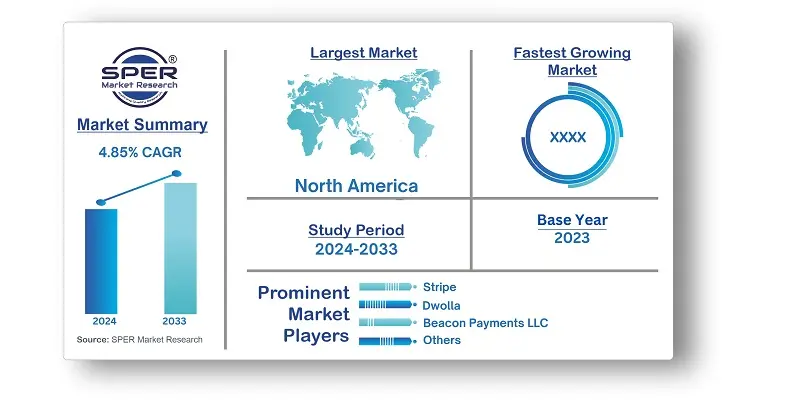

US Payment Gateway Market Growth, Trends, Share, Revenue, Competition and Future Outlook

United States Payment Gateway Market Growth, Size, Trends Analysis- By Application, By Mode of Interaction- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Oct-2024 | Report ID: IACT24172 | Pages: 1 - 106 | Formats*: |

| Category : Information & Communications Technology | |||

- April 2024: Dwolla introduces new Open Banking Services focused at improving Account-to-Account (A2A) payments. Dwolla gives businesses a simple implementation process by pre-integrating with key open banking service providers, reducing complexity and speeding up the rollout of A2A payment solutions via Dwolla's single API.

- April 2024: Stripe, a financial infrastructure platform for businesses, announced a partnership with URBN to handle online and in-store retail transactions for Urban Outfitters, Anthropologie Group, Free People, and FP Movement. In addition, by using Stripe as its fundamental payment infrastructure, URBN hopes to increase customer checkout consistency, authorisation rates, and pave the road for future developments.

- Online transactions are made easier with the adoption of QR codes: Modern retail establishments use unique QR codes to streamline customers' online payment experiences thanks to technological advancements. Scanning these codes is possible with smartphones and other IoT devices. Consumers can swiftly and conveniently make payments using them.

- Customers can use the payment provider of their choice to pay for their purchases because the same QR codes can be used with several payment applications. Online payment gateway use has increased as a result of this improvement in payment convenience.

- Online payment gateway like Gpay, Paypal Holdings, and AmazonPay have grown in popularity due to their cashback, incentives, and coupon schemes. These motivate customers to use these platforms.

- Users also regard payment gateway to be a secure means for online purchases. Furthermore, internet payment gateway are adding advanced security features such as fingerprint and face scanners to improve safety and prevent fraudulent transactions.

- Fragmentation and Regulatory Compliance: The Payment Gateway Market faces a significant difficulty in navigating the intricate web of regulatory compliance. A fragmented regulatory environment results from the many laws that different nations and areas have regulating data protection, electronic payments, and consumer rights. This discrepancy might raise compliance expenses and complicate operations for payment gateway companies. Payment gateway are required by strict legislation in many jurisdictions to put strong security mechanisms in place, conduct frequent audits, and have open reporting policies. For small and medium-sized businesses, who might not have the means or know-how to handle compliance concerns well, this regulatory burden can be especially difficult.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Application, By Mode of Interaction |

| Regions covered | Northeast, South, Midwest, West |

| Companies Covered | PayPal, Stripe, Dwolla, Beacon Payments LLC, Adyen NV, Amazon.com Inc, Francisco Partners, JPMorgan Chase & Co. |

- E-commerce Businesses

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Financial Institutions and Banks

- Payment Service Providers (PSPs)

- Mobile App Developers and Digital Wallet Providers

- Subscription-Based Businesses

- Nonprofit Organizations

| By Application: | |

| By Mode of Interaction: | |

| By Region: |

- United States Payment Gateway Market Size (FY’2024-FY’2033)

- Overview of United States Payment Gateway Market

- Segmentation of United States Payment Gateway Market by Application (Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises)

- Segmentation of United States Payment Gateway Market by Mode of Interaction (Hosted Payment Gateway, Pro/Self-Hosted Payment Gateway, API/Non-Hosted Payment Gateway, Local Bank Integrates, Direct Payment Gateway, Platform-Based Payment Gateway)

- Statistical Snap of United States Payment Gateway Market

- Expansion Analysis of United States Payment Gateway Market

- Problems and Obstacles in United States Payment Gateway Market

- Competitive Landscape in the United States Payment Gateway Market

- Impact of COVID-19 and Demonetization on United States Payment Gateway Market

- Details on Current Investment in United States Payment Gateway Market

- Competitive Analysis of United States Payment Gateway Market

- Prominent Players in the United States Payment Gateway Market

- SWOT Analysis of United States Payment Gateway Market

- United States Payment Gateway Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

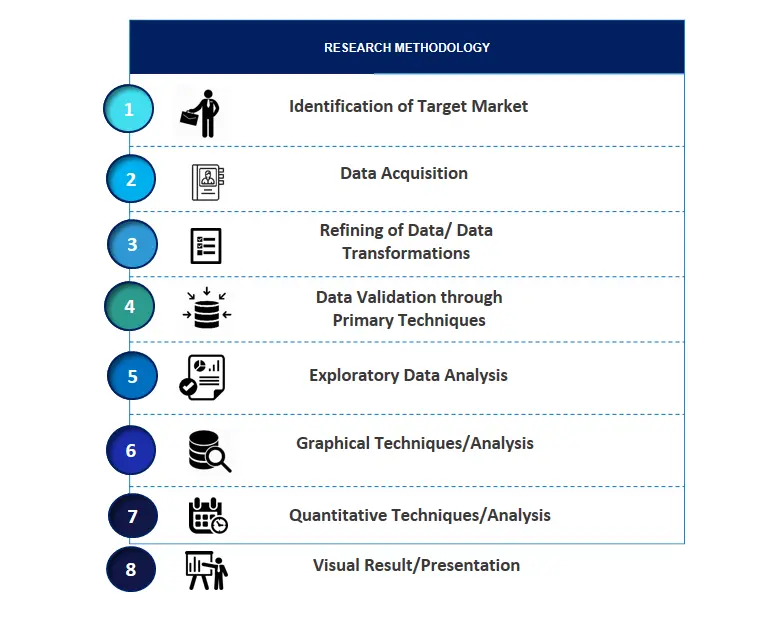

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the United States Payment Gateway Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. United States Payment Gateway Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in United States Payment Gateway Market

7.1. United States Payment Gateway Market Size, Share and Forecast, By Application, 2020-20267.2. United States Payment Gateway Market Size, Share and Forecast, By Application, 2027-20337.3. Large Enterprises7.4. Micro and Small Enterprises7.5. Mid-Size Enterprises

8.1. United States Payment Gateway Market Size, Share and Forecast, By Mode of Interaction, 2020-20268.2. United States Payment Gateway Market Size, Share and Forecast, By Mode of Interaction, 2027-20338.3. Hosted Payment Gateway8.4. Pro/Self-Hosted Payment Gateway8.5. API/Non-Hosted Payment Gateway8.6. Local Bank Integrates8.7. Direct Payment Gateway8.8. Platform-Based Payment Gateway

9.1. United States Payment Gateway Market Size and Market Share

10.1. United States Payment Gateway Market Size and Market Share By Region (2020-2026)10.2. United States Payment Gateway Market Size and Market Share By Region (2027-2033)10.3. Northeast10.4. South10.5. Midwest10.6. West

11.1. PayPal

11.1.1. Company details11.1.2. Financial outlook11.1.3. Product summary11.1.4. Recent developments

11.2. Stripe

11.2.1. Company details11.2.2. Financial outlook11.2.3. Product summary11.2.4. Recent developments

11.3. Dwolla

11.3.1. Company details11.3.2. Financial outlook11.3.3. Product summary11.3.4. Recent developments

11.4. Beacon Payments LLC

11.4.1. Company details11.4.2. Financial outlook11.4.3. Product summary11.4.4. Recent developments

11.5. Adyen NV

11.5.1. Company details11.5.2. Financial outlook11.5.3. Product summary11.5.4. Recent developments

11.6. Amazon.com Inc

11.6.1. Company details11.6.2. Financial outlook11.6.3. Product summary11.6.4. Recent developments

11.7. Francisco Partners

11.7.1. Company details11.7.2. Financial outlook11.7.3. Product summary11.7.4. Recent developments

11.8. JPMorgan Chase & Co

11.8.1. Company details11.8.2. Financial outlook11.8.3. Product summary11.8.4. Recent developments

11.9. Others

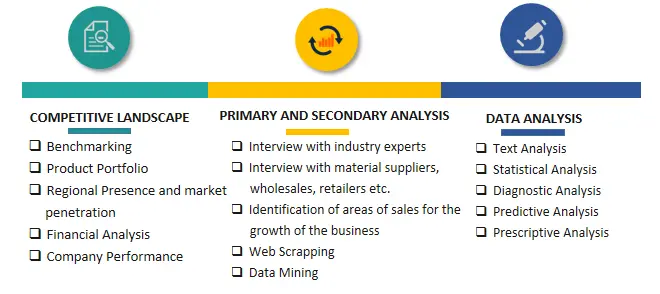

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.