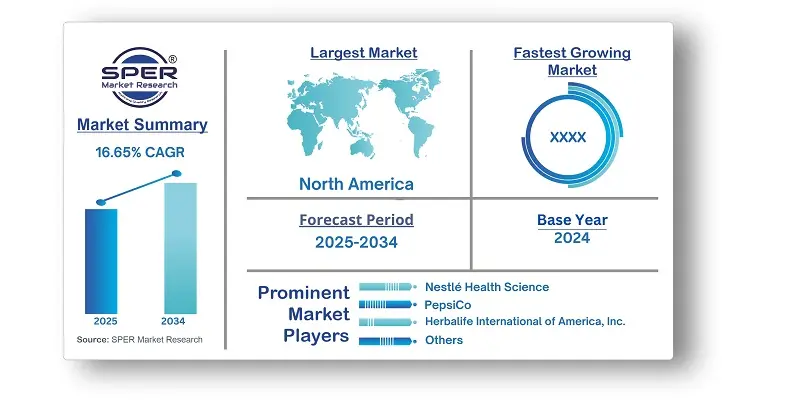

Nutritional Supplements Market Trends, Demand, CAGR Status, Business Opportunities, Challenges and Competitive Analysis 2025-2034

Nutritional Supplements Market Growth, Size, Trends Analysis - By Product, By Formulation, By Consumer Group, By Sales Channel, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

| Published: Apr-2025 | Report ID: FMCG2574 | Pages: 1 - 272 | Formats*: |

| Category : Consumer & Retail | |||

- Steadfast Nutrition added three new supplements to their lineup in June 2024: 180-tablet vegetarian multivitamin mega pack, LIV Raw, and Whey Protein. These goods are designed to meet the dietary and protein requirements of athletes and health-conscious people. The International Health Sports and Fitness Festival (IHFF), Asia's biggest health and fitness event, hosted the premiere.

- In April 2023, Haleon Group of Companies, formerly GSK Consumer Healthcare, is expanding its Centrum supplements brand in India with a new specialized nutrition line called "Benefit Blends," for adults and children. This launch follows Centrum's introduction in India and aims to enhance its market presence. The company plans more product launches to diversify its offerings.

- In May 2023, the Perfect Game, a softball and baseball organisation, teamed up with Launch Hydrate, a major participant in the sports nutrition sector. The goal of this partnership was to provide the Perfect Games competitors with a selection of sports drinks.

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Formulation, By Consumer Group, By Sales Channel, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Glanbia PLC, Nestlé Health Science, Herbalife International of America, Inc, Amway Corp, PepsiCo, The Coca Cola Company, GNC Holdings, LLC, Thorne, NOW Foods, The Vitamin Shopee. |

- Global Nutritional Supplements Market Size (FY’2021-FY’2034)

- Overview of Global Nutritional Supplements Market

- Segmentation of Global Nutritional Supplements Market By Product (Sports Nutrition, Dietary Supplements, Functional Foods and Beverages, Fat Burners)

- Segmentation of Global Nutritional Supplements Market By Consumer Group (Infants, Children, Adults, Pregnant, Geriatric)

- Segmentation of Global Nutritional Supplements Market By Formulation (Tablets, Capsules, Powder, Softgels, Liquid, Others)

- Segmentation of Global Nutritional Supplements Market By Sales Channel (Brick & Mortar, E-commerce)

- Segmentation of Global Nutritional Supplements Market By Application (Sports & Athletics, General Health, Bone & Joint Health, Brain Health, Gastrointestinal Health, Immune Health, Cardiovascular Health, Skin/Hair/Nails, Sexual Health, Women’s Health, Anti-aging, Weight Management, Others)

- Statistical Snap of Global Nutritional Supplements Market

- Expansion Analysis of Global Nutritional Supplements Market

- Problems and Obstacles in Global Nutritional Supplements Market

- Competitive Landscape in the Global Nutritional Supplements Market

- Details on Current Investment in Global Nutritional Supplements Market

- Competitive Analysis of Global Nutritional Supplements Market

- Prominent Players in the Global Nutritional Supplements Market

- SWOT Analysis of Global Nutritional Supplements Market

- Global Nutritional Supplements Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPERs internal database2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Global Nutritional Supplements Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Nutritional Supplements Market

7.1. Sports Nutrition

7.1.1. Sports Supplements7.1.2. Sports Drinks7.1.3. Sports Foods7.1.4. Meal Replacement Products7.1.5. Weight Loss Product

7.2. Dietary Supplements

7.2.1. Vitamins7.2.2. Minerals7.2.3. Enzymes7.2.4. Amino Acids7.2.5. Conjugated Linoleic Acids7.2.6. Others

7.3. Functional Foods and Beverages

7.3.1. Probiotics7.3.2. Omega -37.3.3. Others

7.4. Fat Burners

7.4.1. Green Tea7.4.2. Fiber7.4.3. Protein7.4.4. Green Coffee7.4.5. Others

8.1. Infants8.2. Children8.3. Adults8.4. Pregnant8.5. Geriatric

9.1. Tablets9.2. Capsules9.3. Powder9.4. Softgels9.5. Liquid9.6. Others

10.1. Brick & Mortar

10.1.1. Direct Selling10.1.2. Chemist/Pharmacies10.1.3. Health Food Shops10.1.4. Hyper Markets10.1.5. Super Markets

10.2. E-commerce

11.1. Sports & Athletics11.2. General Health11.3. Bone & Joint Health11.4. Brain Health11.5. Gastrointestinal Health11.6. Immune Health11.7. Cardiovascular Health11.8. Skin/Hair/Nails11.9. Sexual Health11.10. Womens Health11.11. Anti-aging11.12. Weight Management11.13. Others

12.1. Global Nutritional Supplements Market Size and Market Share

13.1. Asia-Pacific

13.1.1. Australia13.1.2. China13.1.3. India13.1.4. Japan13.1.5. South Korea13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France13.2.2. Germany13.2.3. Italy13.2.4. Spain13.2.5. United Kingdom13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia13.3.2. United Arab Emirates13.3.3. Qatar13.3.4. South Africa13.3.5. Egypt13.3.6. Morocco13.3.7. Nigeria13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada13.4.2. Mexico13.4.3. United States

13.5. Latin America

13.5.1. Argentina13.5.2. Brazil13.5.3. Rest of Latin America

14.1. Glanbia PLC

14.1.1. Company details14.1.2. Financial outlook14.1.3. Product summary14.1.4. Recent developments

14.2. Nestle Health Science

14.2.1. Company details14.2.2. Financial outlook14.2.3. Product summary14.2.4. Recent developments

14.3. Herbalife International of America, Inc

14.3.1. Company details14.3.2. Financial outlook14.3.3. Product summary14.3.4. Recent developments

14.4. Amway Corp

14.4.1. Company details14.4.2. Financial outlook14.4.3. Product summary14.4.4. Recent developments

14.5. PepsiCo

14.5.1. Company details14.5.2. Financial outlook14.5.3. Product summary14.5.4. Recent developments

14.6. The Coca Cola Company

14.6.1. Company details14.6.2. Financial outlook14.6.3. Product summary14.6.4. Recent developments

14.7. GNC Holdings, LLC

14.7.1. Company details14.7.2. Financial outlook14.7.3. Product summary14.7.4. Recent developments

14.8. Thorne

14.8.1. Company details14.8.2. Financial outlook14.8.3. Product summary14.8.4. Recent developments

14.9. NOW Foods

14.9.1. Company details14.9.2. Financial outlook14.9.3. Product summary14.9.4. Recent developments

14.10. The Vitamin Shopee

14.10.1. Company details14.10.2. Financial outlook14.10.3. Product summary14.10.4. Recent developments

14.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.