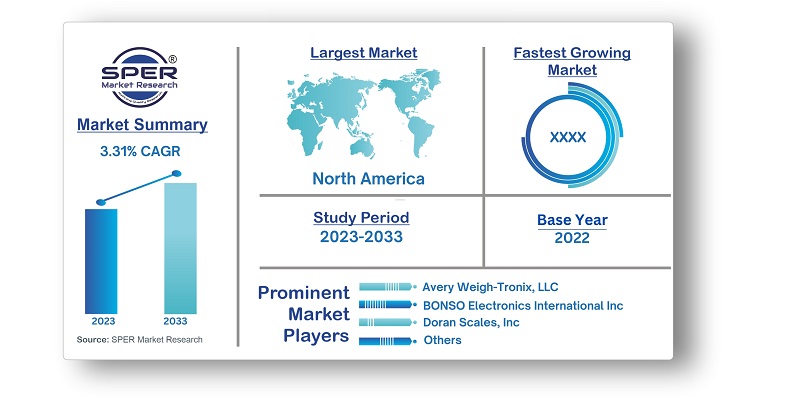

Electronic Weighing Machines Market Growth, Size, Trends, Price, Revenue, Share and Future Scope

Electronic Weighing Machines Market Size- By Type, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Aug-2023 | Report ID: FMCG2397 | Pages: 1 - 244 | Formats*: |

| Category : Consumer & Retail | |||

- June 2020: Mettler-Toledo has unveiled a novel line of precision weighing solutions designed for wash down-resistant check weighing applications. This innovative series includes features that help prevent bacterial contamination hazards, incorporates sloped surfaces to deter the accumulation of debris and liquids, and allows for effortless removal of conveyor belts to streamline the cleaning process.

- February 2020: Mettler-Toledo acquired D.C. Martin & Sons Scales Inc. because it is a supplier of industrial scales and weighing machines. This acquisition bolstered Mettler's operations and expanded its range of scale products in its portfolio.

- Opportunities: The growing utilization of automation across various industries is projected to amplify the demand for electronic weighing machines. Issues related to manual weighing machines, including labour costs, are significant drivers of this trend. Furthermore, electronic weighing machines often come equipped with automation features, reducing the time needed for weighing tasks. Virtually every sector requires electronic weighing machines in some capacity, which is expected to fuel the expansion of the electronic weighing machines market. There exist substantial opportunities in the market for the development of more cost-effective, precise, and accurate machines.

- Challenges: A primary constraint for the electronic weighing machine market is its dependence on electricity for functionality, making it unusable without a power source. This requirement is pushing consumers towards manual weighing machines. Consequently, in developing economies where electricity shortages are prevalent, the adoption rate of electronic weighing machines remains quite low. The market also grapples with issues such as elevated maintenance expenses, high pricing, and the need for high levels of accuracy and precision in comparison to traditional manual weighing machines, posing significant challenges in these developing regions.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Type, By Distribution Channel |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe |

| Companies Covered | A&D Company, Ltd., Avery Weigh-Tronix, LLC., BONSO Electronics International Inc., Doran Scales, Inc., Essae-Teraoka Pvt. Ltd., Fairbanks Scales Inc., Kern & Sohn GmbH, Mettler-Toledo International, Inc., Sartorius Group, Shimadzu Corporation, Others |

- Agriculture

- Commercial Kitchens

- Environmental Monitoring

- Fitness and Health

- Food Processing Industry

- Healthcare Facilities

- Industrial Manufacturers

- Jewelry and Precious Metals

- Logistics and Shipping Companies

- Mining and Construction

- Pharmaceutical Industry

- Retailers

- Waste Management and Recycling

- Others

| By Type: |

|

| By Distribution Channel: |

|

- Global Electronic Weighing Machines Market Size (FY’2023-FY’2033)

- Overview of Global Electronic Weighing Machines Market

- Segmentation of Global Electronic Weighing Machines Market By Type (Gem and Jewelry Scale, Health Scale, Kitchen Scale, Laboratory Scale, Retail Scale, Others)

- Segmentation of Global Electronic Weighing Machines Market By Distribution Channel (Offline, Online)

- Statistical Snap of Global Electronic Weighing Machines Market

- Expansion Analysis of Global Electronic Weighing Machines Market

- Problems and Obstacles in Global Electronic Weighing Machines Market

- Competitive Landscape in the Global Electronic Weighing Machines Market

- Impact of COVID-19 and Demonetization on Global Electronic Weighing Machines Market

- Details on Current Investment in Global Electronic Weighing Machines Market

- Competitive Analysis of Global Electronic Weighing Machines Market

- Prominent Players in the Global Electronic Weighing Machines Market

- SWOT Analysis of Global Electronic Weighing Machines Market

- Global Electronic Weighing Machines Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Global Electronic Weighing Machines Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Global Electronic Weighing Machines Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Electronic Weighing Machines Market

7.1. Global Electronic Weighing Machines Market Value Share and Forecast, By Type, 2023-20337.2. Gem and Jewelry Scale7.3. Health Scale7.4. Kitchen Scale7.5. Laboratory Scale7.6. Retail Scale7.7. Others

8.1. Global Electronic Weighing Machines Market Value Share and Forecast, By Distribution Channel, 2023-20338.2. Offline8.3. Online

9.1. Global Electronic Weighing Machines Market Size and Market Share

10.1. Global Electronic Weighing Machines Market Size and Market Share By Type (2019-2026)10.2. Global Electronic Weighing Machines Market Size and Market Share By Type (2027-2033)

11.1. Global Electronic Weighing Machines Market Size and Market Share By Distribution Channel (2019-2026)11.2. Global Electronic Weighing Machines Market Size and Market Share By Distribution Channel (2027-2033)

12.1. Global Electronic Weighing Machines Market Size and Market Share By Region (2019-2026)12.2. Global Electronic Weighing Machines Market Size and Market Share By Region (2027-2033)12.3. Asia-Pacific12.3.1. Australia12.3.2. China12.3.3. India12.3.4. Japan12.3.5. South Korea12.3.6. Rest of Asia-Pacific12.4. Europe12.4.1. France12.4.2. Germany12.4.3. Italy12.4.4. Spain12.4.5. United Kingdom12.4.6. Rest of Europe12.5. Middle East and Africa12.5.1. Kingdom of Saudi Arabia12.5.2. United Arab Emirates12.5.3. Rest of Middle East & Africa12.6. North America12.6.1. Canada12.6.2. Mexico12.6.3. United States12.7. Latin America12.7.1. Argentina12.7.2. Brazil12.7.3. Rest of Latin America

13.1. A&D Company, Ltd.13.1.1. Company details13.1.2. Financial outlook13.1.3. Product summary13.1.4. Recent developments13.2. Avery Weigh-Tronix, LLC.13.2.1. Company details13.2.2. Financial outlook13.2.3. Product summary13.2.4. Recent developments13.3. BONSO Electronics International Inc.13.3.1. Company details13.3.2. Financial outlook13.3.3. Product summary13.3.4. Recent developments13.4. Doran Scales, Inc.13.4.1. Company details13.4.2. Financial outlook13.4.3. Product summary13.4.4. Recent developments13.5. Essae-Teraoka Pvt. Ltd.13.5.1. Company details13.5.2. Financial outlook13.5.3. Product summary13.5.4. Recent developments13.6. Fairbanks Scales Inc.13.6.1. Company details13.6.2. Financial outlook13.6.3. Product summary13.6.4. Recent developments13.7. Kern & Sohn GmbH13.7.1. Company details13.7.2. Financial outlook13.7.3. Product summary13.7.4. Recent developments13.8. Mettler-Toledo International, Inc.13.8.1. Company details13.8.2. Financial outlook13.8.3. Product summary13.8.4. Recent developments13.9. Sartorius Group13.9.1. Company details13.9.2. Financial outlook13.9.3. Product summary13.9.4. Recent developments13.10. Shimadzu Corporation13.10.1. Company details13.10.2. Financial outlook13.10.3. Product summary13.10.4. Recent developments13.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.