Japan Blockchain in BFSI Market Introduction and Overview

According to SPER Market Research, the Japan Blockchain in BFSI Market is estimated to reach USD XX Million by 2033 with a CAGR of XX%.

The report includes an in-depth analysis of the Japan Blockchain in BFSI Market, encompassing product mix, applications, supplier analysis, market size and trends. Blockchain is a decentralised and distributed ledger system that securely records and validates transactions over a network of computers in the BFSI (banking, financial services, and insurance) industry. This technology enhances transparency, reduces fraud, and increases operational efficiency in the financial sector. Blockchain is widely used in BFSI for secure and tamper-proof record-keeping of financial transactions such as payments, loans, and asset transfers. Smart contracts, which are self-executing contracts having the contents of the agreement explicitly coded into them, speed up operations and automate duties, eliminating the need for middlemen. The decentralised structure of blockchain reduces the possibility of a single point of failure, increases data integrity, and fosters participant confidence.

- IBM announced a new blockchain-based digital identity solution in April 2024, with the goal of improving financial transaction security and efficiency. This solution connects with the existing banking infrastructure to deliver smooth and safe digital identity verification.

- In January 2024, Microsoft upgraded its Azure Blockchain Service to accommodate more financial applications, making it easier for BFSI firms to create blockchain networks. This extension adds more secure features and faster transaction speeds.

- In October 2023, AWS added additional features to its Amazon Managed Blockchain (AMB), cutting setup time by 60% and increasing transaction speeds. These changes have made it more appealing to BFSI institutions seeking to streamline their operations with blockchain technology.

Market Opportunities and Challenges

Opportunities- Blockchain disruption has the potential to significantly revolutionise the payments process by allowing banks to process payments with greater security and cheaper costs over the second half of the projection period, 2023-2026. Blockchain has a huge impact on the methods for closing and verifying financial transactions, managing money, and simplifying resources. Banks incur significant annual costs from various commercial firms. With continued improvements in this industry, blockchain deployment is expected to allow banks to process payments faster and more precisely while lowering transaction costs. This is expected to open up new potential opportunities for blockchain in the BFSI market throughout the forecast period.

Challenges- Integrating with Current Systems: The complexity of integrating blockchain technology with current legacy systems is a significant barrier to its adoption in the BFSI industry. Numerous financial organisations still operate with many antiquated systems ingrained in them. Blockchain integration can be expensive and time-consuming, and it demands a high level of technical know-how. During the integration process, there is also a chance that current operations will be interrupted. For blockchain to advance past pilot projects and be widely adopted in the BFSI industry, it must overcome several operational and technological obstacles.

Market Competitive Landscape

The report provides an appropriate analysis of the major players in the Japan blockchain market for business and financial services (BFSI) as well as a comparative assessment based on the companies' product offerings, business summaries, geographic reach, enterprise strategies, market share in specific segments, and SWOT analyses. Key market players are Coinhive, JSECoin, Tidbit, Coinbase, BitPay.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Type, By Application

|

| Regions covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region

|

| Companies Covered | Coinhive, JSECoin, Tidbit, Coinbase, BitPay.

|

COVID-19 Impact on Japan Blockchain in BFSI Market

The COVID-19 pandemic has spurred blockchain adoption in banking and financial services, as financial organisations look to digitise operations, minimise physical interaction, and improve operational resilience in the face of economic uncertainty and upheavals. The pandemic has underlined the significance of digitalization, security, and efficiency in financial transactions, resulting in increased demand for blockchain-based solutions that provide secure, transparent, and efficient alternatives to traditional banking and finance services.

Key Target Audience:

- Financial Institutions

- Banks

- Insurance Companies

- Fintech Companies

- Regulatory Authorities

- Investors and Traders

- Payment Service Providers

- Technology Providers and Developers

- Wealth Management Firms

- Compliance and Audit Firms

Our in-depth analysis of the Japan Blockchain in BFSI Market includes the following segments:

|

By Type:

|

Private Blockchain

Consortium Blockchain

Public Blockchain

|

|

By Engine Type:

|

Smart Contracts

Security

Trade Finance

Digital Currency

Record Keeping

GRC Management

Identity Management & Fraud Detection

Others

|

Key Topics Covered in the Report:

- Japan Blockchain in BFSI Market Size (FY’2024-FY’2033)

- Overview of Japan Blockchain in BFSI Market

- Segmentation of Japan Blockchain in BFSI Market By Type (Private Blockchain, Consortium Blockchain, Public Blockchain)

- Segmentation of Japan Blockchain in BFSI Market By Application (Smart Contracts, Security, Trade Finance, Digital Currency, Record Keeping, GRC Management, Identity Management & Fraud Detection, Others)

- Statistical Snap of Japan Blockchain in BFSI Market

- Expansion Analysis of Japan Blockchain in BFSI Market

- Problems and Obstacles in Japan Blockchain in BFSI Market

- Competitive Landscape in the Japan Blockchain in BFSI Market

- Impact of COVID-19 and Demonetization on Japan Blockchain in BFSI Market

- Details on Current Investment in Japan Blockchain in BFSI Market

- Competitive Analysis of Japan Blockchain in BFSI Market

- Prominent Players in the Japan Blockchain in BFSI Market

- SWOT Analysis of Japan Blockchain in BFSI Market

- Japan Blockchain in BFSI Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

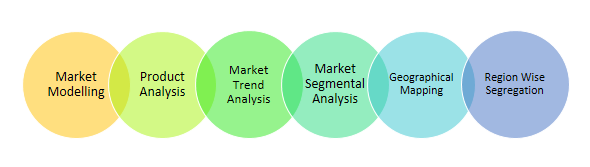

1.2. Market segment analysis

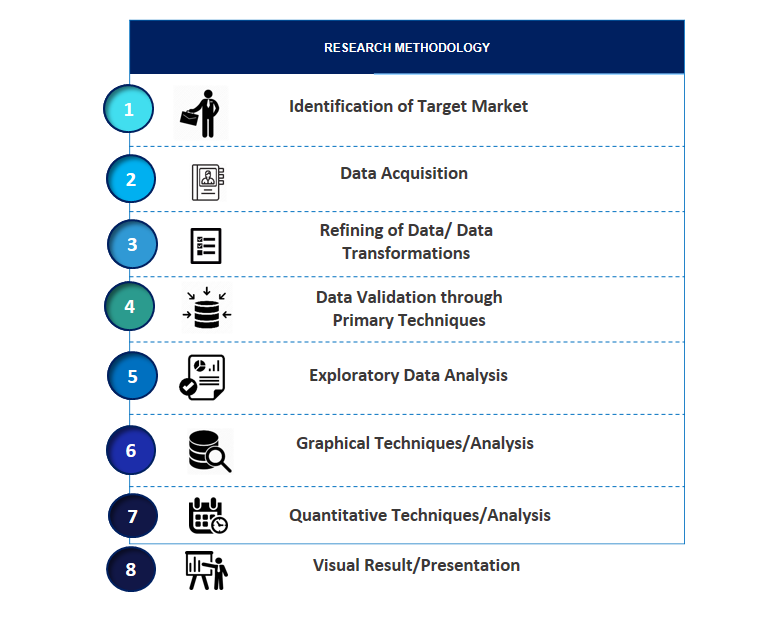

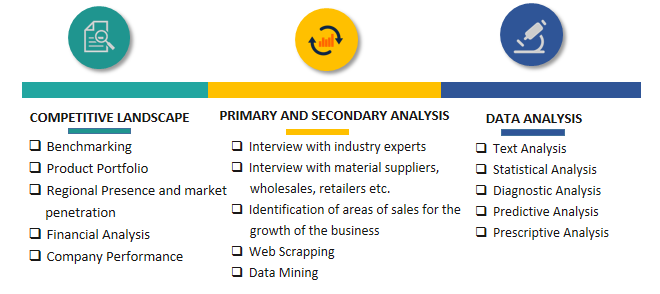

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. COVID-19 Impacts of the Japan Blockchain in BFSI Market.

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Japan Blockchain in BFSI Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Japan Blockchain in BFSI Market

7. Japan Blockchain in BFSI Market, By Type (USD Million) 2020-2033

7.1. Japan Blockchain in BFSI Market Size, Share and Forecast, By Type, 2020-2026

7.2. Japan Blockchain in BFSI Market Size, Share and Forecast, By Type, 2027-2033

7.3. Private Blockchain

7.4. Consortium Blockchain

7.5. Public Blockchain

8. Japan Blockchain in BFSI Market, By Application (USD Million) 2020-2033

8.1. Japan Blockchain in BFSI Market Size, Share and Forecast, By Application, 2020-2026

8.2. Japan Blockchain in BFSI Market Size, Share and Forecast, By Application, 2027-2033

8.3. Smart Contracts

8.4. Security

8.5. Trade Finance

8.6. Digital Currency

8.7. Record Keeping

8.8. GRC Management

8.9. Identity Management & Fraud Detection

8.10. Others

9. Japan Blockchain in BFSI Market Forecast, 2020-2033 (USD Million)

9.1. Japan Blockchain in BFSI Market Size and Market Share

10. Japan Blockchain in BFSI Market, By Region, 2020-2033 (USD Million)

10.1. Japan Blockchain in BFSI Market Size and Market Share By Region (2020-2026)

10.2. Japan Blockchain in BFSI Market Size and Market Share By Region (2027-2033)

10.3. Kanto Region

10.4. Kinki Region

10.5. Central/ Chubu Region

10.6. Kyushu-Okinawa Region

10.7. Tohoku Region

10.8. Chugoku Region

10.9. Hokkaido Region

10.10. Shikoku Region

11. Company Profile

11.1. Coinhive

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. JSECoin

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Tidbit

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Coinbase

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. BitPay

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.