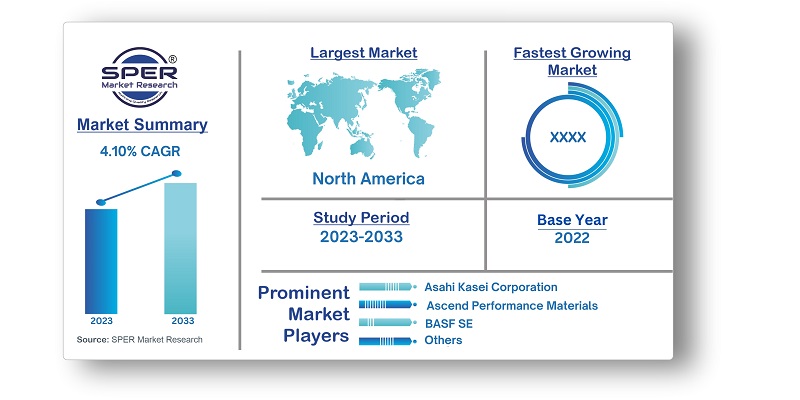

Adipic Acid Market Growth, Size, Trends, Revenue, Demand, Challenges, Share and Future Outlook

Global Adipic Acid Market Size- By Raw Material, By End Product, By Application, By End User Industry- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

| Published: Oct-2015 | Report ID: CHEM1501 | Pages: 1 - 214 | Formats*: |

| Category : Chemical & Materials | |||

- May 2022: Lanxess and Advent reached an agreement to acquire the Engineering Materials business from DSM for approximately EUR 3.7 billion. As part of the deal, Lanxess will transfer its High Performance Materials business to a joint venture. In exchange, Lanxess will receive a payment of at least US$ 1.8 billion and a stake of up to 40 percent in the joint venture. Lanxess intends to use the proceeds from the transaction to reduce its debt and has plans for share buybacks. The joint venture will have an innovative product portfolio and a fully integrated value chain.

- August 2022: Toray, in partnership with Japan's National Institute of Advanced Industrial Science and Technology and RIKEN, successfully developed a 100% bio-based adipic acid. This breakthrough holds significant implications for the production of sustainable PA66 (polyamide 66). By utilizing renewable feedstocks, the development of bio-based adipic acid offers a more environmentally friendly alternative to traditional petroleum-derived adipic acid. This advancement contributes to the pursuit of sustainable and eco-friendly manufacturing processes in the production of PA66.

- Opportunities:

- Growing Demand: The adipic acid market is expanding as a result of the rising demand for nylon 6,6, one of the product types for which adipic acid is mostly used. This need is being fueled by the developing automobile, textile, and electrical industries.

- Transition to bio-based adipic acid: Opportunities for bio-based adipic acid have arisen as a result of growing environmental concerns and the push for sustainable production. The creation of bio-based substitutes utilising renewable feedstocks offers a sizable window of opportunity for industry expansion.

- Challenges:

- Price Volatility of Raw Materials: Market participants face a problem due to the price volatility of raw materials used in the manufacturing of adipic acid, such as benzene and cyclohexane. The entire manufacturing costs and profitability are impacted by these pricing changes.

- Environmental Issues: The manufacture of adipic acid consumes a lot of energy and produces greenhouse gas emissions. The industry has difficulties as a result of environmental legislation and mounting pressure to minimise carbon footprints, forcing the creation of more environmentally friendly production techniques.

| Report Metric | Details |

| Market size available for years | 2019-2033 |

| Base year considered | 2022 |

| Forecast period | 2023-2033 |

| Segments covered | By Raw Material, By End Product, By Application, By End User Industry |

| Regions covered | Asia-Pacific, Europe, Middle East and Africa, North America, Latin America |

| Companies Covered | Asahi Kasei Corporation, Ascend Performance Materials, BASF SE, DOMO Chemicals, INVISTA, LANXESS, Liaoyang Tianhua Chemical Co., Ltd, Radici Partecipazioni S.p.A., Solvay, Sumitomo Chemical Co., Ltd., Others |

- Anesthesiologists

- Healthcare Administrators

- Healthcare Professionals

- Hospitalized Patients

- Medical Device Manufacturers

- Outpatient Care

- Pharmacists

- Others

| By Raw Material : |

|

| By End Product : |

|

| By Application : |

|

| By End User Industry : |

|

- Global Adipic Acid Market Size (FY’2023-FY’2033)

- Overview of Global Adipic Acid Market

- Segmentation of Global Adipic Acid Market By Raw Material (Cyclohexanol, Cyclohexanone)

- Segmentation of Global Adipic Acid Market By End Product (Adipate Esters, Nylon 66 Engineering Resins, Nylon 66 Fibers, Polyurethanes, Other End Products)

- Segmentation of Global Adipic Acid Market By Application (Coatings, Food Additives, Plasticizers, Synthetic Lubricants, Unsaturated Polyester Resins, Wet Paper Resins, Other Applications)

- Segmentation of Global Adipic Acid Market By End User Industry (Automotive, Electrical and Electronics, Food and Beverage, Personal Care, Pharmaceuticals, Textiles, Other End-user Industries)

- Statistical Snap of Global Adipic Acid Market

- Expansion Analysis of Global Adipic Acid Market

- Problems and Obstacles in Global Adipic Acid Market

- Competitive Landscape in the Global Adipic Acid Market

- Impact of COVID-19 and Demonetization on Global Adipic Acid Market

- Details on Current Investment in Global Adipic Acid Market

- Competitive Analysis of Global Adipic Acid Market

- Prominent Market Players in the Global Adipic Acid Market

- SWOT Analysis of Global Adipic Acid Market

- Global Adipic Acid Market Future Outlook and Projections (FY’2023-FY’2033)

- Recommendations from Analyst

1.1. Scope of the report1.2. Market segment analysis

2.1. Research data source2.1.1. Secondary Data2.1.2. Primary Data2.1.3. SPER’s internal database2.1.4. Premium insight from KOL’s2.2. Market size estimation2.2.1. Top-down and Bottom-up approach2.3. Data triangulation

4.1. Driver, Restraint, Opportunity and Challenges analysis4.1.1. Drivers4.1.2. Restraints4.1.3. Opportunities4.1.4. Challenges4.2. COVID-19 Impacts of the Global Adipic Acid Market

5.1. SWOT Analysis5.1.1. Strengths5.1.2. Weaknesses5.1.3. Opportunities5.1.4. Threats5.2. PESTEL Analysis5.2.1. Political Landscape5.2.2. Economic Landscape5.2.3. Social Landscape5.2.4. Technological Landscape5.2.5. Environmental Landscape5.2.6. Legal Landscape5.3. PORTER’s Five Forces5.3.1. Bargaining power of suppliers5.3.2. Bargaining power of buyers5.3.3. Threat of Substitute5.3.4. Threat of new entrant5.3.5. Competitive rivalry5.4. Heat Map Analysis

6.1. Global Adipic Acid Market Manufacturing Base Distribution, Sales Area, Product Type6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Adipic Acid Market

7.1. Global Adipic Acid Market Value Share and Forecast, By Raw Material, 2023-20337.2. Cyclohexanol7.3. Cyclohexanone

8.1. Global Adipic Acid Market Value Share and Forecast, By End Product, 2023-20338.2. Adipate Esters8.3. Nylon 66 Engineering Resins8.4. Nylon 66 Fibers8.5. Polyurethanes8.6. Other End Products

9.1. Global Adipic Acid Market Value Share and Forecast, By Application, 2023-20339.2. Coatings9.3. Food Additives9.4. Plasticizers9.5. Synthetic Lubricants9.6. Unsaturated Polyester Resins9.7. Wet Paper Resins9.8. Other Applications

10.1. Global Adipic Acid Market Value Share and Forecast, By End User Industry, 2023-203310.2. Automotive10.3. Electrical and Electronics10.4. Food and Beverage10.5. Personal Care10.6. Pharmaceuticals10.7. Textiles10.8. Other End-user Industries

11.1. Global Adipic Acid Market Size and Market Share

12.1. Global Adipic Acid Market Size and Market Share By Raw Material (2019-2026)12.2. Global Adipic Acid Market Size and Market Share By Raw Material (2027-2033)

13.1. Global Adipic Acid Market Size and Market Share By End Product (2019-2026)13.2. Global Adipic Acid Market Size and Market Share By End Product (2027-2033)

14.1. Global Adipic Acid Market Size and Market Share By Application (2019-2026)14.2. Global Adipic Acid Market Size and Market Share By Application (2027-2033)

15.1. Global Adipic Acid Market Size and Market Share By End User Industry (2019-2026)15.2. Global Adipic Acid Market Size and Market Share By End User Industry (2027-2033)

16.1. Global Adipic Acid Market Size and Market Share By Region (2019-2026)16.2. Global Adipic Acid Market Size and Market Share By Region (2027-2033)16.3. Asia-Pacific16.3.1. Australia16.3.2. China16.3.3. India16.3.4. Japan16.3.5. South Korea16.3.6. Rest of Asia-Pacific16.4. Europe16.4.1. France16.4.2. Germany16.4.3. Italy16.4.4. Spain16.4.5. United Kingdom16.4.6. Rest of Europe16.5. Middle East and Africa16.5.1. Kingdom of Saudi Arabia16.5.2. United Arab Emirates16.5.3. Rest of Middle East & Africa16.6. North America16.6.1. Canada16.6.2. Mexico16.6.3. United States16.7. Latin America16.7.1. Argentina16.7.2. Brazil16.7.3. Rest of Latin America

17.1. Asahi Kasei Corporation17.1.1. Company details17.1.2. Financial outlook17.1.3. Product summary17.1.4. Recent developments17.2. Ascend Performance Materials17.2.1. Company details17.2.2. Financial outlook17.2.3. Product summary17.2.4. Recent developments17.3. BASF SE17.3.1. Company details17.3.2. Financial outlook17.3.3. Product summary17.3.4. Recent developments17.4. DOMO Chemicals17.4.1. Company details17.4.2. Financial outlook17.4.3. Product summary17.4.4. Recent developments17.5. INVISTA17.5.1. Company details17.5.2. Financial outlook17.5.3. Product summary17.5.4. Recent developments17.6. LANXESS17.6.1. Company details17.6.2. Financial outlook17.6.3. Product summary17.6.4. Recent developments17.7. Liaoyang Tianhua Chemical Co., Ltd17.7.1. Company details17.7.2. Financial outlook17.7.3. Product summary17.7.4. Recent developments17.8. Radici Partecipazioni S.p.A.17.8.1. Company details17.8.2. Financial outlook17.8.3. Product summary17.8.4. Recent developments17.9. Solvay17.9.1. Company details17.9.2. Financial outlook17.9.3. Product summary17.9.4. Recent developments17.10. Sumitomo Chemical Co., Ltd.17.10.1. Company details17.10.2. Financial outlook17.10.3. Product summary17.10.4. Recent developments17.11. Others

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.