US AI in Healthcare Market Introduction and Overview

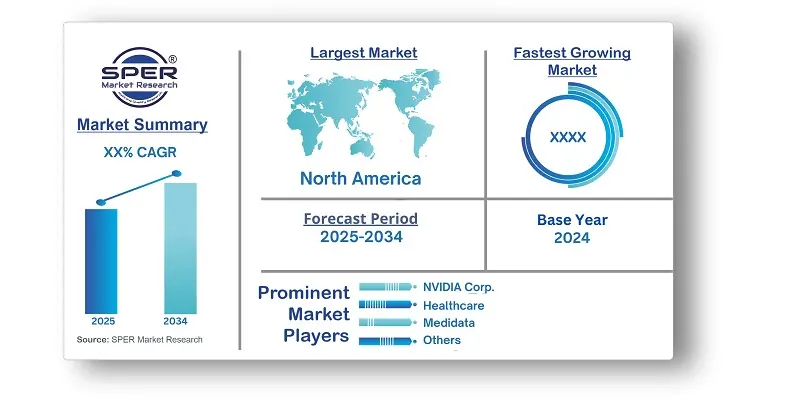

According to SPER Market Research, the US AI in Healthcare Market is estimated to reach USD XX billion by 2034 with a CAGR of XX%.

The report includes an in-depth analysis of the US AI in Healthcare Market, including market size and trends, product mix, Applications, and supplier analysis. The market for artificial intelligence (AI) in healthcare in the United States is expanding quickly and is expected to do so at a compound annual growth rate (CAGR) of significant magnitude. The need to lower healthcare costs, the growing need for tailored medication, and the growing availability of digitized patient health data are some of the drivers driving this trend. Healthcare systems are incorporating AI technologies to increase diagnostic precision and early disease diagnosis. There are still issues, though, such as worries about data security and privacy, the need for thorough testing of AI algorithms to guarantee their precision and dependability, and the difficulties in incorporating AI solutions with current electronic health record systems.

By Component Insights: US AI in Healthcare is classified into three categories: Software, Hardware, Services. During the projection period, the software solution component sector is expected to increase at the quickest CAGR. The fast expanding use of AI-based software solutions by payers, patients, and healthcare providers is responsible for the segment's growth. It is projected that the services component sector will experience notable expansion. The increasing use of AI-based technology in a number of healthcare applications is responsible for this segment's rise.

By Application Insights: The market for US AI in Healthcare is segmented based on applications, including Virtual Assistants, Diagnosis, Robot Assisted Surgery, Clinical Trials, Wearable, Administrative Workflow Assistants, Cyber security, Dosage Error Reduction, Fraud Detection. Additionally, the expansion of the industry is supported by the many benefits AI tools provide in surgery, including increased efficiency and better surgical decision-making. At a significant compound annual growth rate (CAGR), the preliminary diagnostics category is also anticipated to expand significantly over the course of the forecast period.

By Technology Insights: The Market is divided into based on Technology Type, including Machine Learning, Natural Language Processing, Context-aware Computing and Computer Vision. The largest share was accounted for by ML technology. Large volumes of data are produced by the healthcare sector, including genomic data, wearable device data, medical imaging data, and electronic health records. It is anticipated that the market for natural language processing (NLP) technologies will expand at a substantial CAGR. The automation and optimization of clinical documentation procedures, including medical transcribing, coding, and charting, are made possible by natural language processing.

By End User Insights: The market for US AI in Healthcare is divided into many end users, including Hospital & Healthcare Providers, Patients, Pharmaceuticals & Biotechnology Companies, Healthcare Payers. The hospital and clinics sector dominated the market and held the largest share. This segment's growth is being aided by the growing number of new technologies being adopted in various contexts as well as the growing number of important market participants collaborating. Throughout the forecast period, the pharmaceutical and biotechnology firms section is anticipated to expand at a significant compound annual growth rate.

By Regional Insights: The US AI in Healthcare market is expected to grow at the fastest rate in California over the course of the forecast period due to its substantial investments in AI research and development, sophisticated healthcare infrastructure, and the presence of well-known tech firms like NVIDIA Corporation and Alphabet Inc. This concentration of resources encourages creativity and speeds up the state's adoption of AI technologies in healthcare.

Market Competitive Landscape:

Low-cost, technologically advanced solutions designed for regional markets are being offered by new and regional businesses, escalating rivalry. There are regular technological developments in the market, like the incorporation of sophisticated machine learning models. As businesses look to increase their technological prowess and broaden their market reach, strategic alliances, mergers, and acquisitions are also typical. Some of the key market players are Microsoft, IBM, NVIDIA Corp., Intel Corp., Itrex Group, GE Healthcare, Google, Medtronic, Oracle, Medidata, Merck and IQVIA.

Recent Developments:

- In March 2024, Microsoft and NVIDIA collaborated to increase processing power and further AI research. This collaboration leverages Microsoft Azures extensive global reach and advanced processing capabilities, along with NVIDIAs DGX Cloud and Clara suite, to foster innovation and improve patient care.

- In September 2023, Merck KGaA engaged in a strategic partnership with Exscientia and BenevolentAI to integrate advanced AI technologies and speed drug discovery.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Component, By Application, By Technology Type, By End User. |

| Regions covered | Midwest Region, Northeast Region, Southwest Region and West Region. |

| Companies Covered | Microsoft, IBM, NVIDIA Corp., Intel Corp., Itrex Group, GE Healthcare, Google, Medtronic, Oracle, Medidata, Merck, IQVIA. and others. |

Key Topics Covered in the Report:

- US AI in Healthcare Market Size (FY’2021-FY’2034)

- Overview of US AI in Healthcare Market

- Segmentation of US AI in Healthcare Market By Component (Software, Hardware, Services)

- Segmentation of US AI in Healthcare Market By Application (Virtual Assistants, Diagnosis, Robot Assisted Surgery, Clinical Trials, Wearable, Administrative Workflow Assistants, Cyber security, Dosage Error Reduction, Fraud Detection)

- Segmentation of US AI in Healthcare Market By Technology Type (Machine Learning, Natural Language Processing, Context-aware Computing, Computer Vision)

- Segmentation of US AI in Healthcare Market By End User (Hospital & Healthcare Providers, Patients, Pharmaceuticals & Biotechnology Companies, Healthcare Payers)

- Statistical Snap of US AI in Healthcare Market

- Expansion Analysis of US AI in Healthcare Market

- Problems and Obstacles in US AI in Healthcare Market

- Competitive Landscape in the US AI in Healthcare Market

- Details on Current Investment in US AI in Healthcare Market

- Competitive Analysis of US AI in Healthcare Market

- Prominent Players in the US AI in Healthcare Market

- SWOT Analysis of US AI in Healthcare Market

- US AI in Healthcare Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. US AI in Healthcare Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in US AI in Healthcare Market

7. US AI in Healthcare Market, By Component (USD Million) 2021-2034

7.1. Software

7.2. Hardware

7.3. Services

8. US AI in Healthcare Market, By Application (USD Million) 2021-2034

8.1. Virtual Assistants

8.2. Diagnosis

8.3. Robot Assisted Surgery

8.4. Clinical Trials

8.5. Wearable

8.6. Administrative Workflow Assistants

8.7. Cyber security

8.8. Dosage Error Reduction

8.9. Fraud Detection

9. US AI in Healthcare Market, By Technology Type (USD Million) 2021-2034

9.1. Machine Learning

9.2. Natural Language Processing

9.3. Context-aware Computing

9.4. Computer Vision

10. US AI in Healthcare Market, By End User (USD Million) 2021-2034

10.1. Hospital & Healthcare Providers

10.2. Patients

10.3. Pharmaceuticals & Biotechnology Companies

10.4. Healthcare Payers

11. US AI in Healthcare Market, (USD Million) 2021-2034

11.1. US AI in Healthcare Market Size and Market Share

12. US AI in Healthcare Market, By Region, (USD Million) 2021-2034

12.1. Midwest Region

12.2. Northeast Region

12.3. Southwest Region

12.4. West Region

13. Company Profile

13.1. GE Healthcare

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Google

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. IBM

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. IQVIA

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Intel Corporation

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Itrex Group

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Medidata

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Medtronic

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Microsoft

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. NVIDIA Corporation

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links