The Role of AI in Pharma, Biotech, and Drug Discovery

Based on insights from 50 industry participants, including AI leads, R&D executives, drug discovery scientists, clinical development specialists, and biotech founders, the study reveals a rapidly evolving but uneven landscape of AI adoption in pharmaceutical R&D and drug discovery.

1. Current AI Adoption in Drug Discovery

Across the respondents, 76% reported active use of AI in at least one function of the drug discovery pipeline. The top application areas include:

| AI Use Case | % of Organizations Applying |

|---|---|

| Target Identification & Validation | 72% |

| Hit Discovery / Virtual Screening | 68% |

| Early Preclinical Modeling & Toxicity Prediction | 61% |

| Lead Optimization (e.g., generative ML models) | 54% |

| Experimental Design & Automation | 38% |

► Only 14% reported no meaningful use of AI in discovery, signaling industry-wide transition from experimentation to adoption.

2. Measured and Expected Impact

Timeline Reduction Potential

- Current realized impact: 10–22% acceleration in early discovery timelines

- Projected impact by 2030: 30–50% reduction in discovery and preclinical development timelines

Cost Reduction Potential

| Stage | Current Estimated Savings | Expected Savings by 2030 |

|---|---|---|

| Hit Identification | 15–25% | 35–45% |

| Lead Optimization | 10–20% | 25–40% |

| Toxicology & Preclinical Experiments | 5–15% | 20–35% |

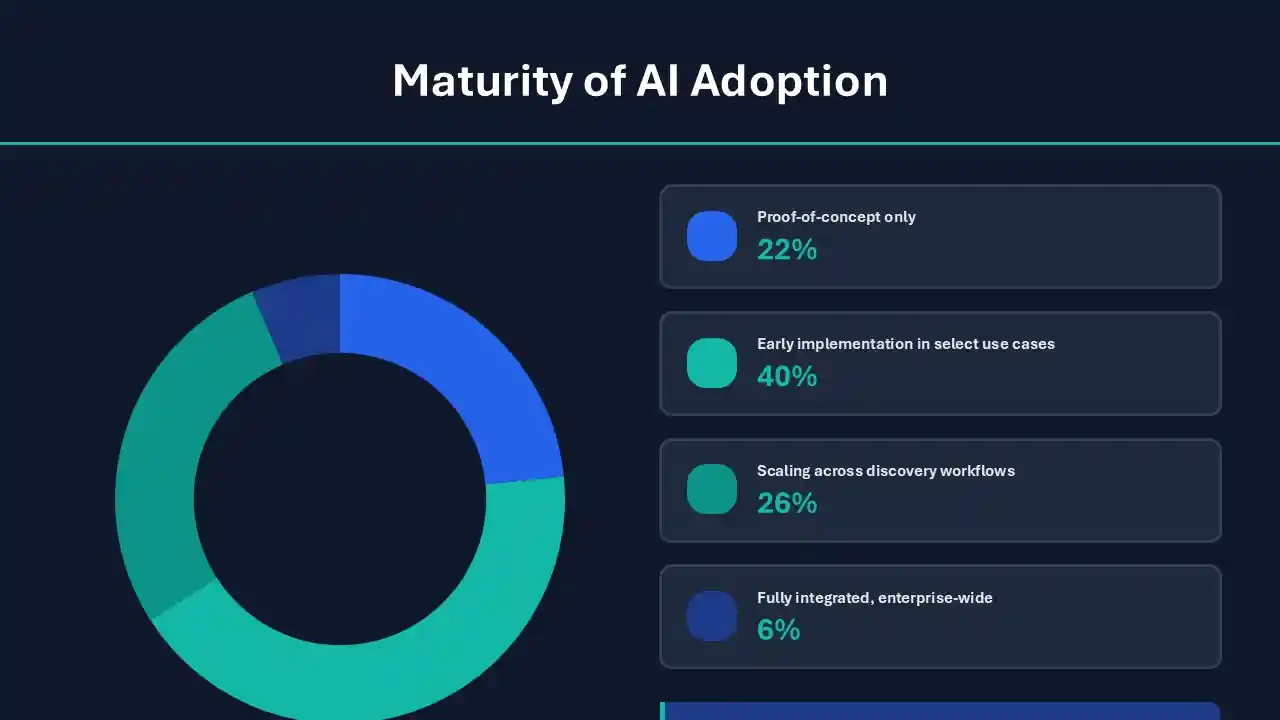

3. Maturity of AI Adoption

Respondents were asked to rate their maturity on a 5-point scale:

| Adoption Stage | % of Respondents |

|---|---|

| Proof-of-concept only | 22% |

| Early implementation in select use cases | 40% |

| Scaling across discovery workflows | 26% |

| Fully integrated, enterprise-wide | 6% |

► Only 1 in 3 organizations have begun scaling beyond pilots — signaling a gap between interest and operationalization.

4. Key Barriers to Scaling AI in Drug Discovery

Participants ranked obstacles from 1 (low) to 5 (critical). The weighted scores reflect priority challenges:

| Barrier Area | Weighted Score (out of 5) |

|---|---|

| Data fragmentation and poor interoperability | 4.6 |

| Lack of validated regulatory frameworks | 4.2 |

| Talent and skills gap (AI + biology hybrid roles) | 4.1 |

| Integration with existing platforms and workflows | 3.8 |

| Limited trust in AI-driven molecular design | 3.5 |

► Over 70% of respondents indicated that data governance and infrastructure modernization are prerequisites before scaling.

5. Investment and Capability Focus Areas

Participants were asked where investments are already active vs. planned:

| Capability Area | Currently Investing | Planned in Next 24 Months |

|---|---|---|

| AI-Ready Unified Data Platforms | 58% | 76% |

| Generative AI for Chemistry/Biology | 46% | 71% |

| Automated / ML-Based Decision Support | 34% | 62% |

| Partnerships with AI-native discovery companies | 52% | 69% |

| Workforce Upskilling (Data + Bio R&D roles) | 29% | 57% |

This suggests a shift from experimentation toward operational capacity building and strategic collaboration.

6. Future Outlook by 2030

Participants forecasted the areas where AI will create the most measurable transformation in pharma and biotech:

| Transformation Category | % Agreeing |

|---|---|

| Faster identification of novel targets | 84% |

| Higher probability of clinical success | 72% |

| Algorithm-driven molecular design replacing traditional screening | 69% |

| Significant reduction in lab-intensive experiments | 61% |

| Personalized/precision drug design | 58% |

Nearly 80% believe that AI will enable a more iterative, simulation-driven and hypothesis-free approach to drug discovery.

Summary: Quantitative Outlook at a Glance

- AI is currently most impactful in early discovery and preclinical modeling.

- Adoption is accelerating, with 68% actively applying AI in chemical or biological design workflows.

- Expected industry-level benefits include:

- 30–50% reduction in discovery timelines

- Up to 45% cost savings in hit identification

- Higher success probability entering clinical phases

- The main barriers remain data, regulatory frameworks, and workforce capability — not algorithm performance.

Final Insight

The study indicates a clear trajectory: AI is transitioning from experimental to essential in pharmaceutical and biotech R&D. Organizations that invest now in scalable data infrastructure, regulatory alignment, and hybrid talent will define the next generation of drug discovery competitiveness.

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.