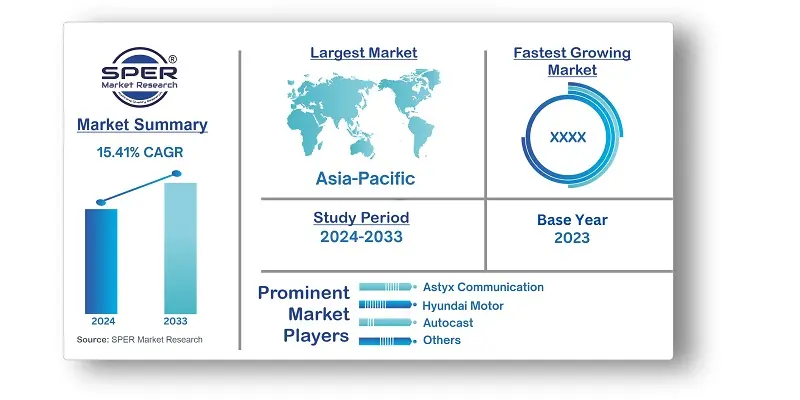

Singapore Autonomous Cars Market Growth, Size, Trends, Demand, Revenue and Future Outlook

Singapore Autonomous Cars Market Size- By Level of Autonomy, By Type, By Vehicle Type- Regional outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Sep-2024 | Report ID: AMIN24199 | Pages: 1 - 106 | Formats*: |

| Category : Automotive & Transportation | |||

- November 2023; Hyundai Motor Group and Motional, a worldwide independent innovation pioneer, together fostered the all-electric IONIQ 5 robot taxi, which will be made at the Hyundai Engine Gathering Development Center Singapore (HMGICS). The IONIQ 5 robot taxi is one of the primary SAE Level 4 independent vehicles to be ensured under the U.S. Government Engine Vehicle Wellbeing Norms (FMVSS).

- May 2022; The Chinese producer of electric vehicles, Nio, has reported that it will open an innovative work office in Singapore devoted to man-made reasoning and independent driving. This middle is a part of Nio's arrangement to work with science and exploration associations in Singapore and attract computerized ability. The move by Nio to lay out this middle in Singapore is an impression of a bigger pattern by Chinese automakers as they seek a piece of the pie in the independent driving space.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Level of Autonomy, By Type, By Vehicle Type. |

| Regions covered | North-East, Central, West, East, North. |

| Companies Covered | Astyx Communication, Autocast, Grab, Hyundai Motor, Moovita, nuTonomy, Ottopia, and Renault. |

- Government and Regulatory Bodies

- Automotive Manufacturers

- Technology and Software Developers

- Public Transportation Providers

- Fleet Management Companies

- Insurance Companies

| By Level of Autonomy: |

|

| By Type: |

|

| By Vehicle Type: |

|

- Singapore Autonomous Cars Market Size (FY’2024-FY’2033)

- Overview of Singapore Autonomous Cars Market

- Segmentation of Singapore Autonomous Cars Market by Level of Autonomy (Level 1, Level 2, Level 3, Others)

- Segmentation of Singapore Autonomous Cars Market by Type (Passenger Vehicle, Commercial Vehicle, Service Vehicle)

- Segmentation of Singapore Autonomous Cars Market by Vehicle Type (Hatchback, Sedan, SUV)

- Statistical Snap of Singapore Autonomous Cars Market

- Expansion Analysis of Singapore Autonomous Cars Market

- Problems and Obstacles in Singapore Autonomous Cars Market

- Competitive Landscape in the Singapore Autonomous Cars Market

- Impact of COVID-19 and Demonetization on Singapore Autonomous Cars Market

- Details on Current Investment in Singapore Autonomous Cars Market

- Competitive Analysis of Singapore Autonomous Cars Market

- Prominent Players in the Singapore Autonomous Cars Market

- SWOT Analysis of Singapore Autonomous Cars Market

- Singapore Autonomous Cars Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Singapore Autonomous Cars Market

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Singapore Autonomous Cars Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Singapore Autonomous Cars Market

7.1. Singapore Autonomous Cars Market Size, Share and Forecast, By Level of Autonomy, 2020-20267.2. Singapore Autonomous Cars Market Size, Share and Forecast, By Level of Autonomy, 2027-20337.3. Level 17.4. Level 27.5. Level 37.6. Others

8.1. Singapore Autonomous Cars Market Size, Share and Forecast, By Type, 2020-20268.2. Singapore Autonomous Cars Market Size, Share and Forecast, By Type, 2027-20338.3. Passenger Vehicle8.4. Commercial Vehicle8.5. Service Vehicle

9.1. Singapore Autonomous Cars Market Size, Share and Forecast, By Vehicle Type, 2020-20269.2. Singapore Autonomous Cars Market Size, Share and Forecast, By Vehicle Type, 2027-20339.3. Hatchback9.4. Sedan9.5. SUV

10.1. Singapore Autonomous Cars Market Size and Market Share

11.1. Singapore Autonomous Cars Market Size and Market Share By Region (2020-2026)11.2. Singapore Autonomous Cars Market Size and Market Share By Region (2027-2033)11.3. North-East11.4. Central11.5. West11.6. East11.7. North

12.1. Astyx Communication

12.1.1. Company details12.1.2. Financial outlook12.1.3. Product summary12.1.4. Recent developments

12.2. Autocast

12.2.1. Company details12.2.2. Financial outlook12.2.3. Product summary12.2.4. Recent developments

12.3. Grab

12.3.1. Company details12.3.2. Financial outlook12.3.3. Product summary12.3.4. Recent developments

12.4. Hyundai Motor

12.4.1. Company details12.4.2. Financial outlook12.4.3. Product summary12.4.4. Recent developments

12.5. Moovita

12.5.1. Company details12.5.2. Financial outlook12.5.3. Product summary12.5.4. Recent developments

12.6. nuTonomy

12.6.1. Company details12.6.2. Financial outlook12.6.3. Product summary12.6.4. Recent developments

12.7. Ottopia

12.7.1. Company details12.7.2. Financial outlook12.7.3. Product summary12.7.4. Recent developments

12.8. Renault

12.8.1. Company details12.8.2. Financial outlook12.8.3. Product summary12.8.4. Recent developments

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.