Venture Capital Investment Market Growth, Trends, Size, Revenue, Challenges and Future Outlook

Venture Capital Investment Market Size- By Funding Type, By Fund Size, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jul-2023 | Report ID: BFSI2327 | Pages: 1 - 230 | Formats*: |

| Category : BFSI | |||

- 2021: The global venture capital market witnessed a remarkable year in 2021. Abundant available capital, along with the participation of non-traditional investors and a significant increase in exit activities, led to a surge in venture capital investments across various industries. However, larger organizations that demonstrated stronger performance managed to raise more substantial funds during this period.

-010163119072023.jpg)

- Opportunities:

- Emerging Technologies: For venture capitalists looking to profit from disruptive developments, the rise of transformative technologies like artificial intelligence, blockchain, biotechnology, and sustainable energy presents lucrative investment prospects.

- Startup Ecosystem Growth: A wide range of investment opportunities are created by the rising number of startups in a variety of industries, particularly in those that are seeing rapid growth and innovation.

- Challenges:

- Foreign exchange volatility: When corporations engage in cross-border transactions using foreign currencies, they face transaction risks due to potential fluctuations in exchange rates. For instance, a Canadian corporation doing business in China is exposed to foreign exchange risks when dealing with transactions in Chinese Yuan and reporting in Canadian Dollars. The risk arises from the time gap between the transaction and its settlement, leading to potential losses if the currency rate decreases relative to the dollar. Such transaction risks could impede market growth during the forecast period.

- Risk and Uncertainty: Investments in venture capital are inherently hazardous and have a high failure rate. Investors face hurdles in identifying companies with strong growth potential and managing risks related to new technology, market rivalry, and shifting regulations.

-010163719072023.jpg)

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Funding Type, By Fund Size, By End User |

| Regions covered | Asia Pacific, Europe, Middle East and Africa, North America, Latin America |

| Companies Covered | Accel, Andreessen Horowitz, Benchmark, Bessemer Venture Partners, First Round Capital LLC, Founders Fund LLC, Ggv Management L.L.C., Index Ventures, Sequoia Capital Operations LLC, Union Square Ventures LLC, Others |

- Diversity-Focused Companies

- Entrepreneurs

- Growth-Stage Companies

- Industry Disruptors

- Research and Development Projects

- Sector-Specific Companies

- Startups and Early-Stage Companies

- Technology Innovators

- Others

| By Funding Type: |

|

| By Fund Size: |

|

| By End User: |

|

- Global Venture Capital Investment Market Size (FY’2023-FY’2033)

- Overview of Global Venture Capital Investment Market

- Segmentation of Global Venture Capital Investment Market By Funding Type (First-Time Venture Funding, Follow-on Venture Funding)

- Segmentation of Global Venture Capital Investment Market By Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B)

- Segmentation of Global Venture Capital Investment Market By End User (Communications, Computer and Consumer Electronics, Energy, Life Sciences, Others)

- Statistical Snap of Global Venture Capital Investment Market

- Expansion Analysis of Global Venture Capital Investment Market

- Problems and Obstacles in Global Venture Capital Investment Market

- Competitive Landscape in the Global Venture Capital Investment Market

- Impact of COVID-19 and Demonetization on Global Venture Capital Investment Market

- Details on Current Investment in Global Venture Capital Investment Market

- Competitive Analysis of Global Venture Capital Investment Market

- Prominent Players in the Global Venture Capital Investment Market

- SWOT Analysis of Global Venture Capital Investment Market

- Global Venture Capital Investment Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

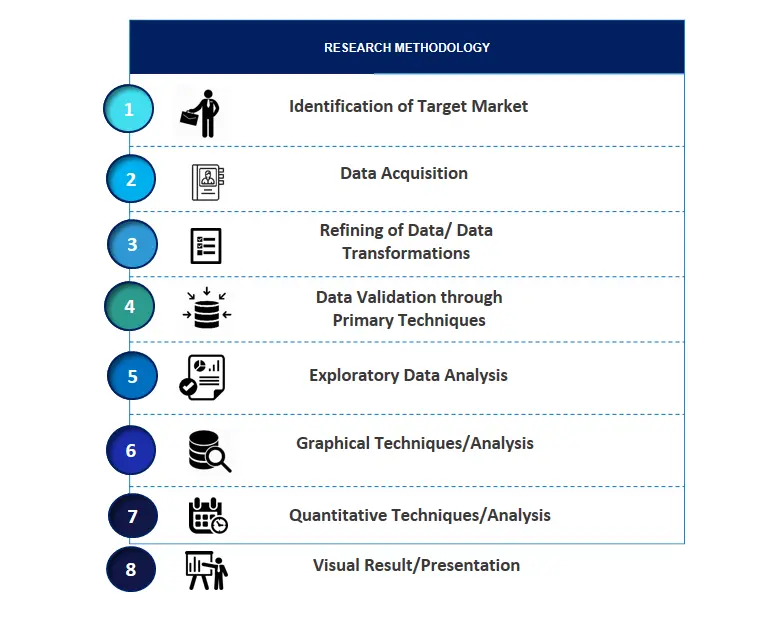

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Global Venture Capital Investment Market

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Global Venture Capital Investment Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Venture Capital Investment Market

7.1. Global Venture Capital Investment Market Value Share and Forecast, By Funding Type, 2023-20337.2. First-Time Venture Funding7.3. Follow-on Venture Funding

8.1. Global Venture Capital Investment Market Value Share and Forecast, By Fund Size, 2023-20338.2. Under $50 M8.3. $50 M to $100 M8.4. $100 M to $250 M8.5. $250 M to $500 M8.6. $500 M to $1 B8.7. Above $1 B

9.1. Global Venture Capital Investment Market Value Share and Forecast, By End User, 2023-20339.2. Communications9.3. Computer and Consumer Electronics9.4. Energy9.5. Life Sciences9.6. Others

10.1. Global Venture Capital Investment Market Size and Market Share

11.1. Global Venture Capital Investment Market Size and Market Share By Funding Type (2019-2026)11.2. Global Venture Capital Investment Market Size and Market Share By Funding Type (2027-2033)

12.1. Global Venture Capital Investment Market Size and Market Share By Fund Size (2019-2026)12.2. Global Venture Capital Investment Market Size and Market Share By Fund Size (2027-2033)

13.1. Global Venture Capital Investment Market Size and Market Share By End User (2019-2026)13.2. Global Venture Capital Investment Market Size and Market Share By End User (2027-2033)

14.1. Global Venture Capital Investment Market Size and Market Share By Region (2019-2026)14.2. Global Venture Capital Investment Market Size and Market Share By Region (2027-2033)14.3. Asia-Pacific

14.3.1. Australia14.3.2. China14.3.3. India14.3.4. Japan14.3.5. South Korea14.3.6. Rest of Asia-Pacific

14.4. Europe

14.4.1. France14.4.2. Germany14.4.3. Italy14.4.4. Spain14.4.5. United Kingdom14.4.6. Rest of Europe

14.5. Middle East and Africa

14.5.1. Kingdom of Saudi Arabia14.5.2. United Arab Emirates14.5.3. Rest of Middle East & Africa14.6. North America

14.6.1. Canada14.6.2. Mexico14.6.3. United States

14.7. Latin America

14.7.1. Argentina14.7.2. Brazil14.7.3. Rest of Latin America

15.1. Accel

15.1.1. Company details15.1.2. Financial outlook15.1.3. Product summary15.1.4. Recent developments

15.2. Andreessen Horowitz

15.2.1. Company details15.2.2. Financial outlook15.2.3. Product summary15.2.4. Recent developments

15.3. Benchmark

15.3.1. Company details15.3.2. Financial outlook15.3.3. Product summary15.3.4. Recent developments

15.4. Bessemer Venture Partners

15.4.1. Company details15.4.2. Financial outlook15.4.3. Product summary15.4.4. Recent developments

15.5. First Round Capital LLC

15.5.1. Company details15.5.2. Financial outlook15.5.3. Product summary15.5.4. Recent developments

15.6. Founders Fund LLC

15.6.1. Company details15.6.2. Financial outlook15.6.3. Product summary15.6.4. Recent developments

15.7. Ggv Management L.L.C.

15.7.1. Company details15.7.2. Financial outlook15.7.3. Product summary15.7.4. Recent developments

15.8. Index Ventures

15.8.1. Company details15.8.2. Financial outlook15.8.3. Product summary15.8.4. Recent developments

15.9. Sequoia Capital Operations LLC

15.9.1. Company details15.9.2. Financial outlook15.9.3. Product summary15.9.4. Recent developments

15.10. Union Square Ventures LLC

15.10.1. Company details15.10.2. Financial outlook15.10.3. Product summary15.10.4. Recent developments

15.11. Others

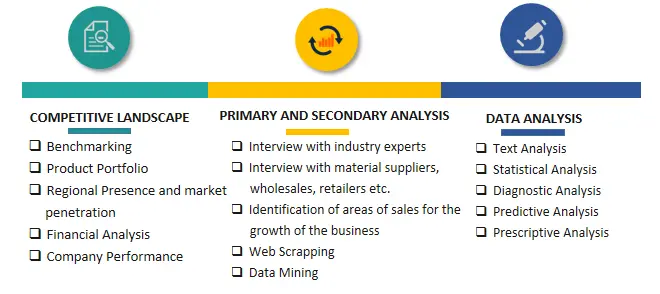

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.