Animal Feed Antioxidant Market Introduction and Overview

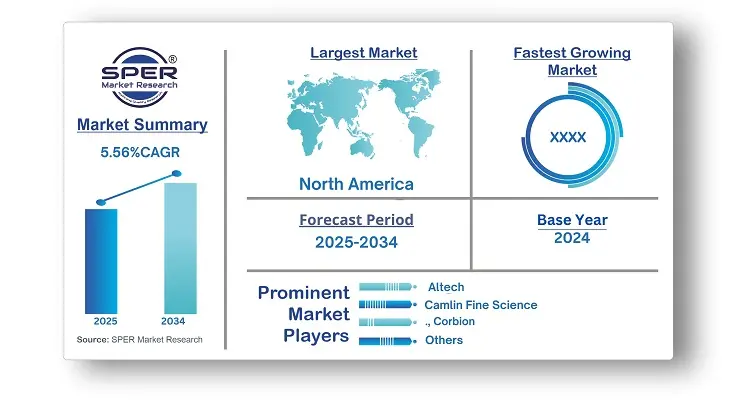

According to SPER Market Research, the Global Animal Feed Antioxidant Market is estimated to reach USD 656.81 million by 2034 with a CAGR of 5.56%.

The report includes an in-depth analysis of the Global Animal Feed Antioxidant Market, including market size and trends, product mix, Applications, and supplier analysis. The increasing awareness of animal nutrition has led to rising demand for antioxidants in animal feed, which help prevent oxidation, preserve nutritional value, and extend shelf life. Feed manufacturers are incorporating antioxidants due to concerns about feed safety, quality, and optimizing animal health. Additionally, the shift towards sustainable, natural solutions and legal requirements for feed efficacy and safety are driving this trend. However, the market faces challenges from raw material price volatility, impacting manufacturers' profit margins and cost structures. Fluctuations in prices for key ingredients like vitamins, minerals, and plant extracts disrupt production schedules and complicate long-term planning.

By Type:

The market is categorized by type into butylated hydroxytoluene (BHT), butylated hydroxy anisole (BHA), ethoxyquin, vitamins, and botanical extracts. Butylated hydroxytoluene (BHT) holds a highest market share and is expected to continue growing. BHT is a synthetic antioxidant known for enhancing the shelf life and overall quality of animal feed. It provides greater stability, helping to preserve the nutritional value of feed over time. Animal feed producers and livestock farmers prefer BHT for its effectiveness in preventing lipid oxidation and reducing the risk of rancidity, ensuring the feed remains fresh and nutritious.

By Form:

The market is segmented into powder, granular, liquid, and pellet forms, with the powder segment holding the largest market share. Powdered antioxidants are favored for their versatility, ease of handling, and compatibility with various feed processing methods. They ensure uniform mixing in feed formulas, maximizing effectiveness. Additionally, powdered antioxidants typically offer better stability and a longer shelf life compared to liquid or granular forms. As a result, feed manufacturers seeking cost-effective solutions with minimal degradation risk prefer the powder form.

By Animal:

The animal feed antioxidant market is divided into poultry, swine, cattle, aquaculture, pet food, and others, with the poultry segment holding the largest market share. Poultry dominates the market due to the high global production of chicken, driven by the increasing demand for chicken meat and eggs. Additionally, chickens are particularly susceptible to oxidative stress due to their high metabolic rates and exposure to environmental stressors. As a result, poultry farmers prioritize incorporating antioxidants into feed formulations to maintain the health, productivity, and quality of their flocks, ensuring optimal performance and welfare.

By Regional Insights

Asia Pacific led the global animal feed antioxidant market in 2024 and is expected to maintain strong growth in the coming years. Several factors have contributed to the region’s dominance in the market. The increasing demand for animal-derived products, driven by rapid urbanization, population growth, and rising disposable incomes, has created a need for antioxidants to preserve feed quality and enhance animal health. As these trends continue, the demand for antioxidants in animal feed is expected to rise significantly in Asia Pacific.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are ADM, Altech, BTSA, Camlin Fine Science, Cargill Inc., Corbion, Food Safe Technologies, Kemin, Lallemand Nutrition, Miavit, and others.

Recent Developments:

In February 2021, global animal nutrition leaders Alltech and DLG Group (DLG) formed a joint venture aimed at improving the profitability and efficiency of livestock producers in Scandinavia. As part of this strategic initiative, they are in the process of acquiring the Finnish company Kärki-Agri. This acquisition is intended to enhance their ability to provide innovative, proven animal nutrition solutions.

In October 2021, BASF and Cargill enhanced their partnership in the animal nutrition sector by expanding their collaboration to include research and development capabilities. This growth also involved exploring new markets beyond their existing feed enzyme distribution agreements. The two companies are dedicated to jointly developing, producing, marketing, and selling enzyme products and solutions focused on meeting customer needs.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Form, By Animal |

| Regions covered | North America, Latin America, Asia-Pacific,Europe, and Middle East & Africa |

| Companies Covered | ADM, Altech, BTSA, Camlin Fine Science, Cargill Inc., Corbion, Food Safe Technologies, Kemin, Lallemand Nutrition, Miavit, and others.. |

Key Topics Covered in the Report

- Global Animal Feed Antioxidant Market Size (FY’2021-FY’2034)

- Overview of Global Animal Feed Antioxidant Market

- Segmentation of Global Animal Feed Antioxidant Market By Type (Butylated hydroxytoluene, Butylated hydroxyanisole, Ethoxyquin, Vitamin, Botanical extract)

- Segmentation of Global Animal Feed Antioxidant Market By Form (Powder, Granular, Liquid, Pellet)

- Segmentation of Global Animal Feed Antioxidant Market By Animal (Poultry, Swine, Cattle, Aquaculture, Pet Food, Others)

- Statistical Snap of Global Animal Feed Antioxidant Market

- Expansion Analysis of Global Animal Feed Antioxidant Market

- Problems and Obstacles in Global Animal Feed Antioxidant Market

- Competitive Landscape in the Global Animal Feed Antioxidant Market

- Details on Current Investment in Global Animal Feed Antioxidant Market

- Competitive Analysis of Global Animal Feed Antioxidant Market

- Prominent Players in the Global Animal Feed Antioxidant Market

- SWOT Analysis of Global Animal Feed Antioxidant Market

- Global Animal Feed Antioxidant Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Animal Feed Antioxidant Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Animal Feed Antioxidant Market

7. Global Animal Feed Antioxidant Market, By Type, (USD Million) 2021-2034

7.1. Butylated hydroxytoluene (BHT)

7.2. Butylated hydroxyanisole (BHA)

7.3. Ethoxyquin

7.4. Vitamin

7.5. Botanical extract

8. Global Animal Feed Antioxidant Market, By Form, (USD Million) 2021-2034

8.1. Powder

8.2. Granular

8.3. Liquid

8.4. Pellet

9. Global Animal Feed Antioxidant Market, By Animal, (USD Million) 2021-2034

9.1. Poultry

9.2. Swine

9.3. Cattle

9.4. Aquaculture

9.5. Pet Food

9.6. Others

10. Global Animal Feed Antioxidant Market, (USD Million) 2021-2034

0.1. Global Animal Feed Antioxidant Market Size and Market Share

11. Global Animal Feed Antioxidant Market, By Region, 2021-2034 (USD Million)

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ADM

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Altech

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BTSA

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Camlin fine science

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Cargill Inc

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Corbion

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

` 12.8. Kemin

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Lallemand Nutrition

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Miavit

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.