North America Energy Drinks Market Growth, Size, Trends, Demand, Revenue and Future Outlook

North America Energy Drinks Market Size- Soft Drink Type, By Packaging Type, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: May-2024 | Report ID: FOOD2453 | Pages: 1 - 156 | Formats*: |

| Category : Food & Beverages | |||

- In July 2023: Monster Beverage Corporation declared that Blast Asset Acquisition LLC, a subsidiary, had successfully paid over USD 362 million to acquire nearly all of the assets of Vital Pharmaceuticals, Inc. and a few of its affiliates (collectively, "Bang Energy"). Two of the acquired assets include a beverage production facility located in Phoenix, Arizona, and Bang Energy drinks.

- July 2023: To go from selling multi-packs in grocery stores to selling single-serve cold beverages at c-stores, Zevia LLC, a Los Angeles-based startup, is thinking about finding a new distribution partner.

| Report Metric | Details |

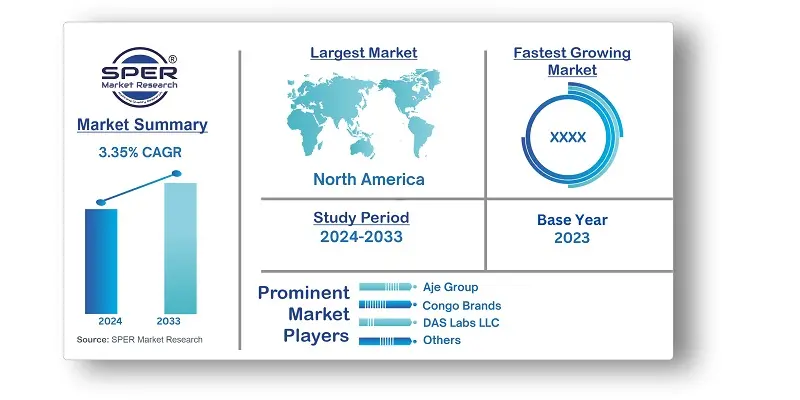

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | Soft Drink Type, By Packaging Type, By Distribution Chan |

| Regions covered | Eastern Region, Western Region, southern region, Northern Region |

| Companies Covered | Aje Group, Congo Brands, DAS Labs LLC, Living Essentials, LLC, Monster Beverage Corporation, N.V.E. Pharmaceuticals, PepsiCo, Inc., Red Bull GmbH, Seven & I Holdings Co., Ltd., The Coca-Cola Company, Others |

- Athletes and Fitness Enthusiasts

- Young Adults and College Students

- Professionals and Office Workers

- Gamers and Esports Enthusiasts

- Shift Workers and Night Owls

- Health-Conscious Consumers

- On-the-Go Individuals and Travelers

- Partygoers and Nightlife Participants

- Drivers and Long-Distance Travelers

| By Soft Drink Type: |

|

| By Packaging Type: |

|

| By Distribution Channel: |

|

- North America Energy Drinks Market Size (FY’2024-FY’2033)

- Overview of North America Energy Drinks Market

- Segmentation of North America Energy Drinks Market By Soft Drink Type (Energy Shots, Natural/Organic Energy Drinks, Traditional Energy Drinks, Others)

- Segmentation of North America Energy Drinks Market By Packaging Type (Glass Bottles, Metal Can, PET Bottles)

- Segmentation of North America Energy Drinks Market By Distribution Channel (Off-trade, On-trade)

- Expansion Analysis of North America Energy Drinks Market

- Problems and Obstacles in North America Energy Drinks Market

- Competitive Landscape in the North America Energy Drinks Market

- Impact of COVID-19 and Demonetization on North America Energy Drinks Market

- Details on Current Investment in North America Energy Drinks Market

- Competitive Analysis of North America Energy Drinks Market

- Prominent Players in the North America Energy Drinks Market

- SWOT Analysis of North America Energy Drinks Market

- North America Energy Drinks Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the North America Energy Drinks Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. North America Energy Drinks Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in North America Energy Drinks Market

7.1. North America Energy Drinks Market Size, Share and Forecast, By Soft Drink Type, 2020-20267.2. North America Energy Drinks Market Size, Share and Forecast, By Soft Drink Type, 2027-20337.3. Energy Shots7.4. Natural/Organic Energy Drinks7.5. Traditional Energy Drinks7.6. Others

8.1. North America Energy Drinks Market Size, Share and Forecast, By Packaging Type (2020-20268.2. North America Energy Drinks Market Size, Share and Forecast, By Packaging Type (, 2027-20338.3. Glass Bottles8.4. Metal Can8.5. PET Bottles

9.1. North America Energy Drinks Market Size, Share and Forecast, By Distribution Channel, 2020-20269.2. North America Energy Drinks Market Size, Share and Forecast, By Distribution Channel 2027-20339.3. Off- trade9.3.1. Convenience Stores9.3.2. Online Retail9.3.3. Supermarket/Hypermarket9.3.4. Others9.4. On-trade

10.1. North America Energy Drinks Market Size and Market Share

11.1. North America Energy Drinks Market Size and Market Share By Region (2020-2026)11.2. North America Energy Drinks Market Size and Market Share By Region (2027-2033)11.3. Eastern11.4. Western11.5. Northern11.6. Southern

12.1. Aje Group12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments12.2. Congo Brands12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments12.3. DAS Labs LLC12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments12.4. Living Essentials, LLC12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments12.5. Monster Beverage Corporation12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments12.6. N.V.E. Pharmaceuticals12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments12.7. PepsiCo, Inc.12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments12.8. Red Bull GmbH12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments12.9. Seven & I Holdings Co., Ltd.12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments12.10. The Coca-Cola Company12.10.1. Company details12.10.2. Financial outlook12.10.3. Product summary12.10.4. Recent developments12.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.