Infectious Disease Diagnostics Market Share, Covid-19 Impact Analysis, Report And Forecast 2027

Global Infectious Disease Diagnostics Market - Analysis of Market Size, Share & Trends for 2019 – 2020 and Forecast to 2027

| Published: Aug-2021 | Report ID: MEDE2105 | Pages: 1 - 232 | Formats*: |

| Category : Medical Devices | |||

- Abbott Laboratories (US)

- F. Hoffmann-La Roche Ltd(Switzerland)

- bioMérieux SA (France)

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Quidel Corporation (US)

- Hologic, Inc. (US)

- Siemens Healthineers AG (Germany)

- Becton, Dickinson and Company (US)

- PerkinElmer Inc. (US)

- QIAGEN (Netherlands)

- Grifols S.A. (Spain)

- DiaSorin S.p.A (Italy)

- Bio-Rad Laboratories Inc. (US)

- Sysmex Corporation (Japan)

- Ortho Clinical Diagnostics (US)

- Luminex Corporation (US)

- Meridian Bioscience (US)

- Genetic Signatures (Australia)

- OraSure Technologies (US)

- Trinity Biotech Plc. (Ireland)

- Chembio Diagnostic Systems

- Inc. (US)

- Seegene Inc. (South Korea)

- Co-Diagnostics Inc. (US)

- ELITechGroup (France)

- Epitope Diagnostics, Inc. (US)

- Trivitron Healthcare (India)

- Meril Life Sciences Pvt. Ltd. (India)

- InBios International Inc. (US)

- and ABACUS Diagnostica Oy (Finland)

5.1. Introduction5.2. Market Dynamics

5.2.1. Drivers5.2.2. Restraints5.2.3. Opportunities5.2.4. Challenges

5.3. COVID-19 Impact of the Infectious Disease Diagnostics Market

6.1. Introduction6.2. Industry Trends

7.1. Introduction7.2. Reagents, kits & consumables7.3. Instruments7.4. Software & services

8.1. Laboratory Testing8.2. POC Testing

9.1. Immunodiagnostics9.2. Clinical Microbiology9.3. PCR9.4. INAAT9.5. DNA Sequencing & NGS9.6. DNA Microarrays9.7. Other Technologies

10.1. COVID-1910.2. HIV10.3. HAIs10.4. Hepatitis10.5. CT/NG10.6. HPV10.7. TB10.8. Influenza10.9. Other Infectious Diseases

11.1. Diagnostics Laboratories11.2. Hospitals & Clinics11.3. Academic Research Institutes11.4. Other End Users

12.1. North America

12.1.1. US12.1.2. Canada

12.2. Europe

12.2.1. Germany12.2.2. UK12.2.3. France12.2.4. Italy12.2.5. Spain12.2.6. Rest of Europe

12.3. Asia-Pacific

12.3.1. China12.3.2. Japan12.3.3. India12.3.4. Rest of Asia-Pacific

12.4. Rest of the World

12.4.1. Latin America12.4.2. Middle East & Africa

13.1. Introduction13.2. Market Share Analysis13.3. Competitive Situation and Trends

13.3.1. Product Launches13.3.2. Partnerships, Collaborations and Agreements13.3.3. Acquisitions13.3.4. Expansions13.3.5. Other Developments

14.1. Abbott Laboratories (US)14.2. F. Hoffmann-La Roche Ltd (Switzerland)14.3. bioMérieux SA (France)14.4. Thermo Fisher Scientific Inc. (US)14.5. Danaher Corporation (US)14.6. Quidel Corporation (US)14.7. Hologic, Inc. (US)14.8. Siemens Healthineers AG (Germany)14.9. Becton, Dickinson and Company (US)14.10. PerkinElmer Inc. (US)14.11. QIAGEN (Netherlands)14.12. Grifols S.A. (Spain)14.13. DiaSorin S.p.A (Italy)14.14. Bio-Rad Laboratories, Inc. (US)14.15. Sysmex Corporation (Japan)14.16. Ortho Clinical Diagnostics (US)14.17. Luminex Corporation (US)14.18. Meridian Bioscience (US)14.19. Genetic Signatures (Australia)14.20. OraSure Technologies (US)14.21. Trinity Biotech Plc. (Ireland)14.22. Chembio Diagnostic Systems, Inc. (US)14.23. Seegene Inc. (South Korea)14.24. Co-Diagnostics, Inc. (US)14.25. ELITechGroup (France)14.26. Epitope Diagnostics, Inc. (US)14.27. Trivitron Healthcare (India)14.28. Meril Life Sciences Pvt. Ltd. (India)14.29. InBios International, Inc. (US)14.30. ABACUS Diagnostica Oy (Finland).

15.1. Discussion Guide15.2. Available Customizations15.3. Related Reports

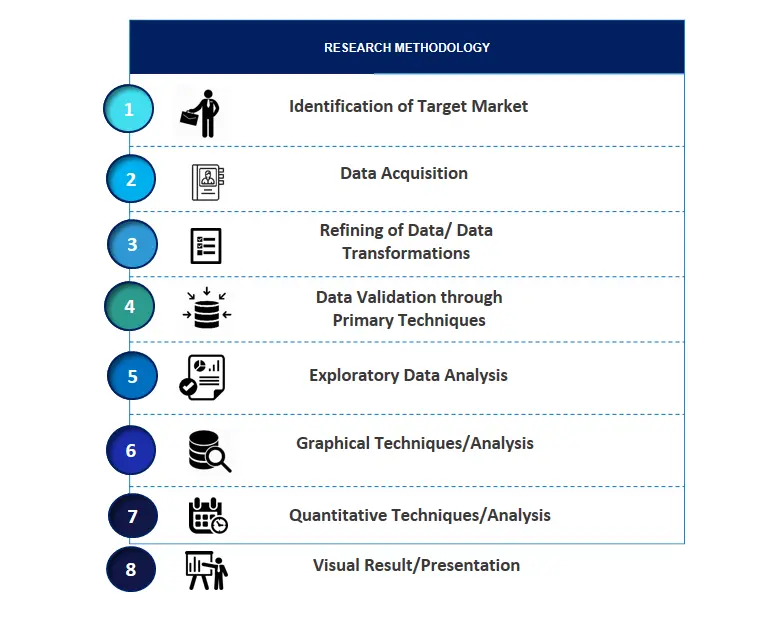

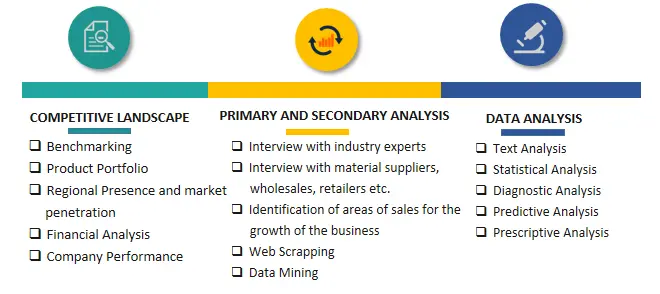

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.