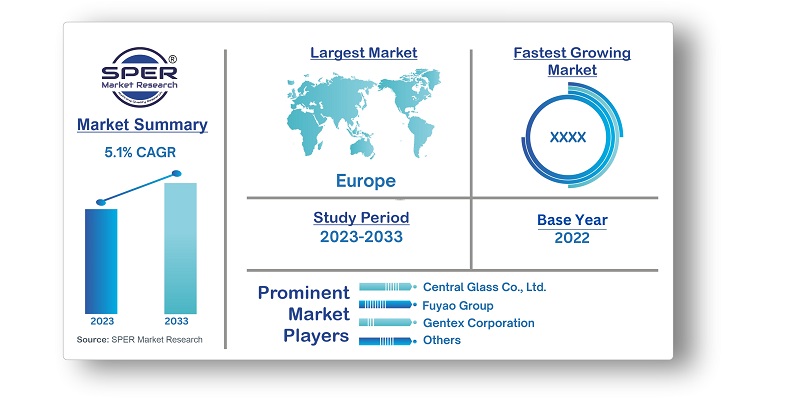

Europe Automotive Glass Market Growth, Size, Trends, Demand, Revenue, Share and Future Outlook

Europe Automotive Glass Market Size- By Glass Type, By Material Type, By Vehicle Type, By Application, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Jan-2024 | Report ID: AMIN2430 | Pages: 1 - 156 | Formats*: |

| Category : Automotive & Transportation | |||

- January 2020: BMW debuted intelligent glass control, a reflective glass type that can be turned on or off manually or automatically, in its electric SUV, the iNextit, at CES 2020. Glass can detect any particular sun position using a variety of sensors, allowing only specific sections of the window to be altered to block out excessive heat and light.

- In 2019: At its production facilities in Europe, Guardian Glass made investments to update its float glass lines. Since the current furnace is nearing the end of its useful life, the factory in the United Kingdom will undergo an upgrade and modernization.

- It's been anticipated that smart glasses will be the next big thing in the whole car business. The majority of research focused on enhancing and expanding the use of smart glass in consumer automobiles. It can be utilised to install a front screen in cars, which will facilitate easier access to all controls and enhance the interior design. Producers like as Mercedes and Volvo are working hard to create this kind of glass soon.

- Growing use of advanced driver-assistance systems (ADAS): ADAS integration in cars necessitates specific automotive glass components; this gives industry participants an opportunity to provide cutting-edge glass solutions that facilitate ADAS features.

- Shift towards lightweight materials: Lightweight materials are becoming more popular in the automobile sector as a result of the increased focus on fuel economy and carbon emission reduction. This creates chances for producers of automotive glass to create and offer lightweight glass options that lower the total weight of vehicles.

- Price volatility for raw materials: Market participants may face difficulties due to price fluctuations for raw materials like soda ash and silica sand, which are utilised in the production of automotive glass. These variations in price may have an effect on the industry's overall profitability.

- Exorbitant installation and replacement costs: Installing and replacing car glass can be expensive for consumers, which might put off some prospective buyers. Growth in the market may be hampered by this element, particularly in price-sensitive sectors.

- Environmental issues: There may be an environmental impact from the manufacture and disposal of automotive glass. To address these issues, the sector must concentrate on sustainable methods, such as recycling and energy conservation.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Glass Type, By Material Type, By Vehicle Type, By Application, By End User |

| Regions covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Arkwin Industries, Inc., Eaton Corporation plc, HYCOM, Liebherr-International Deutschland GmbH, Moog Inc., PARKER HANNIFIN CORP, Safran S.A., Senior plc, Triumph Group, Woodward, Inc. |

- Aftermarket Consumers

- Automobile Manufacturers

- Automotive Glass Distributors and Retailers

- Automotive Glass Suppliers

- Automotive Repair and Maintenance Service Providers

- Others

| By Glass Type: | |

| By Material Type: | |

| By Vehicle Type | |

| By Application: | |

| By End User: |

- Europe Automotive Glass Market Size (FY’2023-FY’2033)

- Overview of Europe Automotive Glass Market

- Segmentation of Europe Automotive Glass Market By Glass Type (Laminated Glass, Tempered Glass, Others)

- Segmentation of Europe Automotive Glass Market By Material Type (IR PVB, Metal Coated Glass, Tinted Glass, Others)

- Segmentation of Europe Automotive Glass Market By Vehicle Type (Buses, Light Commercial Vehicles, Passenger Cars, Trucks, Others)

- Segmentation of Europe Automotive Glass Market By Application (Backlite, Rear Quarter Glass, Rearview Mirror, Sidelite, Sideview Mirror, Windshield, Others)

- Segmentation of Europe Automotive Glass Market By End User (Aftermarket Suppliers, OEMs)

- Statistical Snap of Europe Automotive Glass Market

- Expansion Analysis of Europe Automotive Glass Market

- Problems and Obstacles in Europe Automotive Glass Market

- Competitive Landscape in the Europe Automotive Glass Market

- Impact of COVID-19 and Demonetization on Europe Automotive Glass Market

- Details on Current Investment in Europe Automotive Glass Market

- Competitive Analysis of Europe Automotive Glass Market

- Prominent Players in the Europe Automotive Glass Market

- SWOT Analysis of Europe Automotive Glass Market

- Europe Automotive Glass Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source

2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges

4.2. COVID-19 Impacts of the Europe Automotive Glass Market

5.1. SWOT Analysis

5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6.1. Europe Automotive Glass Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Europe Automotive Glass Market

7.1. Europe Automotive Glass Market Value Share and Forecast, By Glass Type, 2023-20337.2. Laminated Glass7.3. Tempered Glass7.4. Others

8.1. Europe Automotive Glass Market Value Share and Forecast, By Material Type, 2023-20338.2. IR PVB8.3. Metal Coated Glass8.4. Tinted Glass8.5. Others

9.1. Europe Automotive Glass Market Value Share and Forecast, By Vehicle Type, 2023-20339.2. Buses9.3. Light Commercial Vehicles9.4. Passenger Cars9.5. Trucks9.6. Others

10.1. Europe Automotive Glass Market Value Share and Forecast, By Application, 2023-203310.2. Backlite10.3. Rear Quarter Glass10.4. Rearview Mirror10.5. Sidelite10.6. Sideview Mirror10.7. Windshield10.8. Others

11.1. Europe Automotive Glass Market Value Share and Forecast, By End User, 2023-203311.2. Aftermarket Suppliers11.3. OEMs

12.1. Europe Automotive Glass Market Size and Market Share

13.1. Europe Automotive Glass Market Size and Market Share By Glass Type (2019-2026)13.2. Europe Automotive Glass Market Size and Market Share By Glass Type (2027-2033)

14.1. Europe Automotive Glass Market Size and Market Share By Material Type (2019-2026)14.2. Europe Automotive Glass Market Size and Market Share By Material Type (2027-2033)

15.1. Europe Automotive Glass Market Size and Market Share By Vehicle Type (2019-2026)15.2. Europe Automotive Glass Market Size and Market Share By Vehicle Type (2027-2033)

16.1. Europe Automotive Glass Market Size and Market Share By Application (2019-2026)16.2. Europe Automotive Glass Market Size and Market Share By Application (2027-2033)

17.1. Europe Automotive Glass Market Size and Market Share By End User (2019-2026)17.2. Europe Automotive Glass Market Size and Market Share By End User (2027-2033)

18.1. Europe Automotive Glass Market Size and Market Share By Region (2019-2026)18.2. Europe Automotive Glass Market Size and Market Share By Region (2027-2033)18.3. Germany18.4. France18.5. United Kingdom18.6. Italy18.7. Spain18.8. Others

19.1. Central Glass Co., Ltd.

19.1.1. Company details19.1.2. Financial outlook19.1.3. Product summary19.1.4. Recent developments

19.2. Fuyao Group

19.2.1. Company details19.2.2. Financial outlook19.2.3. Product summary19.2.4. Recent developments

19.3. Gentex Corporation

19.3.1. Company details19.3.2. Financial outlook19.3.3. Product summary19.3.4. Recent developments

19.4. Magna International

19.4.1. Company details19.4.2. Financial outlook19.4.3. Product summary19.4.4. Recent developments

19.5. Nippon Sheet Glass Co., Ltd.

19.5.1. Company details19.5.2. Financial outlook19.5.3. Product summary19.5.4. Recent developments

19.6. Saint Gobain

19.6.1. Company details19.6.2. Financial outlook19.6.3. Product summary19.6.4. Recent developments

19.7. Samvardhana Motherson

19.7.1. Company details19.7.2. Financial outlook19.7.3. Product summary19.7.4. Recent developments

19.8. Vitro, S.A.B de C.V.

19.8.1. Company details19.8.2. Financial outlook19.8.3. Product summary19.8.4. Recent developments

19.9. Webasto SE

19.9.1. Company details19.9.2. Financial outlook19.9.3. Product summary19.9.4. Recent developments

19.10. Xinyi Glass Holdings Limited

19.10.1. Company details19.10.2. Financial outlook19.10.3. Product summary19.10.4. Recent developments

19.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.