Recent developments13.6. Power Crunch13.6.1. Company details13.6.2. Financial outlook13.6.3. Product summary13.6.4. Recent developments13.7. Premier Nutrition Corporation13.7.1. Company details13.7.2. Financial outlook13.7.3. Product summary13.7.4. Recent developments13.8. Simply Good Foods Co.13.8.1. Company details13.8.2. Financial outlook13.8.3. Product summary13.8.4. Recent developments13.9. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.