Vietnam Water Heater Market Introduction and Overview

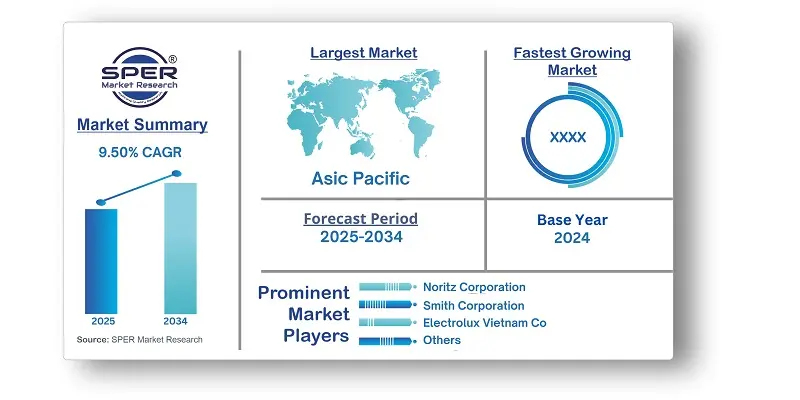

According to SPER Market Research, the Vietnam Water Heater Market is estimated to reach USD 581.20 billion by 2034 with a CAGR of 9.50%.

The report includes an in-depth analysis of the Vietnam Water Heater Market, including market size and trends, product mix, Applications, and supplier analysis. The market growth is attributed to the increasing demand for water heaters in Vietnam, fueled by the escalating need for hot water in the country. The swift pace of urban growth, along with the expanding population, has caused construction activities to rise steeply, thereby generating an increasing demand for water heaters in residential and commercial sectors respectively. Furthermore, as Vietnam's economy grows, the middle-class population is increasing significantly, which in turn generates greater demand for water heaters in the country. Due to the varied geographical and climatic conditions of the country, water heater components experience differing degrees of wear and tear, which makes frequent repairs and replacements necessary. Additionally, the quality of water sources differs from one region to another, with hard water being common in many regions.

By Product Type Insights: The Vietnam Water Heater industry's Electric segment is anticipated to hold a major market share in the forecast period. Due to their straightforward installation and operation, as well as their minimal infrastructure requirements and lack of need for an external fuel source, electric water heaters are widely favoured for various residential and commercial uses. In addition, the relatively stable and accessible electricity supply infrastructure in Vietnam makes electric water heaters a practical and dependable option for consumers in different regions.

By Distribution Channel Insights: The Direct sales has dominated the distribution channel segment this year. This is attributed to strong relationships between manufacturers and commercial clients, such as hotels, hospitals, and large enterprises, which prefer direct procurement for bulk orders and reliable after-sales services. Additionally, direct sales ensure customized solutions and better pricing, making them the preferred choice in both residential and commercial sectors. Other channels, like supermarkets and online platforms, are growing but remain secondary to direct sales

By End User Insights: In 2024, the Commercial segment is anticipated to hold the largest market share. Vietnams rapid urbanization and commercial expansion have driven demand for water heaters in hotels, restaurants, hospitals, and offices, essential for amenities, food preparation, and sanitation. Growing commercial construction projects, including shopping centers, schools, and leisure facilities, further boost water heater demand in the commercial sector.

By Regional Insights: The Northern region of Vietnam holds the largest share of the water heater market due to its colder climate, which drives higher demand for water heating solutions in residential and commercial sectors. Additionally, the region's rapid urbanization, industrial growth, and large population density further contribute to its market dominance.

Market Competitive Landscape:

O. Smith Corporation, Ariston Thermo Group, Bosch Thermotechnology, Eemax Inc., Electrolux Vietnam Co. Ltd., Ferroli S.P.A, Noritz Corporation, Picenza Vietnam Production and Trading Company Ltd., and Rheem Manufacturing Company are key players in the Vietnam water heater market, contributing to the industry's growth through innovative products and technological advancements.

Recent Developments:

- In 2023, Electricity of Vietnam (EVN) reported that the total electricity generation of the system was approximately 26.20 billion kWh, reflecting a 7.1% rise compared to 2022.

- In 2023, The Vietnamese government-initiated Resolution No. 82/NQ-CP on tourism promotion and the National Assembly's (NA) visa policy to stimulate recovery and development in the tourism sector.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product Type, By Distribution Channel, By End User. |

| Regions covered | Northern Vietnam, Central Vietnam, Southern Vietnam. |

| Companies Covered | A. O. Smith Corporation, Ariston Thermo Group, Bosch Thermotechnology, Eemax Inc., Electrolux Vietnam Co. Ltd., Ferroli S.P.A, Noritz Corporation, Picenza Vietnam Production and Trading Company Ltd., and Rheem Manufacturing Company and others. |

Key Topics Covered in the Report:

- Vietnam Water Heater Market Size (FY’2021-FY’2034)

- Overview of Vietnam Water Heater Market

- Segmentation of Vietnam Water Heater Market By Product Type (Electric, Solar, Gas, Others)

- Segmentation of Vietnam Water Heater Market By Distribution Channel (Direct Sales, Supermarket/Hypermarket, Online, Others)

- Segmentation of Vietnam Water Heater Market By End User (Residential, Commercial, Industrial)

- Statistical Snap of Vietnam Water Heater Market

- Expansion Analysis of Vietnam Water Heater Market

- Problems and Obstacles in Vietnam Water Heater Market

- Competitive Landscape in the Vietnam Water Heater Market

- Details on Current Investment in Vietnam Water Heater Market

- Competitive Analysis of Vietnam Water Heater Market

- Prominent Players in the Vietnam Water Heater Market

- SWOT Analysis of Vietnam Water Heater Market

- Vietnam Water Heater Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Vietnam Water Heater Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Vietnam Water Heater Market

7. Vietnam Water Heater Market, By Product Type (USD Million) 2021-2034

7.1. Electric

7.2. Solar

7.3. Gas

7.4. Others

8. Vietnam Water Heater Market, By Distribution Channel (USD Million) 2021-2034

8.1. Direct Sales

8.2. Supermarket/Hypermarket

8.3. Online

8.4. Others

9. Vietnam Water Heater Market, By End User (USD Million) 2021-2034

9.1. Residential

9.2. Commercial

9.3. Industrial

10. Vietnam Water Heater Market (USD Million) 2021-2034

10.1. Vietnam Water Heater Market Size and Market Share

11. Vietnam Water Heater Market, By Region (USD Million) 2021-2034

11.1. Northern Vietnam

11.2. Central Vietnam

11.3. Southern Vietnam

12. Company Profile

12.1. A. O. Smith Corporation

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Ariston Thermo Group

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Bosch Thermotechnology

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Eemax Inc.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Electrolux Vietnam Co. Ltd.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Ferroli S.P.A

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Noritz Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Picenza Vietnam Production and Trading Company Ltd.

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Rheem Manufacturing Company

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links