Solar Panel Recycling Market Introduction and Overview

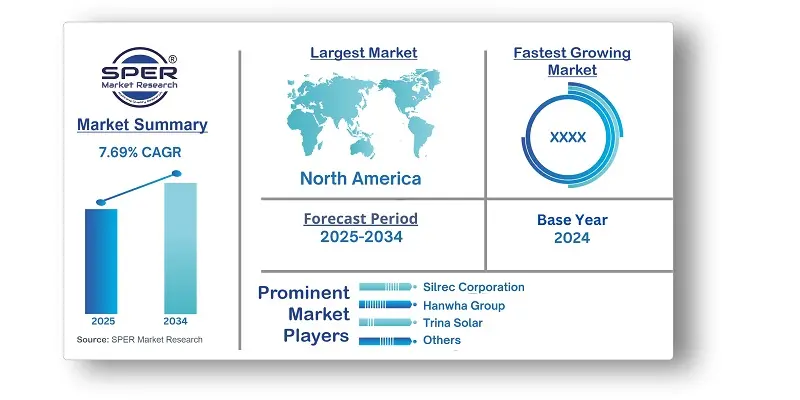

According to SPER Market Research, the Global Solar Panel Recycling Market is estimated to reach USD 677.36 million by 2034 with a CAGR of 7.69%.

The report includes an in-depth analysis of the Global Solar Panel Recycling Market, including market size and trends, product mix, Applications, and supplier analysis. The market is mainly driven by the global rise in solar panel installations and the subsequent increase in panel waste as they reach the end of their limited lifespan. With environmental regulations becoming stricter and governments placing greater emphasis on sustainable disposal practices, the demand for efficient recycling solutions is growing. This regulatory pressure, along with the scarcity of raw materials like silicon and precious metals used in photovoltaic cells, plays a key role in driving the industry forward. However, A major challenge for the global solar panel recycling market is the high cost of the recycling process, as extracting valuable materials often doesn't generate enough revenue to cover expenses. Additionally, the substantial investment required for advanced recycling facilities can limit market growth, especially in regions lacking regulatory incentives or financial support.

By Type: The mechanical recycling segment dominates the solar panel recycling market due to its cost-effectiveness and well-established methods. It involves breaking down panels through shredding, crushing, and grinding to recover valuable materials like glass, aluminum, and silicon, which can be reused in new solar panels and other products. The simplicity and scalability of mechanical processes make them widely adopted for handling large volumes of end-of-life panels. In contrast, laser recycling is expected to grow as demand rises for advanced methods that recover high-purity materials. Laser technologies offer precision, minimal material loss, and are especially effective for reclaiming silver and silicon.

By Shelf Life: In 2024, the sector with the highest revenue share in the solar panel recycling market was early loss (UV panel waste). This category contains solar panels that prematurely fail because of things like bad installation, midlife malfunctions, or anti-reflective coating deterioration. These panels add considerably to the total amount of garbage since they are thrown away before they have lived the 25–30 years that are anticipated. The significant number of early loss panels highlights the necessity of effective recycling in order to recover valuable components and lessen the impact on the environment.

The growing number of solar panels installed worldwide is expected to fuel the normal loss (UV panel waste) segment's rapid growth. As these panels approach the end of their useful lives, they need to be recycled effectively in order to recover materials like silicon, silver, and aluminum.

By Technique: In 2024, the monocrystalline segment led the global market for recycling solar panels. In commercial, industrial, and residential settings, monocrystalline solar panels are popular due to their high efficiency and extended lifespan. Therefore, it is anticipated that a sizable portion of these panels would approach the end of their life cycle in the upcoming years. Monocrystalline panel recycling entails reclaiming precious components like silicon, silver, and aluminum that can be utilized again to create new panels and other goods.

By Regional Insights: The growth of the solar panel recycling market in North America is fueled by the rising number of solar installations reaching the end of their life cycle and increasing awareness of the environmental benefits of recycling. Stringent environmental regulations and government incentives to support renewable energy are also major contributors. Moreover, advancements in recycling technologies and the presence of key industry players further drive the development of the solar panel recycling sector in the region.

Market Competitive Landscape:

Aurubis, Canadian Solar, Echo Environmental LLC, Envaris, First Solar Inc., Hanwha Group, Reiling GmbH & Co. KG, SiC Processing GmbH, SILCONTEL LTD, Silrec Corporation, SunPower Corporation, Trina Solar, Others.

Recent Developments:

- In April 2023, First Solar, with a $1.3 million grant from the U.S. Department of Energy, collaborated with the University of Kansas and Idaho National Laboratory to develop cost-effective solar panel recycling methods. Additionally, First Solar signed a supply agreement with Silicon Ranch to provide advanced thin-film solar modules, supporting a recycling program that recovers 90% of materials for reuse.

- In November 2024, SOLARCYCLE revealed intentions to build the largest solar panel recycling facility in the United States, a 5 GW facility in Georgia. Up to 10 million solar panels can be processed annually by this facility, which will handle a sizable amount of the 25–30% of solar modules that are expected to reach the end of their useful lives by 2030.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Shelf Life, By Technique. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Aurubis, Canadian Solar, Echo Environmental LLC, Envaris, First Solar Inc., Hanwha Group, Reiling GmbH & Co. KG, SiC Processing GmbH, SILCONTEL LTD, Silrec Corporation, SunPower Corporation, Trina Solar, Others. |

Key Topics Covered in the Report:

- Global Solar Panel Recycling Market Size (FY’2021-FY’2034)

- Overview of Global Solar Panel Recycling Market

- Segmentation of Global Solar Panel Recycling Market By Type (Mechanical, Thermal, Laser)

- Segmentation of Global Solar Panel Recycling Market By Shelf Life (Early Loss, Normal Loss)

- Segmentation of Global Solar Panel Recycling Market By Technique (Monocrystalline, Polycrystalline, Thin Film)

- Statistical Snap of Global Solar Panel Recycling Market

- Expansion Analysis of Global Solar Panel Recycling Market

- Problems and Obstacles in Global Solar Panel Recycling Market

- Competitive Landscape in the Global Solar Panel Recycling Market

- Details on Current Investment in Global Solar Panel Recycling Market

- Competitive Analysis of Global Solar Panel Recycling Market

- Prominent Players in the Global Solar Panel Recycling Market

- SWOT Analysis of Global Solar Panel Recycling Market

- Global Solar Panel Recycling Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Solar Panel Recycling Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Solar Panel Recycling Market

7. Global Solar Panel Recycling Market, By Type, (USD Million) 2021-2034

7.1. Mechanical

7.2. Thermal

7.3. Laser

8. Global Solar Panel Recycling Market, By Shelf Life, (USD Million) 2021-2034

8.1. Early Loss

8.2. Normal Loss

9. Global Solar Panel Recycling Market, By Technique, (USD Million) 2021-2034

9.1. Monocrystalline

9.2. Polycrystalline

9.3. Thin Film

10. Global Solar Panel Recycling Market, (USD Million) 2021-2034

10.1. Global Solar Panel Recycling Market Size and Market Share

11. Global Solar Panel Recycling Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Aurubis

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Canadian Solar

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Echo Environmental, LLC

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Envaris

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. First Solar Inc.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Hanwha Group

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Reiling GmbH & Co. KG

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. SiC Processing GmbH

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. SILCONTEL LTD

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Silrec Corporation.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. SunPower Corporation

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Trina Solar

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.