AI as a Service Market Introduction and Overview

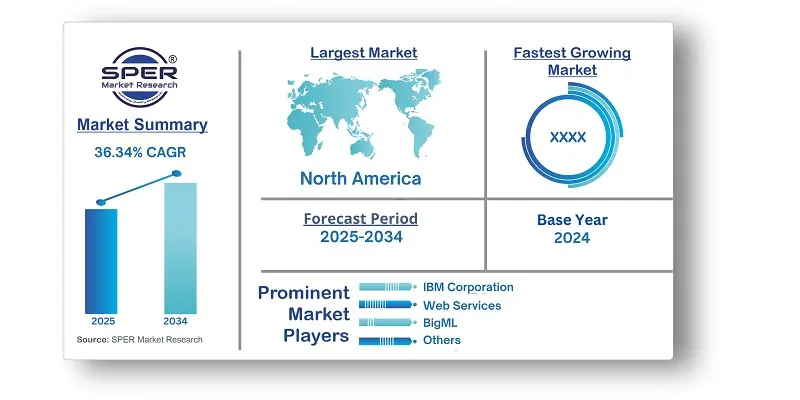

According to SPER Market Research, the Global AI as a Service Market is estimated to reach USD 356.88 billion by 2034 with a CAGR of 36.34%.

The rise of cloud computing, the proliferation of big data, and the growing demand for automation in industries such as healthcare, finance, retail, and manufacturing are all important elements driving this trend. Future potential include the development of more personalized AI solutions, enhanced data privacy, and interaction with new technologies such as the Internet of Things (IoT) and 5G. As businesses seek new methods to exploit AI, the AIaaS market is projected to play an important role in democratizing AI and driving global digital transformation.

- September, 2024: Salesforce, Inc. has revealed AI-powered enhancements for its Service Cloud that aim to improve the handling of customer and staff problems. The firm highlighted its continuous efforts to extend its full portfolio of AI-driven Service Cloud products, ensuring that customers, employees, and HR professionals have 24/7 access to critical information, resulting in faster and more cost-effective case resolutions. The most recent improvements include step-by-step resolution plans for support professionals, tools for monitoring customer sentiment, and AI-powered recommendations targeted at improving the entire customer experience.

- May, 2024: IBM and Salesforce announced an expanded strategic relationship that combines IBMs Watsonx Al and Data Platform capabilities with the Salesforce Einstein 1 Platform, providing customers with more choice and flexibility in Al and data adoption. This collaboration allows teams to make data-driven decisions and execute actions effortlessly inside their workflows.

By Technology: Based on technology, the machine learning (ML) sector led the market with the highest revenue share. Companies are increasingly using ML algorithms for predictive analytics, recommendation systems, and fraud detection. The ease of integrating ML models with cloud-based platforms has accelerated their acceptance, allowing organizations to implement scalable, cost-effective solutions without the need for costly infrastructure.

By Service Type: According to service type, the software segment had the highest market revenue share. Companies are investing in artificial intelligence software to improve data analytics, automate corporate operations, and make better decisions in industries such as healthcare, finance, retail, and manufacturing. The rise of cloud-based software platforms has made it easier for businesses to use AI solutions without requiring costly infrastructure, resulting in widespread adoption.

By Deployment: Based on deployment, the public cloud segment dominated the market with the highest revenue share. Public cloud platforms allow enterprises of all sizes to use AI technology without making substantial infrastructure investments, making it easier to experiment and scale AI solutions. Furthermore, the flexibility of public cloud platforms enables businesses to rapidly deploy and maintain AI models, alter computer resources as needed, and interface with other cloud-based services.

By Organization Size: Based on organization size, the large enterprises segment led the market with the largest revenue share. Large companies have the capacity to adopt advanced AI solutions in a variety of business tasks, such as customer service, supply chain efficiency, and predictive maintenance. Theyre also using AI to achieve a competitive advantage by improving customer experiences, increasing operational efficiency, and making data-driven decisions.

By Vertical: Based on vertical, the BFSI segment dominated the market. Financial institutions are using AIaaS to automate operations, detect fraud, improve compliance, and make better decisions using advanced data analytics. AIaaS solutions allow banks and insurers to examine massive volumes of data for credit scoring, investment forecasts, and underwriting, resulting in more accurate and timely insights. The ability to deploy scalable, cloud-based AI solutions without making significant infrastructure expenditures is driving rapid adoption in the BFSI sector.

By Offering: Based on offering, the software as a service (SaaS) segment led the market with the highest revenue share. SaaS solutions enable enterprises to utilize AI technologies without making major upfront hardware or software expenses. This methodology enables businesses to seamlessly integrate AI capabilities into their existing workflows, hence increasing productivity and efficiency.

By Region: North America leads the artificial intelligence as a service (AIaaS) market with the highest revenue share. North American businesses are at the forefront of AI adoption, using AIaaS solutions to increase operational efficiency, promote innovation, and improve customer experiences. The presence of large cloud service providers and AI start-ups creates a competitive environment that speeds up the development and deployment of AI technology.

Market Competitive Landscape:

The Global AI as a Service Market is highly consolidated. Some of the market players are Amazon Web Services, Inc, BigML, Inc, Fair Isaac Corporation, Google LLC, IBM Corporation, Intel Corporation, Microsoft, Salesforce, Inc, SAP SE, Siemens, and others.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Technology, By Service Type, By Organization Size, By Deployment, By Vertical, By Offering. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, Middle East & Africa. |

| Companies Covered | Amazon Web Services, Inc, BigML, Inc, Fair Isaac Corporation, Google LLC, IBM Corporation, Intel Corporation, Microsoft, Salesforce, Inc, SAP SE, Siemens. and others. |

Key Topics Covered in the Report:

- Global AI as a Service Market Size (FY’2021-FY’2034)

- Overview of Global AI as a Service Market

- Segmentation of Global AI as a Service Market By Technology (Machine Learning, Computer Vision, Natural Language Processing)

- Segmentation of Global AI as a Service Market By Service Type (Software, Services)

- Segmentation of Global AI as a Service Market By Deployment (Public, Private, Hybrid)

- Segmentation of Global AI as a Service Market By Organization Size (Large Enterprises, SMEs)

- Segmentation of Global AI as a Service Market By Vertical (BFSI, Healthcare and Life Sciences, Retail, IT & Telecommunication, Manufacturing, Energy & Utility)

- Segmentation of Global AI as a Service Market By Offering (SaaS, PaaS, IaaS)

- Statistical Snap of Global AI as a Service Market

- Expansion Analysis of Global AI as a Service Market

- Problems and Obstacles in Global AI as a Service Market

- Competitive Landscape in the Global AI as a Service Market

- Details on Current Investment in Global AI as a Service Market

- Competitive Analysis of Global AI as a Service Market

- Prominent Players in the Global AI as a Service Market

- SWOT Analysis of Global AI as a Service Market

- Global AI as a Service Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1.Introduction

1.1.Scope of the report

1.2.Market segment analysis

2.Research Methodology

2.1.Research data source

2.1.1.Secondary Data

2.1.2.Primary Data

2.1.3.SPERs internal database

2.1.4.Premium insight from KOLs

2.2.Market size estimation

2.2.1.Top-down and Bottom-up approach

2.3.Data triangulation

3.Executive Summary

4.Market Dynamics

4.1.Driver, Restraint, Opportunity and Challenges analysis

4.1.1.Drivers

4.1.2.Restraints

4.1.3.Opportunities

4.1.4.Challenges

5.Market variable and outlook

5.1.SWOT Analysis

5.1.1.Strengths

5.1.2.Weaknesses

5.1.3.Opportunities

5.1.4.Threats

5.2.PESTEL Analysis

5.2.1.Political Landscape

5.2.2.Economic Landscape

5.2.3.Social Landscape

5.2.4.Technological Landscape

5.2.5.Environmental Landscape

5.2.6.Legal Landscape

5.3.PORTERs Five Forces

5.3.1.Bargaining power of suppliers

5.3.2.Bargaining power of buyers

5.3.3.Threat of Substitute

5.3.4.Threat of new entrant

5.3.5.Competitive rivalry

5.4.Heat Map Analysis

6.Competitive Landscape

6.1.Global AI as a Service Market Manufacturing Base Distribution, Sales Area, Product Type

6.2.Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global AI as a Service Market

7.Global AI as a Service Market, By Technology (USD Million) 2021-2034

7.1. Machine Learning (ML)

7.2. Computer Vision

7.3. Natural Language Processing (NLP)

8.Global AI as a Service Market, By Service Type (USD Million) 2021-2034

8.1. Software

8.1.1.Data Storage and Archiving

8.1.2.Modeler and Processing

8.1.3.Cloud and Web-Based Application Programming Interface (APIs)

8.2. Services

9.Global AI as a Service Market, By Deployment (USD Million) 2021-2034

9.1. Public

9.2. Private

9.3. Hybrid

10.Global AI as a Service Market, By Organization Size (USD Million) 2021-2034

10.1.Large Enterprises

10.2.SMEs

11.Global AI as a Service Market, By Vertical (USD Million) 2021-2034

11.1.BFSI

11.2.Healthcare and Life Sciences

11.3.Retail

11.4.IT & Telecommunication

11.5.Manufacturing

11.6.Energy & Utility

12.Global AI as a Service Market, By Offering (USD Million) 2021-2034

12.1.SaaS

12.2.PaaS

12.3.IaaS

13.Global AI as a Service Market, (USD Million) 2021-2034

13.1.Global AI as a Service Market Size and Market Share

14.Global AI as a Service Market, By Region, (USD Million) 2021-2034

14.1.Asia-Pacific

14.1.1.Australia

14.1.2.China

14.1.3.India

14.1.4.Japan

14.1.5.South Korea

14.1.6.Rest of Asia-Pacific

14.2.Europe

14.2.1.France

14.2.2.Germany

14.2.3.Italy

14.2.4.Spain

14.2.5.United Kingdom

14.2.6.Rest of Europe

14.3.Middle East and Africa

14.3.1.Kingdom of Saudi Arabia

14.3.2.United Arab Emirates

14.3.3.Qatar

14.3.4.South Africa

14.3.5.Egypt

14.3.6.Morocco

14.3.7.Nigeria

14.3.8.Rest of Middle-East and Africa

14.4.North America

14.4.1.Canada

14.4.2.Mexico

14.4.3.United States

14.5.Latin America

14.5.1.Argentina

14.5.2.Brazil

14.5.3.Rest of Latin America

15.Company Profile

15.1.Amazon Web Services, Inc

15.1.1.Company details

15.1.2.Financial outlook

15.1.3.Product summary

15.1.4.Recent developments

15.2.BigML, Inc

15.2.1.Company details

15.2.2.Financial outlook

15.2.3.Product summary

15.2.4.Recent developments

15.3.Fair Isaac Corporation

15.3.1.Company details

15.3.2.Financial outlook

15.3.3.Product summary

15.3.4.Recent developments

15.4.Google LLC

15.4.1.Company details

15.4.2.Financial outlook

15.4.3.Product summary

15.4.4.Recent developments

15.5.IBM Corporation

15.5.1.Company details

15.5.2.Financial outlook

15.5.3.Product summary

15.5.4.Recent developments

15.6.Intel Corporation

15.6.1.Company details

15.6.2.Financial outlook

15.6.3.Product summary

15.6.4.Recent developments

15.7.Microsoft

15.7.1.Company details

15.7.2.Financial outlook

15.7.3.Product summary

15.7.4.Recent developments

15.8.Salesforce, Inc

15.8.1.Company details

15.8.2.Financial outlook

15.8.3.Product summary

15.8.4.Recent developments

15.9.SAP SE

15.9.1.Company details

15.9.2.Financial outlook

15.9.3.Product summary

15.9.4.Recent developments

15.10.Siemens

15.10.1.Company details

15.10.2.Financial outlook

15.10.3.Product summary

15.10.4.Recent developments

15.11.Others

16.Conclusion

17.List of Abbreviations

18.Reference Links