Digestive Health Products Market Introduction and Overview

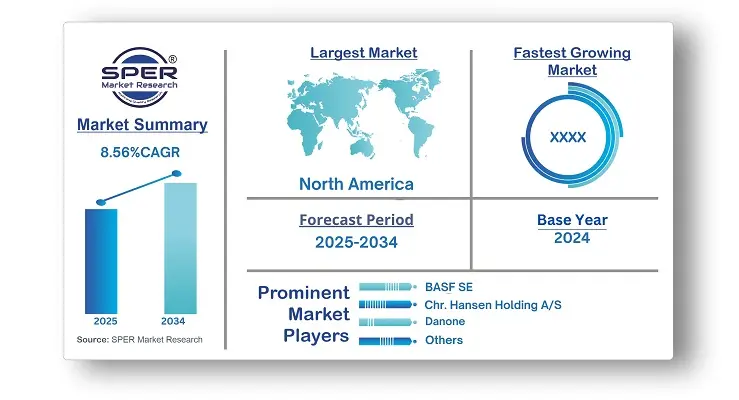

According to SPER Market Research, the Global Digestive Health Products Market is estimated to reach USD 127.4 billion by 2034 with a CAGR of 8.56%.

The report includes an in-depth analysis of the Global Digestive Health Products Market, including market size and trends, product mix, Applications, and supplier analysis. The market for Digestive Health Products is expanding as more people become aware of the connection between gut health and general wellbeing. Poor eating habits, a rise in gastrointestinal problems, and changes in lifestyle are driving up consumer demand for dietary enzymes, probiotics, and prebiotics. The industry is also being driven by improvements in microbiome research and a growing desire for natural and functional foods. But obstacles to expansion include things like complicated regulations, expensive products, and consumers' doubts about the effectiveness of products. Notwithstanding these challenges, it is anticipated that higher R&D expenditures and wider distribution networks would promote the continued use of digestive health products throughout the world.

By Product Insights

Digestive Health Products is classified into four categories based on Product: Dairy Products, Bakery & Cereals, Non - Alcoholic Beverages, Supplements. The market was dominated by dairy products. In addition to the discovery of effective probiotic strains for dairy products that help reduce intestinal inflammation and enhance gut health and immunity, the industry is pushed by consumers' increasing preference for preventative healthcare. With CAGR, the supplement market is expected to grow. The optimistic attitude toward diet and health, fuelled by growing knowledge of the advantages of an active lifestyle and dietary supplements, is anticipated to greatly increase sales of digestive health products.

By Ingredient Insights

The market for Digestive Health Products is segmented based on Ingredient, including Prebiotics, Probiotics and Food Enzymes. The industry leader was the probiotics sector. Growing consumer knowledge of probiotics' potential health advantages, including boosting mental health, lowering inflammation, enhancing digestive health, and supporting immune function, is responsible for their appeal in nutritious foods and supplements. It is projected that the food enzymes market would expand at a CAGR. The food and beverage industry's increasing need for enzyme cultures and the multipurpose nature of food enzymes are anticipated to propel the segment's expansion during the projected period.

By Regional Insights

North America is in dominance. The region's high market share was a result of the stronghold of the major players in the industry, government assistance for the development of new products, and technological advancements in the probiotic and prebiotic industries. In addition, rising healthcare expenses, modifications to food regulations impacting product and label claims, quick advancements in science and processing technologies, an aging population, and a growing desire to achieve wellness via diet will all contribute to the region's future expansion.

Market Competitive Landscape

The market for digestive health products is extremely competitive, and major firms prioritize market expansion, strategic alliances, and innovation. Strong brand recognition and a wide range of products are the hallmarks of dominant corporations. Offering specialized and customized solutions is helping startups and regional companies achieve traction. Some of the key market players are BASF SE, Chr. Hansen Holding A/S, Nestle SA, International Flavors & Fragrances Inc., DuPont de Nemours, Inc., Bayer AG, Danone, Arla Foods amba, Sanofi, Cargill, Inc.

Recent Developments:

In December 2024, The FODMAP-friendly probiotic BioGaia® Gastrus® PURE ACTION was launched by BioGaia for sensitive digestive systems. The formulation contains strains of Lactobacillus reuteri ATCC PTA 6475 and DSM 17938 that have been shown to be clinically effective in increasing digestive comfort. It contains a twice-daily dosage to ease stomach discomforts and is free of sugar, lactose, gluten, and sweeteners as it is vegan.

In November 2024, Volac and Arla Foods Ingredients jointly declared their purchase decision. The announcement describes the specifics of the two businesses' agreement, emphasizing their strategic partnership in the food ingredients industry. It is anticipated that this action will improve their market position and increase the range of products they sell.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Ingredient |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | BASF SE, Chr. Hansen Holding A/S, Nestle SA, International Flavors & Fragrances Inc., DuPont de Nemours, Inc., Bayer AG, Danone, Arla Foods amba, Sanofi, Cargill, Inc.

|

Key Topics Covered in the Report

- Global Digestive Health Products Market Size (FY’2021-FY’2034)

- Overview of Global Digestive Health Products Market

- Segmentation of Global Digestive Health Products Market By Product (Dairy Products, Bakery & Cereals, Non - Alcoholic Beverages, Supplements)

- Segmentation of Global Digestive Health Products Market By Ingredient (Prebiotics, Probiotics, Food Enzymes)

- Statistical Snap of Global Digestive Health Products Market

- Expansion Analysis of Global Digestive Health Products Market

- Problems and Obstacles in Global Digestive Health Products Market

- Competitive Landscape in the Global Digestive Health Products Market

- Details on Current Investment in Global Digestive Health Products Market

- Competitive Analysis of Global Digestive Health Products Market

- Prominent Players in the Global Digestive Health Products Market

- SWOT Analysis of Global Digestive Health Products Market

- Global Digestive Health Products Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analys

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Digestive Health Products Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Digestive Health Products Market

7. Global Digestive Health Products Market, By Product 2021-2034 (USD Million)

7.1. Dairy Products

7.2. Bakery & Cereals

7.3. Non - Alcoholic Beverages

7.4. Supplements

8. Global Digestive Health Products Market, By Ingredient 2021-2034 (USD Million)

8.1. Prebiotics

8.2. Probiotics

8.3. Food Enzymes

8.3.1. Animal Based

8.3.2. Plant Based

8.3.3. Microbial Based

9. Global Digestive Health Products Market, 2021-2034 (USD Million)

9.1. Global Digestive Health Products Market Size and Market Share

10. Global Digestive Health Products Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Arla Foods amba

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

.2. BASF SE

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Cargill, Inc.

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Danone

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Delta Apparel

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. DuPont de Nemours, Inc.

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Fruit of the Loom, Inc.

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Hanes brands Inc.

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Nestle SA

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Sanofi

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.