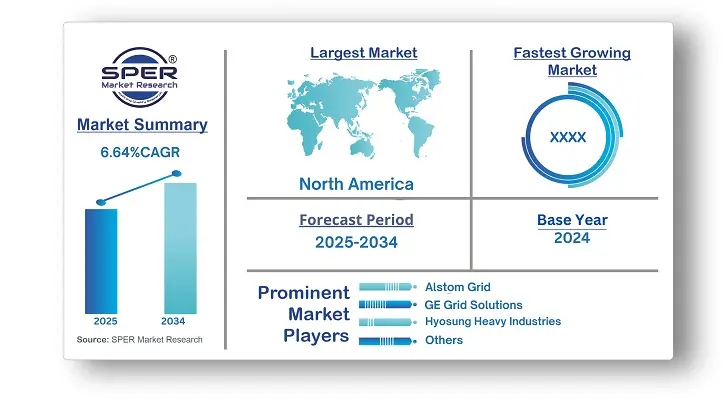

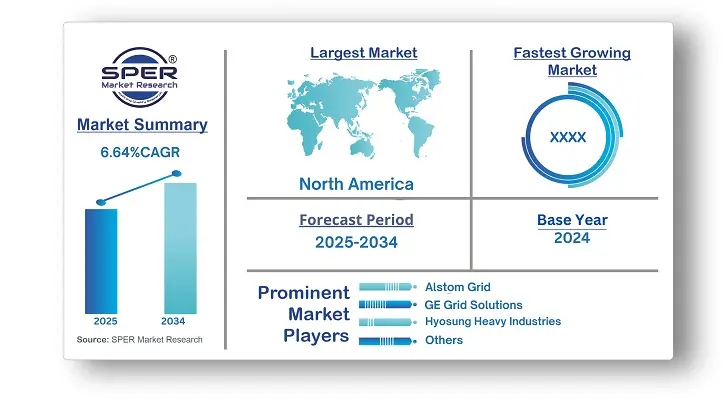

According to SPER Market Research, the Global Utility Scale Green Power Transformer Market is estimated to reach USD 1119.11 million by 2034 with a CAGR of 6.64%.

The report includes an in-depth analysis of the Global Utility Scale Green Power Transformer Market, including market size and trends, product mix, Applications, and supplier analysis. The global shift to renewable energy sources, like wind, solar, and hydropower, has increased the demand for power transformers to efficiently transmit and distribute electricity. Green power transformers are crucial for integrating renewable energy into the grid and supporting the growing use of battery energy storage systems (BESS), which help maintain grid stability. These transformers are designed to minimize energy losses, reducing greenhouse gas emissions and enhancing energy efficiency. The adoption of green transformers is further driven by evolving regulations and standards that promote environmental sustainability in the transformer market, ensuring better performance and lower environmental impact. However, challenges including high initial costs and the need for advanced technology to efficiently integrate renewable energy sources. Additionally, maintaining reliability and performance in diverse environmental conditions remains a critical concern.

By Phase:

The market for three-phase green power transformers was valued at a significant amount in 2024 and is expected to experience substantial growth by 2034. These transformers are widely used in conjunction with Battery Energy Storage Systems (BESS). The market has been shaped by strict environmental regulations and emission reduction goals. Governments and regulatory authorities have actively encouraged the adoption of eco-friendly and energy-efficient transformers as part of efforts to reduce the carbon footprint in the power sector.

By Rating:

The market for 100 kVA - 500 kVA green power transformers saw significant growth in 2023 and is projected to continue expanding at a steady pace through 2032. Ongoing global efforts to modernize power grids have driven the demand for medium voltage green transformers. The shift toward decentralized energy generation, especially the installation of solar and wind systems at the medium voltage level, has increased the need for adaptable transformers. These transformers are specially designed to handle the fluctuations in power generation and effectively integrate Distributed Energy Resources (DERs) into the grid.

By Region:

The North American utility-scale green power transformer market is expected to see substantial growth by 2032. Although there was initial reluctance to invest in infrastructure in the United States, significant progress has been made in securing funding for infrastructure projects. A key example is the anticipated funding for the Highway Trust Fund, aimed at significantly boosting the nation's infrastructure development.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hitachi Energy Ltd., Hyosung Heavy Industries, Ormazabal, Schneider Electric, Siemens Energy, and others.

Recent Developments:

In March 2023, General Electric revealed an investment exceeding USD 450 million in its existing manufacturing facilities across the U.S. This investment will focus on acquiring advanced equipment and making upgrades to enhance the company and support its American workforce. The initiative aligns with GE’s plans to create two distinct, industry-leading entities in energy and aerospace. Additionally, the investment will help expand GE’s energy portfolio, which includes transformers, turbines, and generators.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Phase, By Rating |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hitachi Energy Ltd., Hyosung Heavy Industries, Ormazabal, Schneider Electric, Siemens Energy, and others.

|

Key Topics Covered in the Report:

- Global Utility Scale Green Power Transformer Market Size (FY’2021-FY’2034)

- Overview of Global Utility Scale Green Power Transformer Market

- Segmentation of Global Utility Scale Green Power Transformer Market By Phase (Single Phase, Three Phase)

- Segmentation of Global Utility Scale Green Power Transformer Market By Rating (100 kVA, 100 kVA - 500 kVA, > 500 kVA)

- Statistical Snap of Global Utility Scale Green Power Transformer Market

- Expansion Analysis of Global Utility Scale Green Power Transformer Market

- Problems and Obstacles in Global Utility Scale Green Power Transformer Market

- Competitive Landscape in the Global Utility Scale Green Power Transformer Market

- Details on Current Investment in Global Utility Scale Green Power Transformer Market

- Competitive Analysis of Global Utility Scale Green Power Transformer Market

- Prominent Players in the Global Utility Scale Green Power Transformer Market

- SWOT Analysis of Global Utility Scale Green Power Transformer Market

- Global Utility Scale Green Power Transformer Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analys

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Utility Scale Green Power Transformer Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Utility Scale Green Power Transformer Market

7. Global Utility Scale Green Power Transformer Market, By Phase, (USD Million) 2021-2034

7.1. Single Phase

7.2. Three Phase

8. Global Utility Scale Green Power Transformer Market, By Rating, (USD Million) 2021-2034

8.1. 100 kVA

8.2. 100 kVA - 500 kVA

8.3. > 500 kVA

9. Global Utility Scale Green Power Transformer Market, (USD Million) 2021-2034

9.1. Global Utility Scale Green Power Transformer Market Size and Market Share

10. Global Utility Scale Green Power Transformer Market, By Region, 2021-2034 (USD Million)

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. ABB

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Alstom Grid

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. CG Power and Industrial Solutions

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Eaton

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. GE Grid Solutions

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Hitachi Energy Ltd.

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Hyosung Heavy Industries

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Ormazabal

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Schneider Electric

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

1.10. Siemens Energy

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links