Dairy Blends Market Introduction and Overview

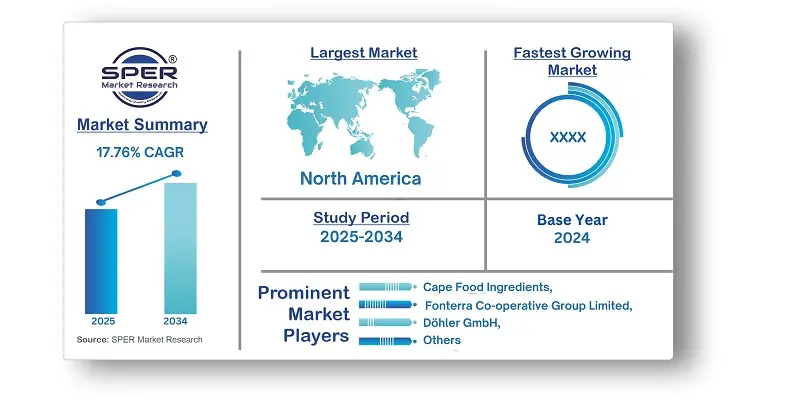

According to SPER Market Research, the Global Dairy Blends Market is estimated to reach USD 5.53 billion by 2034 with a CAGR of 7.76%.

The report includes an in-depth analysis of the Global Dairy Blends Market, including market size and trends, product mix, Applications, and supplier analysis. The global dairy blends market was valued at USD 2. 62 billion in 2024 and is expected to grow at a rate of 7.76% from 2025 to 2030. The health benefits of dairy blends have led to their application in a variety of industries, including baking, confectionery, food and beverage, and newborn nutrition. The shift in consumer demand toward more nutritious and convenient foods is driving market growth. With a growing global population and rising need for nutritious food options, demand for these ingredients is likely to increase.

By Application Insights: The food sector had the biggest revenue share in the market in 2023, owing to the wide range of applications for dairy blends in food products. For example, they can be used as versatile ingredients in a variety of food products, such as baked goods, confectioneries, dairy products, and processed foods. Furthermore, dairy blends provide a number of functional features, such as better texture, flavor, and shelf life, all of which are essential for obtaining desirable product attributes in a variety of food applications. As a result, their incorporation has become critical for the majority of food manufacturers worldwide, resulting in a sizable proportion of this market.

By Form Insights: The market with the largest revenue share in 2023 was powder form. When compared to liquid or other formulations, this sort of dairy blend shows remarkable stability during storage, therefore it is less likely to degrade. Manufacturers and wholesalers that work across long supply chains will especially benefit from this feature. Additionally, powdered dairy blends have a broad range of uses in a variety of industries, such as bakery, food, beverage, and newborn nutrition. Increased demand and improved market penetration are the results of this adaptability.

By Regional Insights: Asia Pacific had the largest revenue share in the global dairy blends market in 2023. Key countries like Australia and India are major dairy producers, ensuring a strong supply for dairy blend manufacturing. The abundant production leads to competitive prices for raw materials. Supportive government policies, such as subsidies and investments in infrastructure, have also helped the dairy blend industry grow in this region. Meanwhile, India’s growing urban population is leading to increased demand for premium and value-added dairy products.

Market Competitive Landscape

The market for dairy blends is quite competitive, with many domestic and international manufacturers. Private-label brands have been gaining a competitive edge in terms of cost-effective solutions and product distinctiveness. All American Foods, Batory Foods, Royal Frieslandcampina NV, Kerry Group, Dana Foods Inc., and Cargill are the market leaders in the examined area. Because the industry is fragmented, several players are concentrating on expanding and developing new products in order to hold onto their market positions. The goal of businesses is to expand the usage of dairy blend ingredients and serve emerging sectors. All American Foods is a manufacturer in the U. S. that makes dairy and non-dairy food products. Their brand Pro Mix includes cheese powders, dry milk powders, and high-fat powders. They also produce milk-protein powders, dried cultured ingredients, egg replacement powders, and sour cream and butter powders.

Recent Developments: Frisian Flag Indonesia, a FrieslandCampina affiliate, announced in July 2024 the launch of a new dairy facility in Indonesia's West Java province. This factory would serve as the company's principal center in Southeast Asia, allowing the dairy business to expand globally. The plant will have an annual production capacity of 700 million kg for dairy products, including milk blends. Fonterra Co-operative Group Ltd. announced in February 2024 that it would soon merge its dairy companies in Australia and New Zealand (Fonterra Australia and Fonterra Brands New Zealand). This move is expected to strengthen the company's position in the region. International Flavors & Fragrances Inc. and Health & Biosciences added four new cultures to their YOY MIX ViV product line in 2022 in order to meet the demands of yogurt producers. The goal of these new cultures is to help manufacturers overcome their challenges so that superior products can be produced.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Application, By Form. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | All American Foods, Kerry Group plc, FrieslandCampina, Cargill, Incorporated, Fonterra Co-operative Group Limited, Döhler GmbH, Agropur, AFP advanced food products llc, Cape Food Ingredients, Intermix Australia Pty Ltd. |

Key Topics Covered in the Report:

- Global Dairy Blends Market Size (FY’2025-FY’2034)

- Overview of Global Dairy Blends Market

- Segmentation of Global Dairy Blends Market By Application (Food, Beverages, Infant Formula, others)

- Segmentation of Global Dairy Blends Market By Form (Spreadable, Powder, Liquid)

- Statistical Snap of Global Dairy Blends Market

- Expansion Analysis of Global Dairy Blends Market

- Problems and Obstacles in Global Dairy Blends Market

- Competitive Landscape in the Global Dairy Blends Market

- Details on Current Investment in Global Dairy Blends Market

- Competitive Analysis of Global Dairy Blends Market

- Prominent Players in the Global Dairy Blends Market

- SWOT Analysis of Global Dairy Blends Market

- Global Dairy Blends Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Dairy Blends Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Dairy Blends Market

7. Global Dairy Blends Market, By Application (USD Million) 2025-2034

7.1. Food

7.1.1. Bakery

7.1.2. Confectionery

7.1.3. Ice Cream

7.1.4. Cheese

7.1.5. Yogurt

7.2. Beverages

7.3. Infant Formula

7.4. Others

8. Global Dairy Blends Market, By Form (USD Million) 2025-2034

8.1. Spreadable

8.2. Powder

8.3. Liquid

9. Global Dairy Blends Market Forecast, 2025-2034 (USD Million)

9.1. Global Dairy Blends Market Size and Market Share

10. Global Dairy Blends Market, By Region, 2025-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Kerry Group plc

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. FrieslandCampina

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Cargill, Incorporated

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Fonterra Co-operative Group Limited

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Döhler GmbH

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Agropur

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. AFP advanced food products llc

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Cape Food Ingredients

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Intermix Australia Pty Ltd

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links