Feed Premixes Market Trends, Growth, Size, Share, Analysis, Revenue, Demand and Future Outlook

Feed Premixes Market Growth, Size, Trends Analysis- By Form, By Product, By Livestock - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

| Published: Apr-2025 | Report ID: CHEM2532 | Pages: 1 - 256 | Formats*: |

| Category : Chemical & Materials | |||

Feed Premixes Market Introduction and Overview

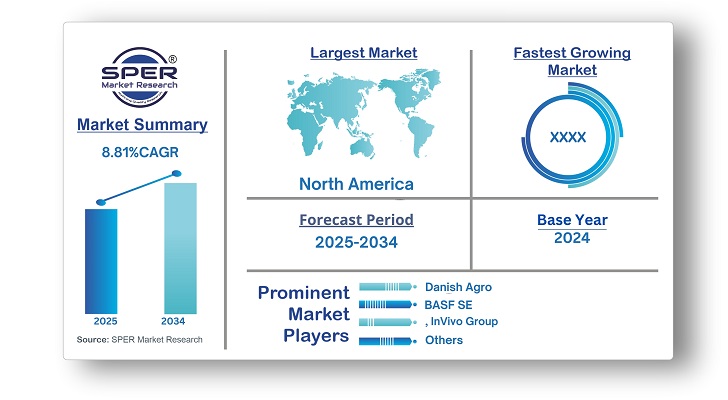

According to SPER Market Research, the Global Feed Premixes Market is estimated to reach USD 32.2 billion by 2034 with a CAGR of 8.81%.

The report includes an in-depth analysis of the Global Feed Premixes Market, including market size and trends, product mix, Applications, and supplier analysis. The global feed premix market is anticipated to grow due to several key factors, such as the rising demand for animal protein, growing awareness of animal nutrition and health issues, technological innovations, and the shift towards intensive animal farming practices. As consumers become more concerned about the quality and safety of animal-based products, the need for feed premixes to improve animal health and productivity is on the rise. Technological advancements have resulted in the creation of more advanced and efficient feed premix products, which are expected to further fuel market growth. However, The prohibition of antibiotics in various countries and the sustainability of the feed and livestock supply chain.

By Form:

The dry segment held the largest revenue share in 2023, largely due to its convenience in storage, ease of handling, lower manufacturing costs, and widespread use in the livestock industry. The dry form is simpler to mix with animal feed and offers a much longer shelf life compared to its liquid counterpart, making it more widely accepted by manufacturers.

In contrast, the wet form provides distinct advantages for livestock applications. Its main benefit is the even distribution of nutrients within the feed, leading to improved consistency. The liquid form allows for precise dosing, giving livestock owners greater control over nutrient levels. This form is particularly well-suited for extruded or pelleted feeds, enhancing overall feed quality.

By Product:

The amino acids segment held the largest revenue share in 2023, primarily due to their crucial role in animal protein development, which enhances both the quality and quantity of meat. Common amino acids used in feed premixes, such as lysine and methionine, are especially important for raising broiler poultry and pigs.

Antioxidants, including vitamin E, vitamin C, selenium, and others, play a vital role in promoting livestock health by neutralizing harmful free radicals in the animal’s body. They also protect other essential nutrients in the premixes from oxidation, helping to preserve pet food products for a longer period while maintaining their nutritional value.

By Livestock:

The poultry segment held the largest revenue share in 2023, driven by the industry's four major sectors—eggs, broilers, pullets, and breeders—which are key consumers of feed premixes globally. The growing demand for poultry meat, particularly in developing countries, has led to an increase in poultry livestock numbers. Factors such as affordable prices, easy availability, and broader acceptance across various religious and social norms have contributed to the rising popularity of poultry meat.

By Regional Insights

The Asia Pacific region held the largest revenue share in 2024, largely due to its substantial livestock population in countries like China, India, and Bangladesh. The region is home to some of the top animal feed producers, with China leading the way, while countries such as Japan, Indonesia, and Thailand also boast significant feed production capabilities. According to Alltech, a large number of the world’s top feed companies are based in the Asia Pacific region, making it a highly competitive market.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are ADM, BASF SE, Cargill Inc., Danish Agro, DLG, dsm-firmenich, ForFarmers, Godrej Agrovet Limited, InVivo Group, and Land O'Lakes Inc.

Recent Developments:

- In October 2022, Cargill (US) and its partner Naturisa S.A. (Ecuador) reached an agreement with Skyvest EC Holding SA to establish a joint venture aimed at expanding shrimp feed production in Ecuador. The feed plant, which was built in 2018, will be managed by Cargill (US) and has a production capacity of 156,000 tonnes, employing over 200 people.

- In September 2022, Cargill (US) opened a corn wet mill in Pandaan, Indonesia, to meet the increasing demand for starches, sweeteners, and feed products in Asia and Indonesia. This initiative is expected to support the growth of Indonesia’s food, beverage, and feed industries.

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Form, By Product, By Livestock |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ADM, BASF SE, Cargill Inc., Danish Agro, DLG, dsm-firmenich, ForFarmers, Godrej Agrovet Limited, InVivo Group, and Land O'Lakes Inc. |

Key Topics Covered in the Report

- Global Feed Premixes Market Size (FY’2021-FY’2034)

- Overview of Global Feed Premixes Market

- Segmentation of Global Feed Premixes Market By Form (Dry, Wet)

- Segmentation of Global Feed Premixes Market By Product (Vitamins, Amino Acids, Antibiotics, Antioxidants, Other Products)

- Segmentation of Global Feed Premixes Market By Livestock (Pork/Swine, Poultry, Cattle, Aquaculture, Other Livestock)

- Statistical Snap of Global Feed Premixes Market

- Expansion Analysis of Global Feed Premixes Market

- Problems and Obstacles in Global Feed Premixes Market

- Competitive Landscape in the Global Feed Premixes Market

- Details on Current Investment in Global Feed Premixes Market

- Competitive Analysis of Global Feed Premixes Market

- Prominent Players in the Global Feed Premixes Market

- SWOT Analysis of Global Feed Premixes Market

- Global Feed Premixes Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Global Feed Premixes Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Feed Premixes Market

7. Global Feed Premixes Market, By Form, (USD Million) 2021-2034

7.1. Dry7.2. Wet

8.1. Vitamins8.2. Amino Acids8.3. Antibiotics8.4. Antioxidants8.5. Other Products

9.1. Pork/Swine9.2. Poultry9.3. Cattle9.4. Aquaculture9.5. Other Livestock

10.1. Global Feed Premixes Market Size and Market Share

11.1. Asia-Pacific

11.1.1. Australia11.1.2. China11.1.3. India11.1.4. Japan11.1.5. South Korea11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France11.2.2. Germany11.2.3. Italy11.2.4. Spain11.2.5. United Kingdom11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia11.3.2. United Arab Emirates11.3.3. Qatar11.3.4. South Africa11.3.5. Egypt11.3.6. Morocco11.3.7. Nigeria11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada11.4.2. Mexico11.4.3. United States

11.5. Latin America

11.5.1. Argentina11.5.2. Brazil11.5.3. Rest of Latin America

12.1. ADM

12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments

12.2. BASF SE

12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments

12.3. Cargill Inc.

12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments

12.4. Danish Agro

12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments

12.5. DLG

12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments

12.6. dsm-firmenich

12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments

12.7. ForFramers

12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments

12.8. Godrej Agrovet Limited

12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments

12.9. InVivo Group

12.9.1. Company details12.9.2. Financial outlook12.9.3. Product summary12.9.4. Recent developments

12.10. Land O'Lakes Inc

12.10.1. Company details12.10.2. Financial outlook12.10.3. Product summary12.10.4. Recent developments

12.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.