Trypsin Market Introduction and Overview

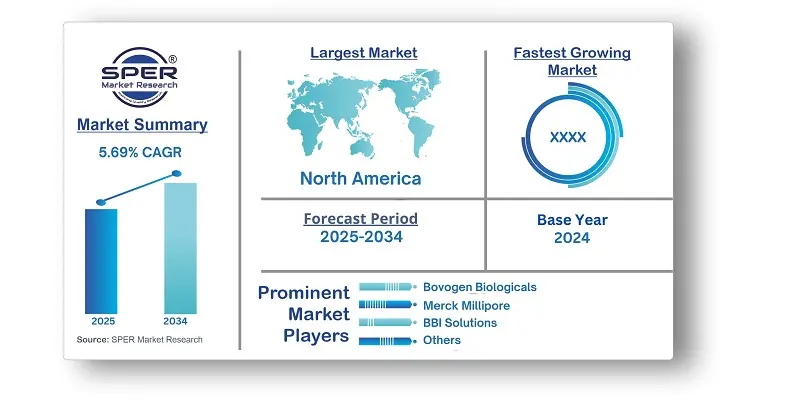

According to SPER Market Research, the Global Trypsin Market is estimated to reach USD 167.31 billion by 2034 with a CAGR of 5.69%.

The report includes an in-depth analysis of the Global Trypsin Market, including market size and trends, product mix, Applications, and supplier analysis. Trypsin is a crucial enzyme for protein digestion, and its increasing use across industries such as pharmaceuticals, food science research, detergents, and leather processing is expected to drive market growth. The growing focus on drug discovery and development is also contributing to this expansion. However, there are factors that may limit the growth of the global trypsin market, including its tendency for autolysis and incomplete digestion. As trypsin is a protein, it can undergo autolysis, a process where it breaks down its own cells through enzymatic activity, which could impede market progress. Additionally, when using trypsin, there is no guarantee that all proteins will be fully digested.

By Source: The bovine segment held the largest market share of 59.90% in 2024, driven by its specific cleavage activity, affordability, and wide availability. It is extensively used in vaccine production and cell culture applications. Leading companies like Merck Millipore and Thermo Fisher offer bovine trypsin for various uses. The porcine segment is expected to grow at a significant rate, with porcine trypsin used in vaccine production, though its use is now regulated and minimized.

By Application: Due to the increasing use of trypsin in high-throughput screening to investigate protein interactions and aid in drug development, the biotechnology and pharmaceutical industries dominate the market. Trypsin facilitates the development of new treatments by helping to understand the links between protein structure and function. Businesses like Novea Technologies and Thermo Scientific make investments in creating premium enzymes for a range of uses, such as nutraceuticals and diagnostics. Additionally, the use of trypsin in skincare products for skin renewal and exfoliating is driving growth in the personal care and cosmetics industry.

By End Use: In 2024, the market's largest share was held by the industrial usage category. This expansion is fueled by the increasing use of trypsin in sectors like food and medicine, detergents, and leather processing. Though its application is restricted because of safety and environmental issues, trypsin aids in the removal of protein-based stains such as blood and egg in detergents. Trypsin is used to enhance the emulsification, foaming, solubility, and gelling of food proteins in the food and pharmaceutical industries.

By Regional Insights: North America led the global trypsin market in 2024, capturing a significant share. This dominance is attributed to the presence of major market players like Bio-Rad Laboratories, Creative Enzymes, Hawkins, Agilent Technologies, Promega Corporation, and Thermo Fisher Scientific. Collaborations and partnerships among these companies have further driven regional market growth. Moreover, the rising prevalence of conditions such as pancreatitis, cystic fibrosis, and cancer is expected to boost demand for trypsin in diagnostic applications.

Market Competitive Landscape:

The market is highly consolidated. Some of the market key players are Agilent Technologies, BBI Solutions, BIOZYM, Bovogen Biologicals, Linzyme Biosciences, Merck Millipore, Neova Technologies, Novozymes, Promega Corporation, PromoCell GmbH, Sartorius AG, and Thermo Fisher Scientific, along with others.

Recent Developments:

- In January 2024, Trypsin-Chymotrypsin, a potent blend of proteolytic enzymes that is expected to propel major breakthroughs in a number of industries, was unveiled by Creative Enzymes, a world leader in enzyme-related goods and services. In the scientific community, this launch marks a significant turning point with the goal of improving operational efficiency.

- Sun Pharma India completed the purchase of Aksigen's Disperzyme and Phlogam brands in January 2023. These medications, which are especially made for patients having minor surgery to help control the inflammatory response, are the first enzyme-bioflavonoid combos to finish scientific investigations and obtain DCGI approval in India.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Source, By Application, By End Use. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Agilent Technologies, BBI Solutions, BIOZYM, Bovogen Biologicals, Linzyme Biosciences, Merck Millipore, Neova Technologies, Novozymes, Promega Corporation, PromoCell GmbH, Sartorius AG, and Thermo Fisher Scientific, along with and others. |

Key Topics Covered in the Report:

- Global Trypsin Market Size (FY’2021-FY’2034)

- Overview of Global Trypsin Market

- Segmentation of Global Trypsin Market By Source (Bovine, Porcine, Others)

- Segmentation of Global Trypsin Market By Application (Biotechnology and Pharmaceutical Industry, Food Industry, Cosmetics and Personal Care, Waste Treatment, Others)

- Segmentation of Global Trypsin Market By End Use (Research, Diagnostic, Industrial use)

- Statistical Snap of Global Trypsin Market

- Expansion Analysis of Global Trypsin Market

- Problems and Obstacles in Global Trypsin Market

- Competitive Landscape in the Global Trypsin Market

- Details on Current Investment in Global Trypsin Market

- Competitive Analysis of Global Trypsin Market

- Prominent Players in the Global Trypsin Market

- SWOT Analysis of Global Trypsin Market

- Global Trypsin Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Trypsin Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Trypsin Market

7. Global Trypsin Market, By Source, (USD Million) 2021-2034

7.1. Bovine

7.2. Porcine

7.3. Others

8. Global Trypsin Market, By Application, (USD Million) 2021-2034

8.1. Biotechnology and Pharmaceutical Industry

8.2. Food Industry

8.3. Cosmetics and Personal Care

8.4. Waste Treatment

8.5. Others

9. Global Trypsin Market, By End Use, (USD Million) 2021-2034

9.1. Research

9.2. Diagnostic

9.3. Industrial use

10. Global Trypsin Market, (USD Million) 2021-2034

10.1. Global Trypsin Market Size and Market Share

11. Global Trypsin Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Agilent Technologies

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. BBI Solutions

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. BIOZYM

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Bovogen Biologicals

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Linzyme Biosciences

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Merck Millipore

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Neova Technologies

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Novozymes

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Promega Corporation

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. PromoCell GmbH

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Sartorius AG

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Thermo Fisher Scientific

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links