Electric Off-Highway Equipment Market Introduction and Overview

According to SPER Market Research, the Global Electric Off- Highway Equipment Market is estimated to reach USD 54.76 billion by 2033 with a CAGR of 16.97%.

The report includes an in-depth analysis of the Global Electric Off- Highway Equipment Market, including market size and trends, product mix, applications, and supplier analysis. The term "electric off-highway equipment" describes a class of vehicles and machines that run without conventional internal combustion engines and are intended for usage in a variety of industries, such as forestry, mining, construction, and agriculture. Rather, these devices use electric power sources, including fuel cells or batteries, to carry out operations that are normally done by diesel-powered machinery. These cars have cutting-edge features that improve performance and operating efficiency, such as electric drivetrains, regenerative braking systems, and smart controls. Additionally, electric off-highway machinery frequently produces less noise, which is advantageous for both operators and the communities around them. Agricultural tractors, loaders, haulers, and excavators are a few types of electric off-highway machinery. It is anticipated that the use of electric off-highway equipment will increase as battery technology develops.

- January 2024: An important step towards improving environmentally friendly operations in industrial sectors has been taken with the announcement of a strategic collaboration between Caterpillar and CRH to deliver electric off-highway vehicles and related charging systems. The agreement intends to lower carbon emissions and operating costs by incorporating cutting-edge electric trucks and charging infrastructure, in line with international environmental goals and offering a path for the industry-wide adoption of green technologies.

- February 2024: In partnership with GUSS Automation, John Deere has introduced an electric, self-sufficient herbicide sprayer made especially for managing orchards. Because it runs solely on electricity, this cutting-edge equipment promotes sustainability by lowering greenhouse gas emissions and reliance on fossil fuels. Herbicides can be applied precisely thanks to its autonomous technology, which increases productivity while reducing chemical use and environmental impact.

Market Opportunities and Challenges

Opportunities- Global Electric off-highway equipment is becoming more and more popular as a cleaner and greener approach to lower carbon footprints in a variety of industries due to stricter emissions laws and growing environmental concerns. Compared to conventional diesel-powered equipment, electric machinery has cheaper operating and maintenance expenses because it uses less fuel and has fewer moving parts, which improves operational efficiency. Rapid advancements in battery technology, including increased energy density and quicker charging times, have enhanced the functionality and range of electric off-highway vehicles, increasing their viability and usefulness. To encourage the use of electric off-highway equipment, governments throughout the world are providing subsidies and incentives. This creates a favourable market environment and pushes producers and end users to use electric alternatives.

Challenges- Future growth and profitability of the global market for electric off-highway equipment may be impacted by a number of serious concerns. The competition from conventional diesel-powered machinery poses a serious threat to the market for electric off-highway equipment. Rapid adoption of electric off-highway gear may be hampered by the established infrastructure and familiarity of diesel-powered equipment, especially in sectors where switching to electric solutions necessitates significant financial outlays and operational changes. The absence of adequate charging infrastructure, especially in rural or undeveloped areas, is another major danger to the global market for electric off-highway equipment. The lack of easily available charging stations could prevent electric machinery from being widely used, restricting its use to areas with sufficient charging infrastructure and thus impeding market expansion.

Market Competitive Landscape

The Global Electric Off-Highway Equipment Market is a highly competitive arena due to the presence of multiple global and regional companies in the competitive environment. Leading companies in the industry are Caterpillar Inc, Komatsu Ltd, Volvo Construction Equipment, Hitachi Construction Machinery Co. Ltd, Liebherr Group, Deere & Company (John Deere), Sandvik AB, Doosan Infracore Co. Ltd, Wacker Neuson SE, SANY Group, Others.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Type, By Propulsion |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe |

| Companies Covered | Caterpillar Inc, Komatsu Ltd, Volvo Construction Equipment, Hitachi Construction Machinery Co. Ltd, Liebherr Group, Deere & Company (John Deere), Sandvik AB, Doosan Infracore Co. Ltd, Wacker Neuson SE, SANY Group, Others. |

COVID-19 Impact on Global Electric Off-Highway Equipment Market

The global market for electric off-highway equipment has been greatly impacted by this epidemic since some producers are forced to halt plant operations, while others are still thinking about putting in extra effort to meet the need for medical supplies. Construction and mining operations are being significantly impacted by the lockdowns implemented globally to stop the disease's spread. It is anticipated that nearly all planned projects would be delayed, which might have an impact on equipment purchases as well as the demand for frequently replaced goods like lubricants from current fleets. The major participants in this industry are aware that output levels will be lowered upon reopening in order to comply with safety regulations. Additionally, customers are spending less.

Key Target Audience

- Construction Companies

- Mining Companies

- Agriculture & Forestry Enterprises

- Government and Public Sector Agencies

- Rental Equipment Companies

- Energy and Utility Companies:

- OEMs (Original Equipment Manufacturers)

- Logistics and Transport Companies

- Environmental and Sustainability Organizations

- Investors and Stakeholders in Clean Technology

Our in-depth analysis of the Electric Off-Highway Equipment Market includes the following segments: | By Type | ExcavatorsLoadersDump TrucksOthers |

| By Propulsion | ElectricHybrid Electric |

| By Region: | Asia-PacificEuropeMiddle East & AfricaNorth AmericaLatin America |

Key Topics Covered in the Report- Global Electric Off-Highway Equipment Market Size (FY’2024-FY’2033)

- Overview of Global Electric Off-Highway Equipment Market

- Segmentation of Global Electric Off-Highway Equipment Market By Type (Excavators, Loaders, Dump Trucks, Others)

- Segmentation of Global Electric Off-Highway Equipment Market By Propulsion (Electric, Hybrid Electric)

- Statistical Snap of Global Electric Off-Highway Equipment Market

- Expansion Analysis of Global Electric Off-Highway Equipment Market

- Problems and Obstacles in Global Electric Off-Highway Equipment Market

- Competitive Landscape in the Global Electric Off-Highway Equipment Market

- Impact of COVID-19 and Demonetization on Global Electric Off-Highway Equipment Market

- Details on Current Investment in Global Electric Off-Highway Equipment Market

- Competitive Analysis of Global Electric Off-Highway Equipment Market

- Prominent Players in the Global Electric Off-Highway Equipment Market

- SWOT Analysis of Global Electric Off-Highway Equipment Market

- Global Electric Off-Highway Equipment Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

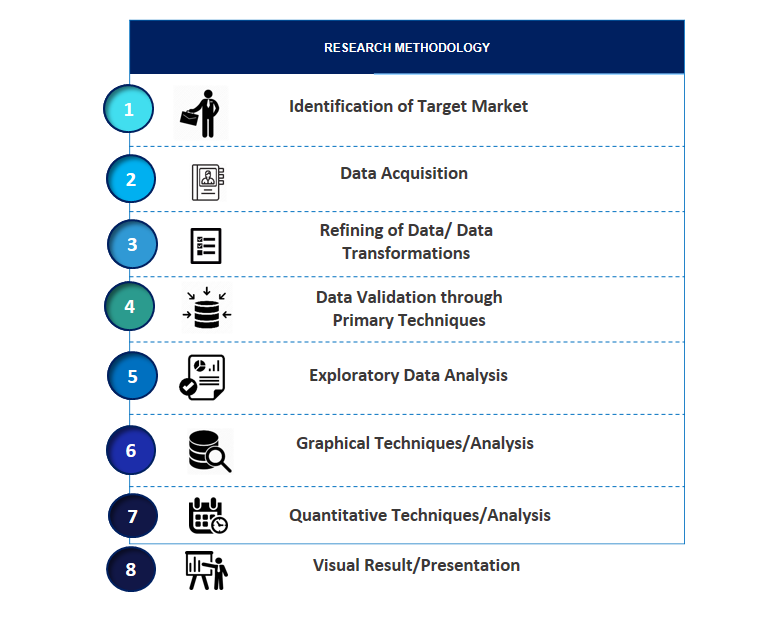

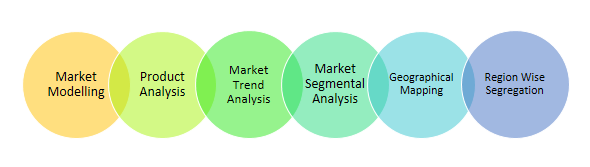

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. COVID-19 Impacts of the Global Electric Off- Highway Equipment Market.

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Electric Off- Highway Equipment Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Electric Off- Highway Equipment Market

7. Global Electric Off- Highway Equipment Market, By Type (USD Million) 2020-2033

7.1. Global Electric Off- Highway Equipment Market Size, Share and Forecast, By Type, 2020-2026

7.2. Global Electric Off- Highway Equipment Market Size, Share and Forecast, By Type, 2027-2033

7.3. Excavators

7.4. Loaders

7.5. Dump Trucks

7.6. Others

8. Global Electric Off- Highway Equipment Market, By Propulsion (USD Million) 2020-2033

8.1. Global Electric Off- Highway Equipment Market Size, Share and Forecast, By Propulsion, 2020-2026

8.2. Global Electric Off- Highway Equipment Market Size, Share and Forecast, By Propulsion, 2027-2033

8.3. Electric

8.4. Hybrid Electric

9. Global Electric Off- Highway Equipment Market Forecast, 2020-2033 (USD Million)

9.1. Global Electric Off- Highway Equipment Market Size and Market Share

10. Global Electric Off- Highway Equipment Market, By Region, 2020-2033 (USD Million)

10.1. Global Electric Off- Highway Equipment Market Size and Market Share By Region (2020-2026)

10.2. Global Electric Off- Highway Equipment Market Size and Market Share By Region (2027-2033)

10.3. Asia-Pacific

10.3.1. Australia

10.3.2. China

10.3.3. India

10.3.4. Japan

10.3.5. South Korea

10.3.6. Rest of Asia-Pacific

10.4. Europe

10.4.1. France

10.4.2. Germany

10.4.3. Italy

10.4.4. Spain

10.4.5. United Kingdom

10.4.6. Rest of Europe

10.5. Middle East and Africa

10.5.1. Kingdom of Saudi Arabia

10.5.2. United Arab Emirates

10.5.3. Qatar

10.5.4. South Africa

10.5.5. Egypt

10.5.6. Morocco

10.5.7. Nigeria

10.5.8. Rest of Middle-East and Africa

10.6. North America

10.6.1. Canada

10.6.2. Mexico

10.6.3. United States

10.7. Latin America

10.7.1. Argentina

10.7.2. Brazil

10.7.3. Rest of Latin America

11. Company Profile

11.1. Caterpillar Inc

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Komatsu Ltd

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Volvo Construction Equipment

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Hitachi Construction Machinery Co. Ltd

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Liebherr Group

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Deere & Company (John Deere)

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Sandvik AB

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Doosan Infracore Co. Ltd

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Wacker Neuson SE

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. SANY Group 11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.10. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

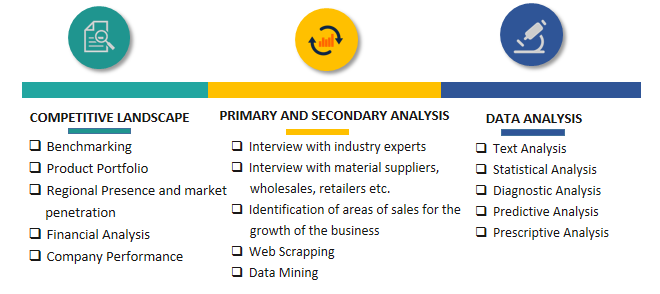

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.