Latin America Fintech Market Growth, Size, Trends, Share, Revenue, Demand and Future Outlook

Latin America Fintech Market Size- By Technology, By Service, By Application, By Deployment Mode- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jul-2024 | Report ID: BFSI2423 | Pages: 1 - 158 | Formats*: |

| Category : BFSI | |||

- July 2021 - Z1, a digital bank aimed at Latin American GenZers based in Sao Paulo, has raised USD 2.5 million in a funding round led by Homebrew in the United States. Z1 is a digital banking software built exclusively for teenagers and young adults. The company was founded on the notion that by using its app and associated prepaid card, Brazilian and Latin American youth may achieve more financial independence. Z1 is now focused on Brazil, but the business intends to expand to other Latin American countries in the future.

- June 2021 - Conductor, a prominent payments and banking service platform in Latin America, has announced the arrival of its technical platform in Mexico, which is viewed as vital for the company's internationalisation and global expansion.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Technology, By Service, By Application, By Deployment Mode |

| Regions covered | Brazil, Mexico, Chile, Colombia, Peru |

| Companies Covered | Nubank, Uala, Ebanx, RecargaPay, Clip, Bitso, Konfio, Wilobank, Addi, Vortx. |

- Unbanked and Underbanked Populations

- Small and Medium-sized Enterprises (SMEs)

- Millennials and Gen Z

- Gig Economy Workers

- Remittance Senders and Receivers

- Tech-Savvy Consumers

| By Technology: |

|

| By Service: |

|

| By Application: |

|

| By Deployment Mode: |

|

- Latin America Fintech Market Size (FY’2024-FY’2033)

- Overview of Latin American Fintech Market

- Segmentation of Latin America Fintech Market by Technology (API, AI, Blockchain, Distributed Computing, Others)

- Segmentation of Latin America Fintech Market by Service (Payment, Fund Transfer, Personal Finance, Loans, Insurance, Wealth Management)

- Segmentation of Latin America Fintech Market by Application (Banking, Insurance, Securities, Others)

- Segmentation of Latin America Fintech Market by Deployment Mode (Cloud, On-Premises)

- Statistical Snap of Latin America Fintech Market

- Expansion Analysis of Latin America Fintech Market

- Problems and Obstacles in Latin America Fintech Market

- Competitive Landscape in the Latin America Fintech Market

- Impact of COVID-19 and Demonetization on Latin America Fintech Market

- Details on Current Investment in Latin America Fintech Market

- Competitive Analysis of Latin America Fintech Market

- Prominent Players in the Latin America Fintech Market

- SWOT Analysis of Latin America Fintech Market

- Latin America Fintech Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

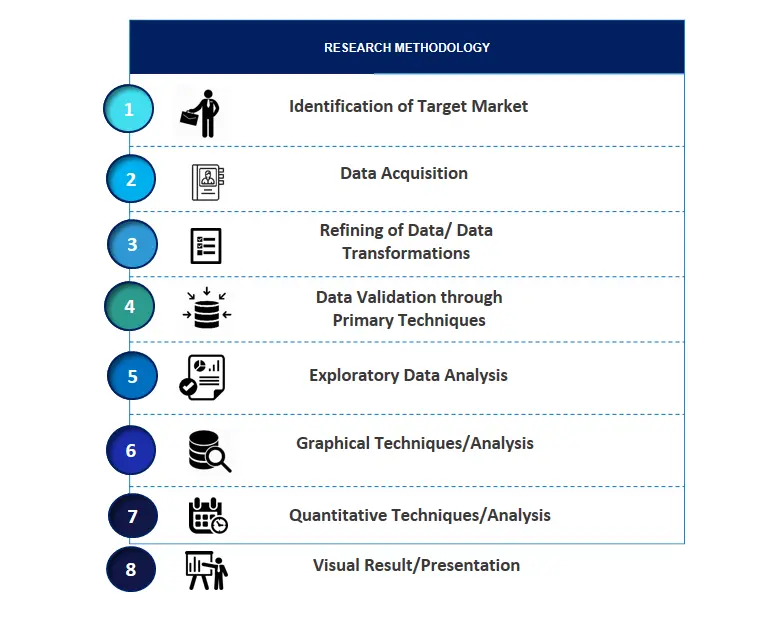

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Latin America Fintech Market.

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Latin America Fintech Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Latin America Fintech Market

7.1. Latin America Fintech Market Size, Share and Forecast, By Technology, 2020-20267.2. Latin America Fintech Market Size, Share and Forecast, By Technology, 2027-20337.3. API7.4. AI7.5. Blockchain7.6. Distributed Computing7.7. Others

8.1. Latin America Fintech Market Size, Share and Forecast, By Service, 2020-20268.2. Latin America Fintech Market Size, Share and Forecast, By Service, 2027-20338.3. Payment8.4. Fund Transfer8.5. Personal Finance8.6. Loans8.7. Insurance8.8. Wealth Management

9.1. Latin America Fintech Market Size, Share and Forecast, By Application, 2020-20269.2. Latin America Fintech Market Size, Share and Forecast, By Application, 2027-20339.3. Banking9.4. Insurance9.5. Securities9.6. Others

10.1. Latin America Fintech Market Size, Share and Forecast, By Deployment Mode, 2020-202610.2. Latin America Fintech Market Size, Share and Forecast, By Deployment Mode, 2027-203310.3. Cloud10.4. On-Premises

11.1. Latin America Fintech Size and Market Share

12.1. Latin America Fintech Market Size and Market Share By Region (2020-2026)12.2. Latin America Fintech Market Size and Market Share By Region (2027-2033)

12.2.1. Brazil12.2.2. Mexico12.2.3. Chile12.2.4. Colombia12.2.5. Peru12.2.6. Others

13.1. Nubank

13.1.1. Company details13.1.2. Financial outlook13.1.3. Product summary13.1.4. Recent developments

13.2. Uala

13.2.1. Company details13.2.2. Financial outlook13.2.3. Product summary13.2.4. Recent developments

13.3. Ebanx

13.3.1. Company details13.3.2. Financial outlook13.3.3. Product summary13.3.4. Recent developments

13.4. RecargaPay

13.4.1. Company details13.4.2. Financial outlook13.4.3. Product summary13.4.4. Recent developments

13.5. Clip

13.5.1. Company details13.5.2. Financial outlook13.5.3. Product summary13.5.4. Recent developments

13.6. Bitso

13.6.1. Company details13.6.2. Financial outlook13.6.3. Product summary13.6.4. Recent developments

13.7. Konfio

13.7.1. Company details13.7.2. Financial outlook13.7.3. Product summary13.7.4. Recent developments

13.8. Wilobank

13.8.1. Company details13.8.2. Financial outlook13.8.3. Product summary13.8.4. Recent developments

13.9. Addi

13.9.1. Company details13.9.2. Financial outlook13.9.3. Product summary13.9.4. Recent developments

13.10. Vortx

13.10.1. Company details13.10.2. Financial outlook13.10.3. Product summary13.10.4. Recent developments

13.11. Others

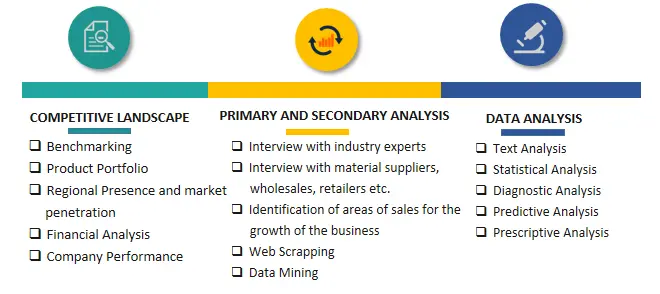

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.