United States Construction Equipment Market Growth, Size, Trends, Demand and Future Outlook

United States Construction Equipment Market Size- By Equipment Type, By Type, By Application, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jun-2024 | Report ID: COAM2425 | Pages: 1 - 107 | Formats*: |

| Category : Construction & Manufacturing | |||

- March 2024; With the goal of cutting emissions of operating costs, Caterpillar Inc. unveiled a new line of electric construction equipment, which included an electric excavator and wheel loader. With their enhanced battery technology, longer life cycles, and quick charging times, these new models can work effectively on construction sites with little downtime.

- August 2022; The announcement was made by Deere and Company to expand its line of autonomous construction machinery by acquiring a top robotics company. By incorporating cutting edge robotics and artificial intelligence technology into its current product lines, Deere hopes to emphasize automation, accuracy, and efficiency in construction operation.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Equipment Type, By Type, By Application, By End-User |

| Regions covered | Northeast, Southwest, West, Southeast, Midwest |

| Companies Covered | Atlas Copco, Caterpillar Inc, CNH Industrial N.V, Deere & Company, Doosan Infracore, Hitachi Construction Machinery Co Ltd, J C Bamford Excavators Ltd (JCB), Komatsu America Corp, Liebherr Group, Sany Heavy Industries Co Ltd. |

- Construction Companies

- Rental Companies

- Government and Municipalities

- Infrastructure Developers

- Mining and Quarrying Companies

- Industrial Sector

- Transport and Logistics Firms

| By Equipment Type: |

|

| By Type: |

|

| By Application: |

|

| By End-Users: |

|

- United States Construction Equipment Market Size (FY’2024-FY’2033)

- Overview of United States Construction Equipment Market

- Segmentation of United States Construction Equipment Market by Equipment Type (Heavy Construction Equipment, Compact Construction Equipment)

- Segmentation of United States Construction Equipment Market by Type (Loader, Cranes, Forklift, Excavator, Dozers, Others)

- Segmentation of United States Construction Equipment Market by Application (Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others)

- Segmentation of United States Construction Equipment Market by End-User (Oil and Gas, Construction and Infrastructure, Manufacturers, Mining Companies, Others)

- Statistical Snap of United States Construction Equipment Market

- Expansion Analysis of United States Construction Equipment Market

- Problems and Obstacles in United States Construction Equipment Market

- Competitive Landscape in the United States Construction Equipment Market

- Impact of COVID-19 and Demonetization on United States Construction Equipment Market

- Details on Current Investment in United States Construction Equipment Market

- Competitive Analysis of United States Construction Equipment Market

- Prominent Players in the United States Construction Equipment Market

- SWOT Analysis of United States Construction Equipment Market

- United States Construction Equipment Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

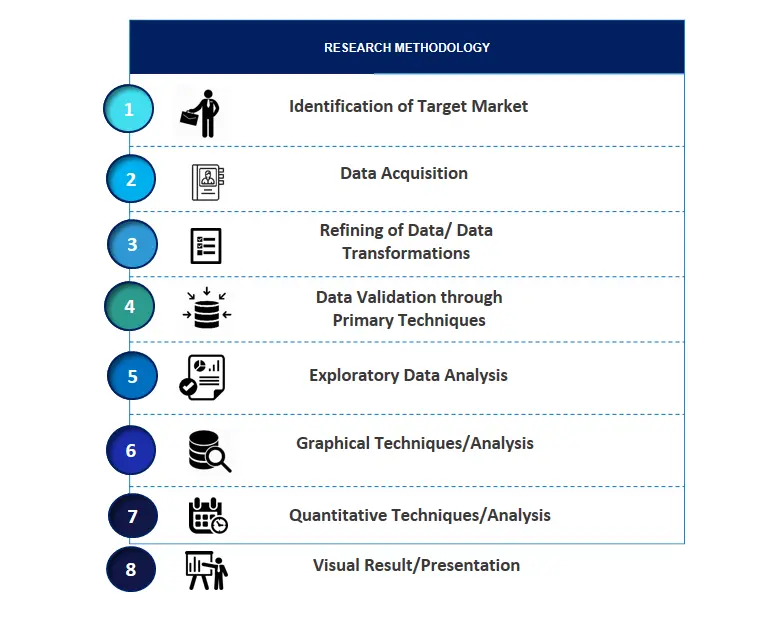

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the United States Construction Equipment Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. United States Construction Equipment Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in United States Construction Equipment Market

7.1. United States Construction Equipment Market Size, Share and Forecast, By Equipment Type, 2020-20267.2. United States Construction Equipment Market Size, Share and Forecast, By Equipment Type, 2027-20337.3. Heavy Construction Equipment7.4. Compact Construction Equipment

8.1. United States Construction Equipment Market Size, Share and Forecast, By Type, 2020-20268.2. United States Construction Equipment Market Size, Share and Forecast, By Type, 2027-20338.3. Loader8.4. Cranes8.5. Forklift8.6. Excavator8.7. Dozers8.8. Others

9.1. United States Construction Equipment Market Size, Share and Forecast, By Application, 2020-20269.2. United States Construction Equipment Market Size, Share and Forecast, By Application, 2027-20339.3. Excavation and Mining9.4. Lifting and Material Handling9.5. Earth Moving9.6. Transportation9.7. Others

10.1. United States Construction Equipment Market Size, Share and Forecast, By End-Users, 2020-202610.2. United States Construction Equipment Market Size, Share and Forecast, By End-Users, 2027-203310.3. Oil and Gas10.4. Construction and Infrastructure10.5. Manufacturers10.6. Mining Companies10.7. Others

11.1. United States Construction Equipment Market Size and Market Share

12.1. United States Construction Equipment Market Size and Market Share By Region (2020-2026)12.2. United States Construction Equipment Market Size and Market Share By Region (2027-2033)12.3. Northeast12.4. Southwest12.5. West12.6. Southeast12.7. Midwest

13.1. ATLAS COPCO

13.1.1. Company details13.1.2. Financial outlook13.1.3. Product summary13.1.4. Recent developments

13.2. CATERPILLAR, INC.

13.2.1. Company details13.2.2. Financial outlook13.2.3. Product summary13.2.4. Recent developments

13.3. CNH INDUSTRIAL N.V.

13.3.1. Company details13.3.2. Financial outlook13.3.3. Product summary13.3.4. Recent developments

13.4. DEERE AND COMPANY

13.4.1. Company details13.4.2. Financial outlook13.4.3. Product summary13.4.4. Recent developments

13.5. DOOSAN INFRACARE

13.5.1. Company details13.5.2. Financial outlook13.5.3. Product summary13.5.4. Recent developments

13.6. J C BAMFORD EXCAVATORS LTD. (JCB)

13.6.1. Company details13.6.2. Financial outlook13.6.3. Product summary13.6.4. Recent developments

13.7. KOMATSU AMERICA CORP.

13.7.1. Company details13.7.2. Financial outlook13.7.3. Product summary13.7.4. Recent developments

13.8. LIEBHERR GROUP

13.8.1. Company details13.8.2. Financial outlook13.8.3. Product summary13.8.4. Recent developments

13.9. SANY HEAVY INDUSTRIES CO. LTD.

13.9.1. Company details13.9.2. Financial outlook13.9.3. Product summary13.9.4. Recent developments

13.10. Others

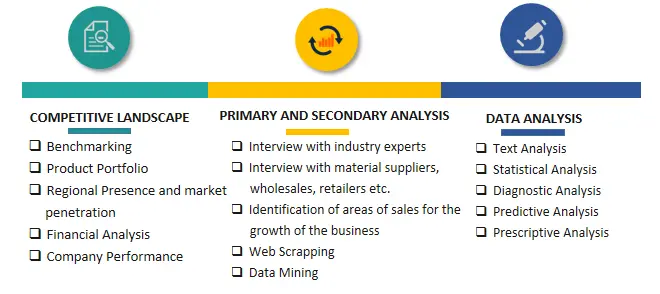

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.