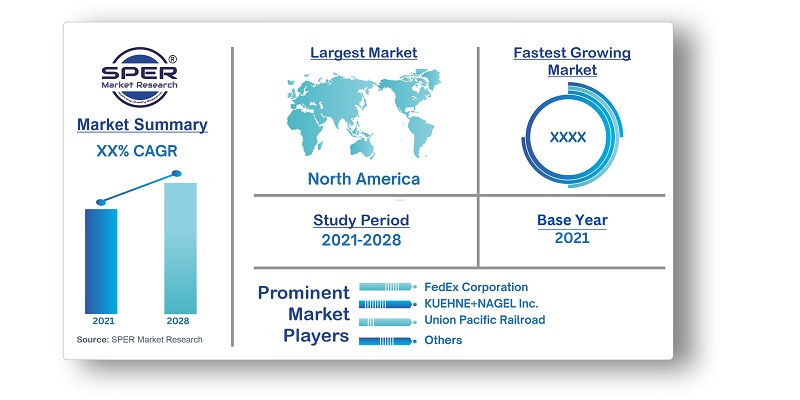

Third-Party Logistics Market Share, Demand, Technology & Future Outlook 2021-2028

Global Third-Party Logistics Market- By Services (Dedicated Contract Carriage (DCC)/Freight forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution (W&D), Value Added Logistics Services (VALs)), By Transportation (Roadways, Railways, Waterways), By End-User (Manufacturing, Retail, Healthcare, Automotive, Others) and By Region (North America, Europe, Asia Pacific, South America, and Middle East, & Africa)- Global forecast from 2021-2028.

| Published: Aug-2021 | Report ID: IACT2135 | Pages: 1 - 250 | Formats*: |

| Category : Information & Communications Technology | |||

1.1. Market Modelling1.2. Product Analysis1.3. Market Trend and Economic Factors Analysis1.4. Market Segmental Analysis1.5. Geographical Mapping1.6. Country Wise Segregation

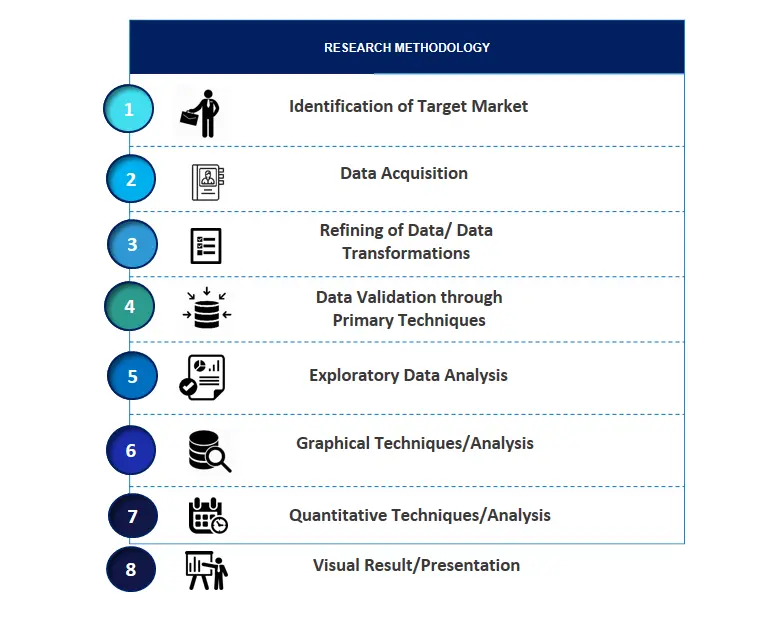

2.1. Identification of Target Market2.2. Data Acquisition2.3. Refining of Data/ Data Transformations2.4. Data Validation through Primary Techniques2.5. Exploratory Data Analysis2.6. Graphical Techniques/Analysis2.7. Quantitative Techniques/Analysis2.8. Visual Result/Presentation

4.1. Economic Factor Analysis4.1.1. Drivers4.1.2. Trends4.1.3. Opportunities4.1.4. Challenges4.2. Competitors & Product Analysis4.3. Regulatory Framework4.4. Company market share analysis, 20194.5. Porter’s Five forces analysis4.6. New Investment Analysis4.7. PESTEL Analysis

5.1. Market Size & Forecast, 2016-20275.1.1. Demand5.1.1.1. By Value (USD Million)5.2. Market Share & Forecast, 2016-20275.2.1. By Service5.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding5.2.1.2. Domestic Transportation Management (DTM)5.2.1.3. International Transportation Management (ITM)5.2.1.4. Warehousing & Distribution (W&D)5.2.1.5. Value Added Logistics Services (VALs)5.2.2. By Transport5.2.2.1. Roadways5.2.2.2. Railways5.2.2.3. Waterways5.2.2.4. Airways5.2.3. By End-use5.2.3.1. Manufacturing5.2.3.2. Retail5.2.3.3. Healthcare5.2.3.4. Automotive5.2.3.5. Others5.2.4. By Region5.2.4.1. Europe5.2.4.2. North America5.2.4.3. Asia Pacific5.2.4.4. South America5.2.4.5. Middle East & Africa

6.1. Europe Third-Party Logistics Market Size & Forecast, 2016-20276.1.1. Demand6.1.1.1. By Value (USD Million)6.2. Europe Third-Party Logistics Market Share & Forecast, 2016-20276.2.1. By Service6.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding6.2.1.2. Domestic Transportation Management (DTM)6.2.1.3. International Transportation Management (ITM)6.2.1.4. Warehousing & Distribution (W&D)6.2.1.5. Value Added Logistics Services (VALs)6.2.2. By Transport6.2.2.1. Roadways6.2.2.2. Railways6.2.2.3. Waterways6.2.2.4. Airways6.2.3. By End-use6.2.3.1. Manufacturing6.2.3.2. Retail6.2.3.3. Healthcare6.2.3.4. Automotive6.2.3.5. Others6.2.4. By Country6.2.4.1. Germany6.2.4.2. UK6.2.4.3. France6.2.4.4. Italy6.2.4.5. Rest of Europe6.2.5. Company Market Share (Top 3-5)6.2.6. Economic Impact Study on Europe Third-Party Logistics Market

7.1. North America Third-Party Logistics Market Size & Forecast, 2016-20277.1.1. Demand7.1.1.1. By Value (USD Million)7.2. North America Third-Party Logistics Market Share & Forecast, 2016-20277.2.1. By Service7.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding7.2.1.2. Domestic Transportation Management (DTM)7.2.1.3. International Transportation Management (ITM)7.2.1.4. Warehousing & Distribution (W&D)7.2.1.5. Value Added Logistics Services (VALs)7.2.2. By Transport7.2.2.1. Roadways7.2.2.2. Railways7.2.2.3. Waterways7.2.2.4. Airways7.2.3. By End-use7.2.3.1. Manufacturing7.2.3.2. Retail7.2.3.3. Healthcare7.2.3.4. Automotive7.2.3.5. Others7.2.4. By Country7.2.4.1. US7.2.4.2. Canada7.2.4.3. Mexico7.2.5. Company Market Share (Top 3-5)7.2.6. Economic Impact Study on North America Third-Party Logistics Market

8.1. Asia Pacific Third-Party Logistics Market Size & Forecast, 2016-20278.1.1. Demand8.1.1.1. By Value (USD Million)8.2. Asia Pacific Third-Party Logistics Market Share & Forecast, 2016-20278.2.1. By Service8.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding8.2.1.2. Domestic Transportation Management (DTM)8.2.1.3. International Transportation Management (ITM)8.2.1.4. Warehousing & Distribution (W&D)8.2.1.5. Value Added Logistics Services (VALs)8.2.2. By Transport8.2.2.1. Roadways8.2.2.2. Railways8.2.2.3. Waterways8.2.2.4. Airways8.2.3. By End-use8.2.3.1. Manufacturing8.2.3.2. Retail8.2.3.3. Healthcare8.2.3.4. Automotive8.2.4. By Country8.2.4.1. China8.2.4.2. India8.2.4.3. Japan8.2.4.4. Australia8.2.4.5. Rest of Asia Pacific8.2.5. Company Market Share (Top 3-5)8.2.6. Economic Impact Study on Asia Pacific Third-Party Logistics Market

9.1. South America Third-Party Logistics Market Size & Forecast, 2016-20279.1.1. Demand9.1.1.1. By Value (USD Million)9.2. South America Third-Party Logistics Market Share & Forecast, 2016-20279.2.1. By Service9.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding9.2.1.2. Domestic Transportation Management (DTM)9.2.1.3. International Transportation Management (ITM)9.2.1.4. Warehousing & Distribution (W&D)9.2.1.5. Value Added Logistics Services (VALs)9.2.2. By Transport9.2.2.1. Roadways9.2.2.2. Railways9.2.2.3. Waterways9.2.2.4. Airways9.2.3. By End-use9.2.3.1. Manufacturing9.2.3.2. Retail9.2.3.3. Healthcare9.2.3.4. Automotive9.2.4. By Country9.2.4.1. Brazil9.2.4.2. Argentina9.2.4.3. Rest of South America9.2.5. Company Market Share (Top 3-5)9.2.6. Economic Impact Study on South America Third-Party Logistics Market

10.1. Middle East & Africa Third-Party Logistics Market Size & Forecast, 2016-202710.1.1. Demand10.1.1.1. By Value (USD Million)10.2. Middle East & Africa Third-Party Logistics Market Share & Forecast, 2016-202710.2.1. By Service10.2.1.1. Dedicated Contract Carriage (DCC)/Freight forwarding10.2.1.2. Domestic Transportation Management (DTM)10.2.1.3. International Transportation Management (ITM)10.2.1.4. Warehousing & Distribution (W&D)10.2.1.5. Value Added Logistics Services (VALs)10.2.2. By Transport10.2.2.1. Roadways10.2.2.2. Railways10.2.2.3. Waterways10.2.2.4. Airways10.2.3. By End-use10.2.3.1. Manufacturing10.2.3.2. Retail10.2.3.3. Healthcare10.2.3.4. Automotive10.2.4. By Country10.2.4.1. Saudi Arabia10.2.4.2. UAE10.2.4.3. South Africa10.2.4.4. Rest of Middle East & Africa10.2.5. Company Market Share (Top 3-5)10.2.6. Economic Impact Study on Middle East & Africa Third-Party Logistics Market

11.1. Company Description11.2. Financial Analysis11.3. Key Products11.4. Key Management Personnel11.5. Contact Address11.6. SWOT Analysis11.7. Company Profile11.7.1.1. C.H. Robinson Worldwide, Inc.11.7.1.2. DB Schenker11.7.1.3. DHL International GMBH11.7.1.4. FedEx Corporation11.7.1.5. KUEHNE+NAGEL Inc11.7.1.6. Maersk11.7.1.7. Nippon Express11.7.1.8. Panalpina World Transport Ltd.11.7.1.9. Union Pacific Railroad11.7.1.10. United Parcel Service11.7.1.11. Other players

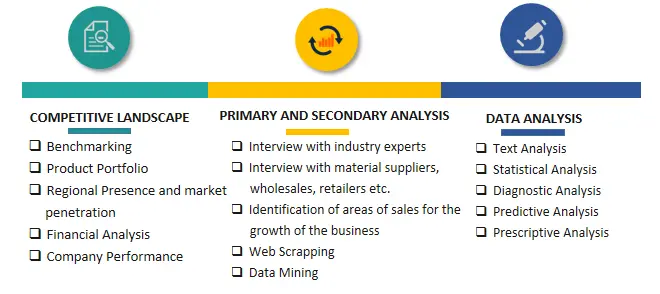

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.