Middle East and Africa E-cigarette and Vape Market Trends, Share, Demand and Future Outlook

Middle East and Africa E-cigarette and Vape Market Growth, Size, Trends Analysis- By Product, By Category, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Nov-2024 | Report ID: FMCG24202 | Pages: 1 - 157 | Formats*: |

| Category : Consumer & Retail | |||

- In April 2022, RELX International, a worldwide electronic cigarette firm, praised Egyptian authorities' recent decision to allow the legal import and sale of e-cigarette goods in the country. The lifting of the prohibition demonstrates Egyptian authorities' evolving approach to e-cigarettes. It lays the groundwork for a regulated market brimming with economic prospects by meeting the demand for conveniently accessible, high-quality items among legal age (adult) consumers across the country.

- "Electronic cigarettes & accessories trading" is a new business that was recently introduced by the Dubai Department of Economic Development (DED) in November 2019 under the "Tobacco and Smoking accessories trading" group.

- Regulatory uncertainty: The e-cigarette and vape market faces significant challenges due to regulatory uncertainty. Inconsistent standards in several areas might stifle growth and disrupt the supply chain. Different methods of regulating e-cigarettes, ranging from outright bans to stringent limitations on marketing and product standards, make it difficult for producers and distributors to meet all criteria. Not knowing what future laws will look like makes it difficult for businesses to make investment decisions and expand their markets, leaving industry players feeling uncertain.

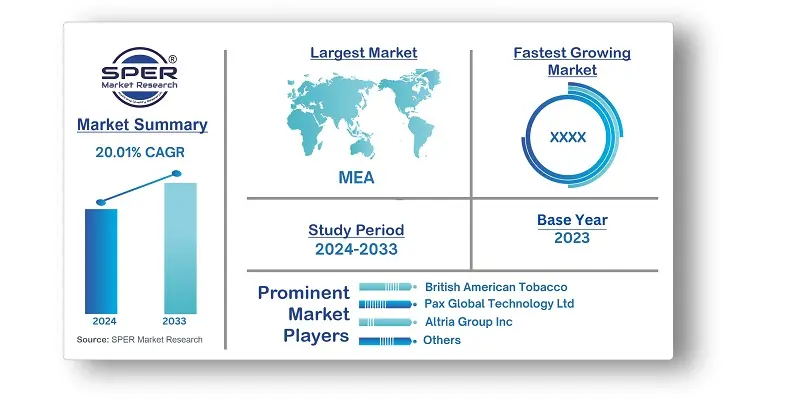

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Product, By Category, By Distribution Channel |

| Regions covered | South Africa, Nigeria, Kenya, Ghana, United Arab Emirates, Egypt, Rest of Middle East & Africa |

| Companies Covered | Altria Group Inc, British American Tobacco, Imperial Brands PLC, Vapor Group Inc, Japan Tobacco Inc, Pax Global Technology Ltd, Philip Morris International Inc, Reynolds Consumer Products Inc, Shenzhen International Holdings Ltd. |

- Increased Health Consciousness: The epidemic has raised people's health awareness, resulting in a greater interest in healthier lifestyle choices. This has caused some smokers to look into e-cigarettes as a possible alternative to traditional smoking.

- Regulatory Response: Some governments have utilized the pandemic to impose stricter regulations on e-cigarettes. This includes sales bans and advertising limitations, which exacerbate the obstacles encountered by industry participants.

- Adult Smokers Seeking Alternatives

- Young Adults and Millennials

- Health-Conscious Consumers (looking to reduce tobacco use)

- Expatriates and Western Influenced Consumers

- Premium and High-Income Consumers

- E-Commerce Shoppers

- Specialty Vape Shops and Retailers

| By Product: | |

| By Category: | |

| By Distribution Channel: | |

| By Region: |

- Middle East & Africa E-cigarette and Vape Market Size (FY’2024-FY’2033)

- Overview of Middle East & Africa E-cigarette and Vape Market

- Segmentation of Middle East & Africa E-cigarette and Vape Market By Product (Disposable, Rechargeable, Modular Devices)

- Segmentation of Middle East & Africa E-cigarette and Vape Market By Category (Open, Closed)

- Segmentation of Middle East & Africa E-cigarette and Vape Market By Distribution Channel (Online, Retail)

- Statistical Snap of Middle East & Africa E-cigarette and Vape Market

- Expansion Analysis of Middle East & Africa E-cigarette and Vape Market

- Problems and Obstacles in Middle East & Africa E-cigarette and Vape Market

- Competitive Landscape in the Middle East & Africa E-cigarette and Vape Market

- Impact of COVID-19 and Demonetization on Middle East & Africa E-cigarette and Vape Market

- Details on Current Investment in Middle East & Africa E-cigarette and Vape Market

- Competitive Analysis of Middle East & Africa E-cigarette and Vape Market

- Prominent Players in the Middle East & Africa E-cigarette and Vape Market

- SWOT Analysis of Middle East & Africa E-cigarette and Vape Market

- Middle East & Africa E-cigarette and Vape Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Middle East & Africa E-cigarette and Vape Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Middle East & Africa E-cigarette and Vape Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Middle East & Africa E-cigarette and Vape Market

7.1. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Product, 2020-20267.2. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Product, 2027-20337.3. Disposable7.4. Rechargeable7.5. Modular Devices

8.1. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Category, 2020-20268.2. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Category, 2027-20338.3. Open8.4. Closed

9.1. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Distribution Channel, 2020-20269.2. Middle East & Africa E-cigarette and Vape Market Size, Share and Forecast, By Distribution Channel, 2027-20339.3. Online9.4. Retail

9.4.1. Convenience Store9.4.2. Drug Store9.4.3. Newsstand9.4.4. Tobacconist Store9.4.5. Specialty E-cigarette Store

10.1. Middle East & Africa E-cigarette and Vape Market Size and Market Share

11.1. Middle East & Africa E-cigarette and Vape Market Size and Market Share By Region (2020-2026)11.2. Middle East & Africa E-cigarette and Vape Market Size and Market Share By Region (2027-2033)11.3. South Africa11.4. Nigeria11.5. Kenya11.6. Ghana11.7. United Arab Emirates11.8. Egypt11.9. Rest of Middle East & Africa

12.1. Altria Group Inc

12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments

12.2. British American Tobacco

12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments

12.3. Imperial Brands PLC

12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments

12.4. Vapor Group Inc

12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments

12.5. Japan Tobacco Inc

12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments

12.6. Pax Global Technology Ltd

12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments

12.7. Philip Morris International Inc

12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments

12.8. Reynolds Consumer Products Inc

12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments

12.9. Shenzhen International Holdings Ltd

12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments

12.10. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.