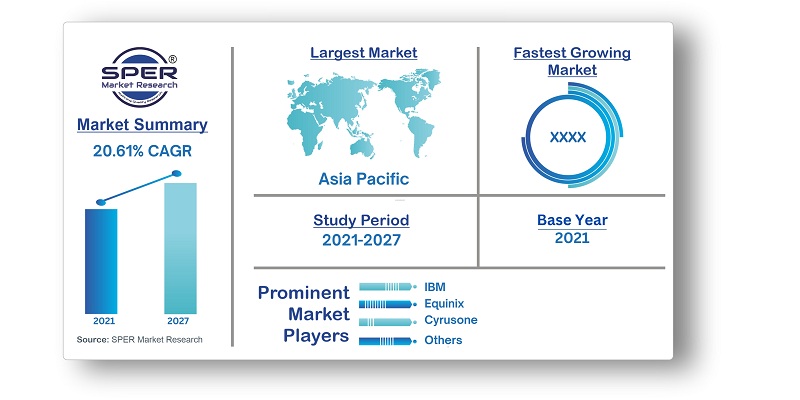

India Cloud Computing Market Share, CAGR Growth, Trends, Scope And Forecast 2027

India Cloud Computing Market by Service Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), by Deployment Model (Public, Private, and Hybrid), by Organization Size (Small and Medium-Sized Enterprises, and Large Enterprises), by Workload (Application Development and Testing, Storage, Backup, and Disaster Recovery, Database Management, Business Analytics, Integration and Orchestration, Enterprise Resource Management, and Collaboration and Content Management), By End-User Industry (BFSI, IT and Telecommunications, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences and Others), and By Region (North India, South India, West India and East India)- Forecast to 2027

| Published: Jul-2021 | Report ID: IACT2133 | Pages: 1 - 120 | Formats*: |

| Category : Information & Communications Technology | |||

1.1. Market Modelling1.2. Product Analysis1.3. Market Trend and Economic Factors Analysis1.4. Market Segmental Analysis1.5. Geographical Mapping1.6. Country Wise Segregation

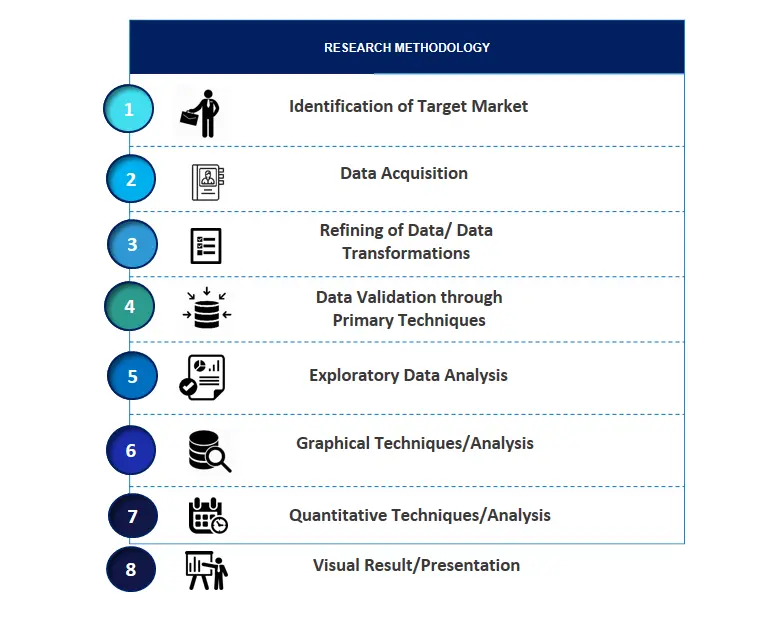

2.1. Identification of Target Market2.2. Data Acquisition2.3. Refining of Data/ Data Transformations2.4. Data Validation through Primary Techniques2.5. Exploratory Data Analysis2.6. Graphical Techniques/Analysis2.7. Quantitative Techniques/Analysis2.8. Visual Result/Presentation

4.1. Economic Factor Analysis4.1.1. Drivers4.1.2. Trends4.1.3. Opportunities4.1.4. Challenges4.2. Technological Landscape4.3. Competitors & Product Analysis4.4. Regulatory Framework4.5. Company market share analysis, 20194.6. Porter’s Five forces analysis4.7. New Investment Analysis4.8. PESTEL Analysis

5.1. Market Size & Forecast, 2016-20275.1.1. Demand5.1.1.1. By Value (USD Million)5.2. Market Share & Forecast, 2016-20275.2.1. By Service Model5.2.1.1. Infrastructure as a Service (IaaS)5.2.1.2. Platform as a Service (PaaS)5.2.1.3. Software as a Service (SaaS))5.2.2. By Deployment Model5.2.2.1. Public Cloud5.2.2.2. Private Cloud5.2.2.3. Hybrid Cloud5.2.3. By Organization Size5.2.3.1. Small and Medium-Sized Enterprises5.2.3.2. Large Enterprises5.2.4. By Workload5.2.4.1. Application Development and Testing5.2.4.2. Storage5.2.4.3. Backup, and Disaster Recovery5.2.4.4. Database Management5.2.4.5. Business Analytics5.2.4.6. Integration and Orchestration5.2.4.7. Enterprise Resource Management5.2.4.8. Collaboration and Content Management5.2.5. By End-User Industry5.2.5.1. BFSI5.2.5.2. IT and Telecommunications5.2.5.3. Government and Public Sector5.2.5.4. Retail and Consumer Goods5.2.5.5. Manufacturing5.2.5.6. Energy and Utilities5.2.5.7. Media and Entertainment5.2.5.8. Healthcare and Life Sciences5.2.5.9. Others5.2.6. By Region5.2.6.1. North India5.2.6.2. South India5.2.6.3. West India5.2.6.4. East India

6.1. North India Cloud Computing Market Size & Forecast, 2016-20276.1.1. Demand6.1.1.1. By Value (USD Million)6.2. North India Cloud Computing Market Share & Forecast, 2016-20276.2.1. By Service Model6.2.1.1. Infrastructure as a Service (IaaS)6.2.1.2. Platform as a Service (PaaS)6.2.1.3. Software as a Service (SaaS))6.2.2. By Deployment Model6.2.2.1. Public Cloud6.2.2.2. Private Cloud6.2.2.3. Hybrid Cloud6.2.3. By Organization Size6.2.3.1. Small and Medium-Sized Enterprises6.2.3.2. Large Enterprises6.2.4. By Workload6.2.4.1. Application Development and Testing6.2.4.2. Storage6.2.4.3. Backup, and Disaster Recovery6.2.4.4. Database Management6.2.4.5. Business Analytics6.2.4.6. Integration and Orchestration6.2.4.7. Enterprise Resource Management6.2.4.8. Collaboration and Content Management6.2.5. By End-User Industry6.2.5.1. BFSI6.2.5.2. IT and Telecommunications6.2.5.3. Government and Public Sector6.2.5.4. Retail and Consumer Goods6.2.5.5. Manufacturing6.2.5.6. Energy and Utilities6.2.5.7. Media and Entertainment6.2.5.8. Healthcare and Life Sciences6.2.5.9. Others

7.1. South India Cloud Computing Market Size & Forecast, 2016-20277.1.1. Demand7.1.1.1. By Value (USD Million)7.2. South India Cloud Computing Market Share & Forecast, 2016-20277.2.1. By Service Model7.2.1.1. Infrastructure as a Service (IaaS)7.2.1.2. Platform as a Service (PaaS)7.2.1.3. Software as a Service (SaaS))7.2.2. By Deployment Model7.2.2.1. Public Cloud7.2.2.2. Private Cloud7.2.2.3. Hybrid Cloud7.2.3. By Organization Size7.2.3.1. Small and Medium-Sized Enterprises7.2.3.2. Large Enterprises7.2.4. By Workload7.2.4.1. Application Development and Testing7.2.4.2. Storage7.2.4.3. Backup, and Disaster Recovery7.2.4.4. Database Management7.2.4.5. Business Analytics7.2.4.6. Integration and Orchestration7.2.4.7. Enterprise Resource Management7.2.4.8. Collaboration and Content Management7.2.5. By End-User Industry7.2.5.1. BFSI7.2.5.2. IT and Telecommunications7.2.5.3. Government and Public Sector7.2.5.4. Retail and Consumer Goods7.2.5.5. Manufacturing7.2.5.6. Energy and Utilities7.2.5.7. Media and Entertainment7.2.5.8. Healthcare and Life Sciences7.2.5.9. Others

8.1. West India Cloud Computing Market Size & Forecast, 2016-20278.1.1. Demand8.1.1.1. By Value (USD Million)8.2. West India Cloud Computing Market Share & Forecast, 2016-20278.2.1. By Service Model8.2.1.1. Infrastructure as a Service (IaaS)8.2.1.2. Platform as a Service (PaaS)8.2.1.3. Software as a Service (SaaS))8.2.2. By Deployment Model8.2.2.1. Public Cloud8.2.2.2. Private Cloud8.2.2.3. Hybrid Cloud8.2.3. By Organization Size8.2.3.1. Small and Medium-Sized Enterprises8.2.3.2. Large Enterprises8.2.4. By Workload8.2.4.1. Application Development and Testing8.2.4.2. Storage8.2.4.3. Backup, and Disaster Recovery8.2.4.4. Database Management8.2.4.5. Business Analytics8.2.4.6. Integration and Orchestration8.2.4.7. Enterprise Resource Management8.2.4.8. Collaboration and Content Management8.2.5. By End-User Industry8.2.5.1. BFSI8.2.5.2. IT and Telecommunications8.2.5.3. Government and Public Sector8.2.5.4. Retail and Consumer Goods8.2.5.5. Manufacturing8.2.5.6. Energy and Utilities8.2.5.7. Media and Entertainment8.2.5.8. Healthcare and Life Sciences8.2.5.9. Others

9.1. East India Cloud Computing Market Size & Forecast, 2016-20279.1.1. Demand9.1.1.1. By Value (USD Million)9.2. East India Cloud Computing Market Share & Forecast, 2016-20279.2.1. By Service Model9.2.1.1. Infrastructure as a Service (IaaS)9.2.1.2. Platform as a Service (PaaS)9.2.1.3. Software as a Service (SaaS))9.2.2. By Deployment Model9.2.2.1. Public Cloud9.2.2.2. Private Cloud9.2.2.3. Hybrid Cloud9.2.3. By Organization Size9.2.3.1. Small and Medium-Sized Enterprises9.2.3.2. Large Enterprises9.2.4. By Workload9.2.4.1. Application Development and Testing9.2.4.2. Storage9.2.4.3. Backup, and Disaster Recovery9.2.4.4. Database Management9.2.4.5. Business Analytics9.2.4.6. Integration and Orchestration9.2.4.7. Enterprise Resource Management9.2.4.8. Collaboration and Content Management9.2.5. By End-User Industry9.2.5.1. BFSI9.2.5.2. IT and Telecommunications9.2.5.3. Government and Public Sector9.2.5.4. Retail and Consumer Goods9.2.5.5. Manufacturing9.2.5.6. Energy and Utilities9.2.5.7. Media and Entertainment9.2.5.8. Healthcare and Life Sciences9.2.5.9. Others

10.1. Company Description10.2. Financial Analysis10.3. Key Products10.4. Key Management Personnel10.5. Contact Address10.6. SWOT Analysis10.7. Company Profile10.7.1. AWS10.7.2. Microsoft10.7.3. Google10.7.4. Alibaba10.7.5. SAP10.7.6. IBM10.7.7. Oracle10.7.8. VMware10.7.9. Salesforce10.7.10. Adobe10.7.11. NTT Communications10.7.12. Cisco10.7.13. Dell10.7.14. HPE10.7.15. Lenovo10.7.16. SAP10.7.17. Infosys10.7.18. Accenture10.7.19. Capgemini10.7.20. TCS10.7.21. AT&T10.7.22. Wipro10.7.23. Zenith InfoTech10.7.24. Wolf Frameworks10.7.25. OrangeScape10.7.26. Cynapse10.7.27. Synage10.7.28. Other Prominent Players

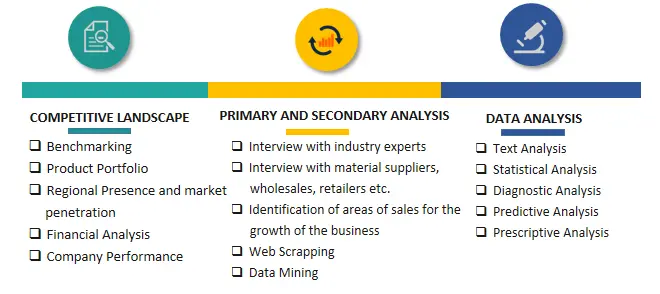

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.