Mild Hybrid Electric Vehicle Market Introduction and Overview

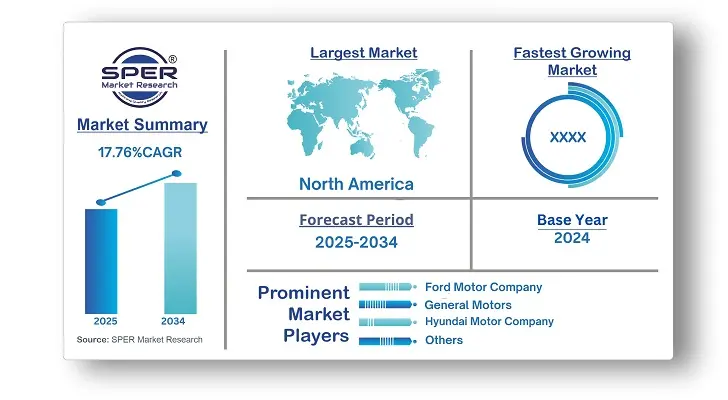

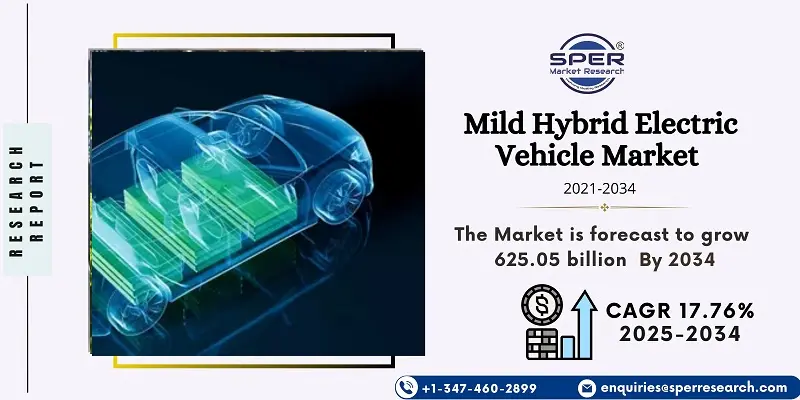

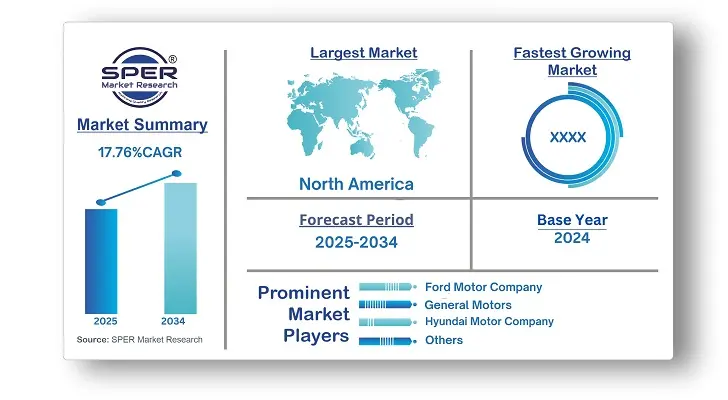

According to SPER Market Research, the Global Mild Hybrid Electric Vehicle Market is estimated to reach USD 625.05 billion by 2034 with a CAGR of 17.76%.

The report includes an in-depth analysis of the Global Mild Hybrid Electric Vehicle Market, including market size and trends, product mix, Applications, and supplier analysis. The Mild Hybrid Electric Vehicle (MHEV) market is witnessing significant growth, driven by the rising number of product launches by major automotive companies. As manufacturers work to comply with stricter emissions standards and meet consumer demand for fuel-efficient vehicles, MHEVs have become a popular solution. For example, Mercedes-Benz introduced mild-hybrid engines in the latest G-Class model, enhancing its power and performance. The demand for MHEVs is also increasing as automakers expand their product offerings into new markets. By venturing into previously untapped regions, companies are responding to global concerns about emissions and fuel efficiency, while also addressing diverse consumer preferences and varying regulatory requirements. This market expansion is expected to continue driving growth in the coming years. Rising fuel prices and the unpredictability of traditional fossil fuel supplies are prompting consumers to look for more fuel-efficient options. MHEVs provide a solution by integrating electric power with traditional internal combustion engines, leading to lower fuel consumption.

By Capacity:

The market is divided based on capacity into two segments: less than 48V and 48V and above. The 48V and above segment holds a significant market share and is expected to experience substantial growth in the coming years. These higher voltage systems provide more powerful electric propulsion and advanced features, improving overall vehicle performance and efficiency.

With growing consumer focus on fuel efficiency and environmental sustainability, MHEVs with 48V and above capacity offer notable benefits, such as enhanced fuel economy and reduced emissions.

By Vehicle:

The mild hybrid electric vehicle market is categorized into passenger cars and commercial vehicles. The passenger car segment holds a dominant share of the market, driven by consumer preferences for fuel efficiency, sustainability, and lower emissions, making MHEVs a popular choice among eco-conscious drivers. Additionally, advancements in hybrid technology have enhanced the performance, driving dynamics, and overall experience of MHEVs in passenger cars, further contributing to their appeal.

By Regional Insights

Asia Pacific is the fastest-growing region in the global mild hybrid electric vehicle market, driven by rapid urbanization, rising disposable incomes, and increasing environmental awareness. The demand for fuel-efficient and eco-friendly transportation options is further fueled by government initiatives supporting clean energy and reducing carbon emissions. With a growing middle class and expanding automotive industries in countries like China, Japan, and South Korea, the region presents significant opportunities for MHEVs. As consumers prioritize sustainable mobility, the demand for MHEVs continues to grow, fostering market expansion and technological innovation.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Ford Motor Company, General Motors, Honda Motor Company Ltd, Hyundai Motor Company, Kia Motors Corporation, Mitsubishi Motors Corporation, Nissan Motor Co. Ltd., Suzuki Motor Corporation, Toyota Motor Corporation, Volkswagen AG, and others.

Recent Developments:

In September 2023, Toyota launched a 48-volt mild hybrid system globally for its Hilux and Land Cruiser Prado models. The company confirmed that the Land Cruiser Prado's 1GD-FTV 2.8-liter inline-four turbo diesel engine will be paired with the 48-volt mild hybrid system.

In January 2024, Maruti Suzuki brought back its mild-hybrid technology in the top manual transmission variants of the Brezza SUV. The 1.5-liter K15C mild-hybrid engine is now available in the ZXI MT and ZXI+ MT trims. Although the company quietly discontinued the mild-hybrid manual variants of the SUV in July, the technology has now made a comeback, but only in the higher-spec variants.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Ford Motor Company, General Motors, Honda Motor Company Ltd, Hyundai Motor Company, Kia Motors Corporation, Mitsubishi Motors Corporation, Nissan Motor Co. Ltd., Suzuki Motor Corporation, Toyota Motor Corporation, Volkswagen AG, and others. |

Key Topics Covered in the Report

- Global Mild Hybrid Electric Vehicle Market Size (FY’2021-FY’2034)

- Overview of Global Mild Hybrid Electric Vehicle Market

- Segmentation of Global Mild Hybrid Electric Vehicle Market By Capacity (Less than 48V, 48 V and above)

- Segmentation of Global Mild Hybrid Electric Vehicle Market By Vehicle (Passenger Cras, Commercial Vehicles)

- Segmentation of Global Mild Hybrid Electric Vehicle Market By Battery (Lithium-ion, Lead Acid, Others)

- Statistical Snap of Global Mild Hybrid Electric Vehicle Market

- Expansion Analysis of Global Mild Hybrid Electric Vehicle Market

- Problems and Obstacles in Global Mild Hybrid Electric Vehicle Market

- Competitive Landscape in the Global Mild Hybrid Electric Vehicle Market

- Details on Current Investment in Global Mild Hybrid Electric Vehicle Market

- Competitive Analysis of Global Mild Hybrid Electric Vehicle Market

- Prominent Players in the Global Mild Hybrid Electric Vehicle Market

- SWOT Analysis of Global Mild Hybrid Electric Vehicle Market

- Global Mild Hybrid Electric Vehicle Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Mild Hybrid Electric Vehicle Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Mild Hybrid Electric Vehicle Market

7. Global Mild Hybrid Electric Vehicle Market, By Capacity, (USD Million) 2021-2034

7.1. Less than 48V

7.2. 48 V and above

8. Global Mild Hybrid Electric Vehicle Market, By Vehicle, (USD Million) 2021-2034

8.1. Passenger cars

8.1.1. Less than 48V

8.1.2. 48 V and above

8.2. Commercial vehicles

8.2.1. Less than 48V

8.2.2. 48 V and above

9. Global Mild Hybrid Electric Vehicle Market, By Battery, (USD Million) 2021-2034

9.1. Lithium-ion

9.2. Lead Acid

9.3. Others

10. Global Mild Hybrid Electric Vehicle Market, (USD Million) 2021-2034

`10.1. Global Mild Hybrid Electric Vehicle Market Size and Market Share

11. Global Mild Hybrid Electric Vehicle Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Ford Motor Company

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. General Motors

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Honda Motor Company Ltd

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Hyundai Motor Company

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Kia Motors Corporation

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Mitsubishi Motors Corporation

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Nissan Motor Co. Ltd.

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Suzuki Motor Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Toyota Motor Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Volkswagen AG

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links