Feed Binders Market Introduction and Overview

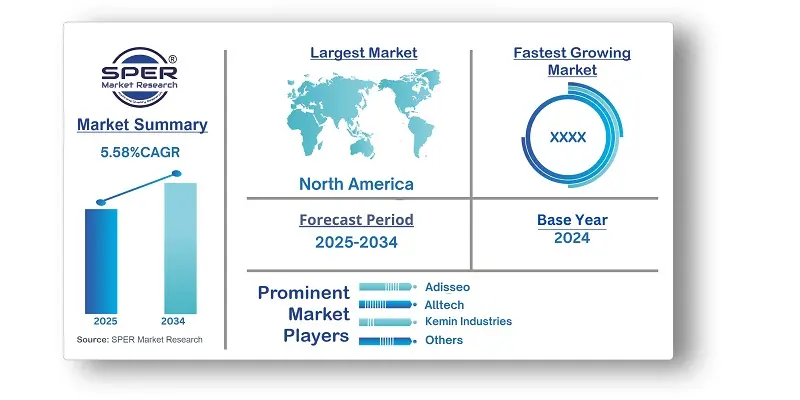

According to SPER Market Research, the Global Feed Binders Market is estimated to reach USD 7.63 billion by 2034 with a CAGR of 5.58%.

The report includes an in-depth analysis of the Global Feed Binders Market, including market size and trends, product mix, Applications, and supplier analysis. The market is experiencing consistent growth, fueled by the rising demand for pelleted feed, growing awareness of animal nutrition, and advancements in feed technology. Notable trends include a shift towards natural and sustainable binders, expansion within the aquaculture sector, and innovation in binder formulations to improve feed efficiency. The growing demand for high-quality animal nutrition to support livestock and aquaculture production is driving the need for efficient binders. Furthermore, the shift towards pelleted feed formats, which enhance feed efficiency and handling, is contributing to the increased use of binders. Rising consumer awareness of animal welfare and sustainable farming practices is also impacting market growth, leading to a growing preference for natural and eco-friendly binder solutions.

By Source:

According to the source, the market is divided into natural and synthetic binders. Natural binders are expected to maintain a dominant share of the market in the coming years. Meanwhile, the trend towards synthetic feed binders is gaining traction due to the growing demand for better feed efficiency and sustainability. Synthetic binders offer precise control over binding properties, ensuring consistent pellet quality and minimizing feed wastage. They also provide improved stability during feed processing and storage, extending shelf life and reducing nutrient degradation. Additionally, synthetic binders help address concerns related to variability and contamination that can arise from some natural binder sources.

By Type:

The feed binders market is classified by type into lignosulfonates, plant gums and starches, gelatin, molasses, clays, and others. The plant gums and starches segment is experiencing growth, driven by their natural origin, sustainability, and functional benefits. Lignosulfonates are gaining popularity in the animal feed industry due to their effectiveness in pelletizing feed, enhancing digestibility, and reducing dust, all of which are contributing to the overall growth of the market.

By Livestock:

The feed binders market is segmented by livestock into poultry, aquaculture, swine, pet, and others. The aquaculture segment is expected to experience significant growth during the forecast period.

In aquaculture, the demand for feed binders is increasing as pelleted feeds for fish and shrimp become more widely adopted. Feed binders are essential for maintaining pellet integrity, minimizing feed waste, and enhancing nutrient absorption in aquatic species. Additionally, the growing focus on sustainable aquaculture practices and the need for efficient feed use are driving the search for effective and environmentally friendly binder solutions.

By Regional Insights

In 2024, the Asia Pacific region led the global feed binders market. The market in this region is experiencing significant growth, fueled by the expansion of the livestock and aquaculture industries. The rising demand for high-quality animal nutrition, along with the shift towards pelleted feed formats, is increasing the need for efficient binders. Manufacturers are focusing on developing cost-effective and sustainable binder solutions that improve feed quality, pellet durability, and animal health.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Adisseo, ADM, Alltech, BASF SE, Borregaard, Cargill, DSM, DuPont, Kemin Industries, O K Bio Systems, and others.

Recent Developments:

In 2022, Jordan's Manaseer Group developed a mineral-based feed additive with mycotoxin-binding properties. This product is designed to mitigate the harmful effects of mycotoxins in feed, such as Aflatoxin B1.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Source, By Type, By Livestock |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa Companies Covered Adisseo, ADM, Alltech, BASF SE, Borregaard, Cargill, DSM, DuPont, Kemin Industries, O K Bio Systems, and others. |

Key Topics Covered in the Report

- Global Feed Binders Market Size (FY’2021-FY’2034)

- Overview of Global Feed Binders Market

- Segmentation of Global Feed Binders Market By Source (Natural, Synthetic)

- Segmentation of Global Feed Binders Market By Type (Lignosulfonates, Plant Gums & Starches, Gelatin, Molasses, Clays, Others)

- Segmentation of Global Feed Binders Market By Livestock (Poultry, Aquaculture, Swine, Pet, Others)

- Statistical Snap of Global Feed Binders Market

- Expansion Analysis of Global Feed Binders Market

- Problems and Obstacles in Global Feed Binders Market

- Competitive Landscape in the Global Feed Binders Market

- Details on Current Investment in Global Feed Binders Market

- Competitive Analysis of Global Feed Binders Market

- Prominent Players in the Global Feed Binders Market

- SWOT Analysis of Global Feed Binders Market

- Global Feed Binders Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Feed Binders Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Feed Binders Market

7. Global Feed Binders Market, By Source, (USD Million) 2021-2034

7.1. Natural

7.2. Synthetic

8. Global Feed Binders Market, By Type, (USD Million) 2021-2034

8.1. Lignosulfonates

8.2. Plant Gums & Starches

8.3. Gelatin

8.4. Molasses

8.5. Clays

8.6. Others

9. Global Feed Binders Market, By Livestock, (USD Million) 2021-2034

9.1. Poultry

9.2. Aquaculture

9.3. Swine

9.4. Pet

9.5. Others

10. Global Feed Binders Market, (USD Million) 2021-2034

10.1. Global Feed Binders Market Size and Market Share

11. Global Feed Binders Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Adisseo

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. ADM

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Alltech

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. BASF SE

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Borregaard

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Cargill

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. DSM

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. DuPont

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Kemin Industries

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. O K Bio Systems

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.