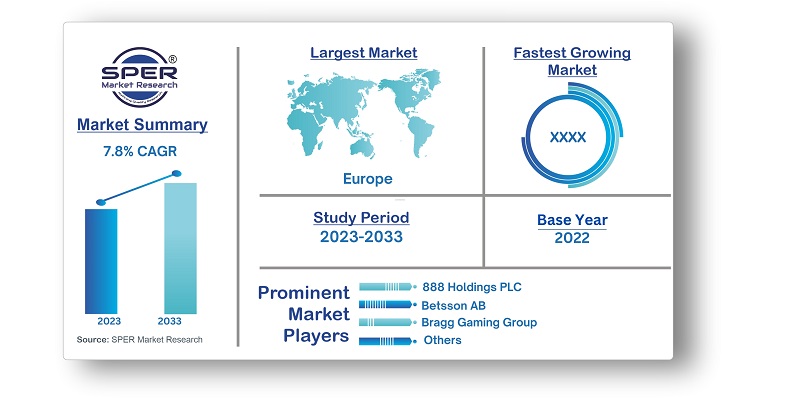

Europe Online Gambling Market Growth, Trends, Size, Demand, Revenue, Share and Future Outlook

Europe Online Gambling Market Size- By Game Type, By Device- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Oct-2023 | Report ID: IACT23166 | Pages: 1 - 153 | Formats*: |

| Category : Information & Communications Technology | |||

- July 2021: In collaboration with sportsbook supplier Sportnco, Betway unveiled a brand-new website targeted at French users. Players in France were expected to have access to betting opportunities on a variety of sporting events and tournaments through Betway.fr and its companion mobile apps.

- March 2021: Flutter Entertainment and Playtech agreed to a five-year extension of their cooperation agreement. In accordance with the new contract, Playtech expanded the use of its technology to support Flutter brands in London, including Paddy Power, Betfair, and Sky Casino.

- Opportunities: One of the main elements creating the opportunities for the online gambling market's expansion in Europe at the moment is the increased desire for online gambling, which guarantees authenticity and eliminates fraudulent operations. Additionally, the expansion of hardware and software advancements in online gambling by several important companies is providing a bright outlook for the business in the area. In addition, people are becoming more and more interested in casino and sports betting. This is accelerating the market's growth in Europe, along with the rising use of smartphones, cutting-edge internet capabilities, and rapid digitization.

- Challenges: In Europe, different legal systems present a considerable barrier in the form of regulatory complexity. It is a tricky undertaking for legislators to strike a balance between consumer protection and industry growth. Strong precautions must be taken to guarantee users' well-being in addition to worries about responsible gambling and the possibility of addiction. To maintain the rising trend of the European online gambling business as it continues to develop, stakeholders must traverse these difficulties, adapting to regulatory environments while putting user safety and responsible gaming practises first.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Game Type, By Device |

| Regions covered | France, Germany, Italy, Spain, United Kingdom, Others |

| Companies Covered | 888 Holdings PLC, Bet365 Group Ltd, Betsson AB, Bragg Gaming Group, Entain PLC (William Hill PLC), Flutter Entertainment, GVC Holdings, LeoVegas AB, The Kindered Group, The Stars Group Inc., Others |

- Adult Gamblers

- Affiliate Marketers

- Casino Enthusiasts

- Gaming Enthusiasts

- Gaming Software Providers

- Problem Gambling Support Organizations

- Sports Fans

- Others

| By Game Type: |

|

| By Device: |

|

- Europe Online Gambling Market Size (FY’2023-FY’2033)

- Overview of Europe Online Gambling Market

- Segmentation of Europe Online Gambling Market By Game Type (Casino, Sports Betting, Others)

- Segmentation of Europe Online Gambling Market By Device (Desktop, Mobile, Others)

- Statistical Snap of Europe Online Gambling Market

- Expansion Analysis of Europe Online Gambling Market

- Problems and Obstacles in Europe Online Gambling Market

- Competitive Landscape in the Europe Online Gambling Market

- Impact of COVID-19 and Demonetization on Europe Online Gambling Market

- Details on Current Investment in Europe Online Gambling Market

- Competitive Analysis of Europe Online Gambling Market

- Prominent Players in the Europe Online Gambling Market

- SWOT Analysis of Europe Online Gambling Market

- Europe Online Gambling Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Europe Online Gambling Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Europe Online Gambling Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Online Gambling Market

7.1. Europe Online Gambling Market Value Share and Forecast, By Game Type, 2023-20337.2. Casino7.2.1. Baccarat7.2.2. Blackjack7.2.3. Live Casino7.2.4. Poker7.2.5. Slots7.2.6. Others7.3. Sports Betting7.3.1. E-Sports7.3.2. Football7.3.3. Horse Racing7.3.4. Others7.4. Others

8.1. Europe Online Gambling Market Value Share and Forecast, By Device, 2023-20338.2. Desktop8.3. Mobile8.4. Others

9.1. Europe Online Gambling Market Size and Market Share

10.1. Europe Online Gambling Market Size and Market Share By Game Type (2019-2026)10.2. Europe Online Gambling Market Size and Market Share By Game Type (2027-2033)

11.1. Europe Online Gambling Market Size and Market Share By Device (2019-2026)11.2. Europe Online Gambling Market Size and Market Share By Device (2027-2033)

12.1. Europe Online Gambling Market Size and Market Share By Region (2019-2026)12.2. Europe Online Gambling Market Size and Market Share By Region (2027-2033)12.3. France12.4. Germany12.5. Italy

12.6. Spain12.7. United Kingdom12.8. Others

13.1. Holdings PLC13.1.1. Company details13.1.2. Financial outlook13.1.3. Product summary13.1.4. Recent developments13.2. Bet365 Group Ltd13.2.1. Company details13.2.2. Financial outlook13.2.3. Product summary13.2.4. Recent developments13.3. Betsson AB13.3.1. Company details13.3.2. Financial outlook13.3.3. Product summary13.3.4. Recent developments13.4. Bragg Gaming Group13.4.1. Company details13.4.2. Financial outlook13.4.3. Product summary13.4.4. Recent developments13.5. Entain PLC (William Hill PLC)13.5.1. Company details13.5.2. Financial outlook13.5.3. Product summary13.5.4. Recent developments13.6. Flutter Entertainment13.6.1. Company details13.6.2. Financial outlook13.6.3. Product summary13.6.4. Recent developments13.7. GVC Holdings13.7.1. Company details13.7.2. Financial outlook13.7.3. Product summary13.7.4. Recent developments13.8. LeoVegas AB13.8.1. Company details13.8.2. Financial outlook13.8.3. Product summary13.8.4. Recent developments13.9. The Kindered Group13.9.1. Company details13.9.2. Financial outlook13.9.3. Product summary13.9.4. Recent developments13.10. The Stars Group Inc.13.10.1. Company details13.10.2. Financial outlook13.10.3. Product summary13.10.4. Recent developments13.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.