Bio-MEMS Market Introduction and Overview

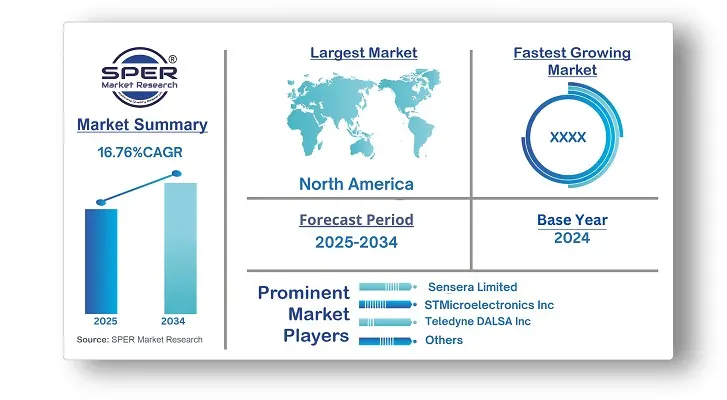

According to SPER Market Research, the Global Bio-MEMS Market is estimated to reach USD XX billion by 2034 with a CAGR of 16.76%.

The report includes an in-depth analysis of the Global Bio-MEMS Market, including market size and trends, product mix, Applications, and supplier analysis. The market for Bio-MEMS (Biological Microelectromechanical Systems) is growing as a result of developments in lab-on-a-chip technology, biosensors, and miniature medical devices. These systems increase drug delivery, patient monitoring, and diagnostic accuracy, which fuels demand in biotechnology and healthcare. The growing incidence of chronic illnesses, the growing need for point-of-care testing, and advancements in micro fabrication technology are some of the major growth factors. Government support and investments in personalized medicine also contribute to the growth of the sector. However, progress is hampered by issues including high production costs, difficult integration with current medical systems, and strict regulatory constraints.

By Application Insights

The market for Bio-MEMS Market is segmented based on Applications, including Patient Monitoring, IVD Testing, Medical Imaging, Drug Delivery and Other Applications. Bio-MEMS applications are growing quickly in a number of healthcare domains, including therapeutic delivery and diagnostics. Bio-MEMS has made it possible to create lab-on-a-chip devices for diagnostics that can conduct several laboratory tests on a single microchip, significantly cutting down on testing time and expense.

By Regional Insights

North America dominates the Bio-MEMS market because to its robust healthcare technology investments, established medical device industry, and cutting-edge micro fabrication and biotechnology research. Strong regulatory frameworks, the existence of major market participants, and the widespread use of cutting-edge medical treatments all contribute to North America's dominance.

Market Competitive Landscape

There is fierce rivalry in this industry, with a number of major competitors fighting for market dominance through strategic alliances, product diversification, and innovation. In order to improve performance and provide accurate solutions, businesses concentrate on creating extremely complex micro-electromechanical systems (MEMS), which combine mechanical and electronic components. Some of the key market players are Sensera Limited, STMicroelectronics Inc., Abbott Laboratories, Teledyne DALSA Inc., Micronit Micro Technologies BV, IntelliSense Software Corporation, Koninklijke Philips N.V., uFluidix, Redbud Labs, Inc., Taylor Hobson (Ametek Inc.).

Recent Developments:

In April 2024, Bosch and Randox Laboratories Ltd., a manufacturer of medical and laboratory equipment, have forged a strategic alliance. The two businesses are spending money on cooperative R&D and sales initiatives. As a result, Bosch Healthcare Solutions' Vivalytic analysis tool will undergo additional testing. One goal is the creation of a high multiplex sepsis test for IVD (in vitro diagnostics), which will be used for the first time and is based on the latest BioMEMS technology.

In October 2023, Precision Neuroscience's BCI has been approved by the FDA, marking a major advancement in the BioMEMS business. It increases manufacturing for the Layer 7 Cortical Interface with 1,024 electrodes by acquiring a MEMS foundry in Texas. Precision is positioned as a leading biomedical MEMS maker in the United States and is aiming for FDA approval.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Application |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | Sensera Limited, STMicroelectronics Inc., Abbott Laboratories, Teledyne DALSA Inc., Micronit Micro Technologies BV, IntelliSense Software Corporation, Koninklijke Philips N.V., uFluidix, Redbud Labs, Inc., Taylor Hobson (Ametek Inc.) |

Key Topics Covered in the Report

- Global Bio-MEMS Market Size (FY’2021-FY’2034)

- Overview of Global Bio-MEMS Market

- Segmentation of Global Bio-MEMS Market By Application (Patient Monitoring, IVD Testing, Medical Imaging, Drug Delivery, Other Applications)

- Statistical Snap of Global Bio-MEMS Market

- Expansion Analysis of Global Bio-MEMS Market

- Problems and Obstacles in Global Bio-MEMS Market

- Competitive Landscape in the Global Bio-MEMS Market

- Details on Current Investment in Global Bio-MEMS Market

- Competitive Analysis of Global Bio-MEMS Market

- Prominent Players in the Global Bio-MEMS Market

- SWOT Analysis of Global Bio-MEMS Market

- Global Bio-MEMS Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Bio-MEMS Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Bio-MEMS Market

7. Global Bio-MEMS Market, By Application 2021-2034 (USD Million)

7.1. Patient Monitoring

7.2. IVD Testing

7.3. Medical Imaging

7.4. Drug Delivery

7.5. Other Applications

8. Global Bio-MEMS Market, 2021-2034 (USD Million)

8.1. Global Bio-MEMS Market Size and Market Share

9. Global Bio-MEMS Market, By Region, 2021-2034 (USD Million)

9.1. Asia-Pacific

9.1.1. Australia

9.1.2. China

9.1.3. India

9.1.4. Japan

9.1.5. South Korea

9.1.6. Rest of Asia-Pacific

9.2. Europe

9.2.1. France

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. United Kingdom

9.2.6. Rest of Europe

9.3. Middle East and Africa

9.3.1. Kingdom of Saudi Arabia

9.3.2. United Arab Emirates

9.3.3. Qatar

9.3.4. South Africa

9.3.5. Egypt

9.3.6. Morocco

9.3.7. Nigeria

9.3.8. Rest of Middle-East and Africa

9.4. North America

9.4.1. Canada

9.4.2. Mexico

9.4.3. United States

9.5. Latin America

9.5.1. Argentina

9.5.2. Brazil

9.5.3. Rest of Latin America

10. Company Profile

10.1. Abbott Laboratories

10.1.1. Company details

10.1.2. Financial outlook

10.1.3. Product summary

10.1.4. Recent developments

10.2. IntelliSense Software Corporation

10.2.1. Company details

10.2.2. Financial outlook

10.2.3. Product summary

10.2.4. Recent developments

10.3. Koninklijke Philips N.V.

10.3.1. Company details

10.3.2. Financial outlook

10.3.3. Product summary

10.3.4. Recent developments

10.4. Micronit Micro Technologies BV

10.4.1. Company details

10.4.2. Financial outlook

10.4.3. Product summary

10.4.4. Recent developments

10.5. Redbud Labs, Inc.

10.5.1. Company details

10.5.2. Financial outlook

10.5.3. Product summary

10.5.4. Recent developments

10.6. Sensera Limited

10.7. STMicroelectronics Inc.

10.7.1. Company details

10.7.2. Financial outlook

10.7.3. Product summary

10.7.4. Recent developments

10.8. Taylor Hobson (Ametek Inc.)

10.8.1. Company details

10.8.2. Financial outlook

10.8.3. Product summary

10.8.4. Recent developments

10.9. Teledyne DALSA Inc.

10.9.1. Company details

10.9.2. Financial outlook

10.9.3. Product summary

10.9.4. Recent developments

10.10. uFluidix

10.10.1. Company details

10.10.2. Financial outlook

10.10.3. Product summary

10.10.4. Recent developments

10.11. Others

11. Conclusion

12. List of Abbreviations

13. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.