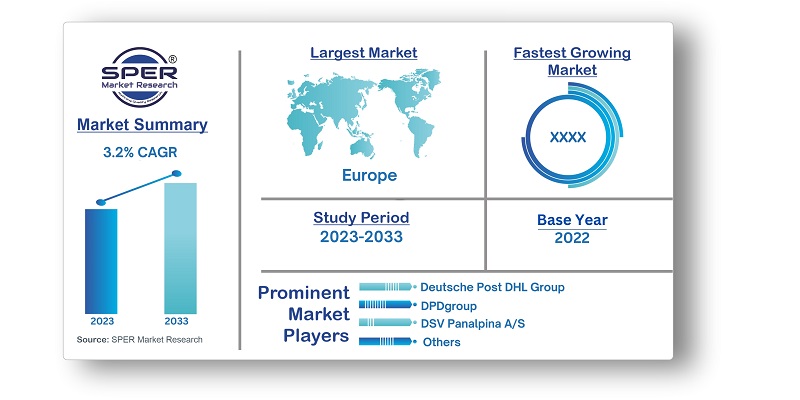

Europe Courier, Express and Parcel Market Growth, Revenue, Size, Trends Demand and Fututre Outlook

Europe Courier, Express and Parcel (CEP) Market Size- By Service Type, By Type, By Destination, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Feb-2024 | Report ID: AMIN2456 | Pages: 1 - 152 | Formats*: |

| Category : Automotive & Transportation | |||

- Cross-Border E-Commerce: For CEP businesses, the expanding trend of cross-border e-commerce offers a number of options. Cross-border shipping solutions must be dependable and efficient as more customers purchase from foreign online merchants.

- Same-Day and Time-Specific Deliveries: Same-day and time-specific delivery services have become more popular as a result of customers' demands for immediate satisfaction and more control over delivery schedules. Offering convenient and adaptable delivery choices gives CEP providers a competitive edge.

- Value-Added Services: CEP firms are going beyond basic deliveries in their service offerings to set themselves out in the market. Services like product installation, returns processing, and customised client interactions fall within this category.

- Sustainable Delivery Options: CEP suppliers have the chance to give environmentally friendly delivery choices as a result of the increased emphasis on environmental sustainability. Putting money into carbon offset programmes, green infrastructure, and electric car purchases will draw eco-aware consumers.

- Regulatory Obstacles: A number of regulatory frameworks, such as import/export limitations, customs requirements, and data privacy laws, affect the CEP market. For market participants, complying with these regulations can be difficult and time-consuming.

- Cost Pressures: The fierce rivalry in the CEP market drives down prices, which may have an effect on profit margins. It is imperative for market participants to achieve equilibrium between preserving profitability and providing competitive pricing.

- Security Concerns: In the CEP industry, tamper-proof and secure delivery are essential. Theft, theft, or damage to packages while they are in transit can undermine customer confidence and tarnish CEP providers' reputations.

| Report Metric | Details |

| Market size available for years | 2020-2033 |

| Base year considered | 2023 |

| Forecast period | 2024-2033 |

| Segments covered | By Service Type, By Type, By Destination, By End User |

| Regions covered | France, Germany, Italy, Spain, United Kingdom, Others |

| Companies Covered | Deutsche Post DHL Group, DPDgroup, DSV Panalpina A/S, FedEx Express Europe, GLS Group, Hermes Group, PostNL, Royal Mail Group, TNT Express, UPS Europe, Others |

- E-commerce Businesses

- Government Agencies

- International Trade and Import/Export Businesses

- Large Corporations

- Logistics and Freight Forwarding Companies

- Online Marketplaces and Platforms

- Retailers and Manufacturers

- Service Providers and Suppliers

- Small and Medium-sized Enterprises (SMEs)

- Others

| By Service Type: |

|

| By Type: |

|

| By Destination: |

|

| By End User: |

|

- Europe Courier, Express and Parcel (CEP) Market Size (FY’2024-FY’2033)

- Overview of Europe Courier, Express and Parcel (CEP) Market

- Segmentation of Europe Courier, Express and Parcel (CEP) Market By Service Type (B2B, B2C, C2C)

- Segmentation of Europe Courier, Express and Parcel (CEP) Market By Type (Air, Road, Ship, Subway)

- Segmentation of Europe Courier, Express and Parcel (CEP) Market By Destination (Domestic, International)

- Segmentation of Europe Courier, Express and Parcel (CEP) Market By End User (Services, Wholesale and Retail Trade, Manufacturing, Construction and Utilities, Others)

- Statistical Snap of Europe Courier, Express and Parcel (CEP) Market

- Expansion Analysis of Europe Courier, Express and Parcel (CEP) Market

- Problems and Obstacles in Europe Courier, Express and Parcel (CEP) Market

- Competitive Landscape in the Europe Courier, Express and Parcel (CEP) Market

- Impact of COVID-19 and Demonetization on Europe Courier, Express and Parcel (CEP) Market

- Details on Current Investment in Europe Courier, Express and Parcel (CEP) Market

- Competitive Analysis of Europe Courier, Express and Parcel (CEP) Market

- Prominent Players in the Europe Courier, Express and Parcel (CEP) Market

- SWOT Analysis of Europe Courier, Express and Parcel (CEP) Market

- Europe Courier, Express and Parcel (CEP) Market Future Outlook and Projections (FY’2024-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Europe Courier, Express and Parcel (CEP) Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Europe Courier, Express and Parcel (CEP) Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Courier, Express and Parcel (CEP) Market

7.1. Europe Courier, Express and Parcel (CEP) Market Value Share and Forecast, By Service Type, 2024-20337.2. B2B (Business-to-Business)7.3. B2C (Business-to-Consumer)7.4. C2C (Customer-to-Customer)

8.1. Europe Courier, Express and Parcel (CEP) Market Value Share and Forecast, By Type, 2024-20338.2. Air8.3. Road8.4. Ship8.5. Subway

9.1. Europe Courier, Express and Parcel (CEP) Market Value Share and Forecast, By Destination, 2024-20339.2. Domestic9.3. International

10.1. Europe Courier, Express and Parcel (CEP) Market Value Share and Forecast, By End User, 2024-203310.2. Services (BFSI- Banking, Financial Services and Insurance)10.3. Wholesale and Retail Trade (E-commerce)10.4. Manufacturing, Construction and Utilities10.5. Others

11.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share

12.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Service Type (2020-2026)12.2. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Service Type (2027-2033)

13.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Type (2020-2026)13.2. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Type (2027-2033)

14.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Destination (2020-2026)14.2. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Destination (2027-2033)

15.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By End User (2020-2026)15.2. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By End User (2027-2033)

16.1. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Region (2020-2026)16.2. Europe Courier, Express and Parcel (CEP) Market Size and Market Share By Region (2027-2033)16.3. France16.4. Germany16.5. Italy16.6. Spain16.7. United Kingdom16.8. Others

17.1. Deutsche Post DHL Group17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments17.2. DPDgroup17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments17.3. DSV Panalpina A/S17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments17.4. FedEx Express Europe17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments17.5. GLS Group17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments17.6. Hermes Group17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments17.7. PostNL17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments17.8. Royal Mail Group17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments17.9. TNT Express17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments17.10. UPS Europe17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments17.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.